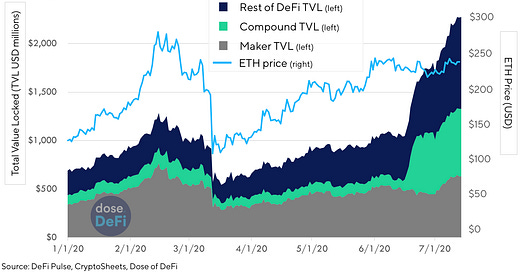

For most of DeFi’s existence, Maker and Compound have sat atop DeFi Pulse’s total value locked (TVL) rankings — Synthetix has also spent some time at #2 — and Maker and Compound have long been in a class by themselves: Maker, the trail blazer and Compound, the innovator.

Last month, Compound usurped Maker for the #1 spot, thanks to a successful COMP liquidity mining launch; the two projects now account for more than 58% of total value locked in DeFi.

Compound’s liquidity mining initiative (sorry, yield farming) attracted significant interest from the broader crypto community, and it also flipped the economics of DeFi on its head. As I discussed before, COMP distribution heavily subsidizes borrowing that in turn leads to more attractive deposit rates, which are also boosted by COMP incentives.

Farming COMP (borrowing and lending on Compound to receive COMP) is the cheapest place to get COMP, but most COMP farmers are agnostic about which assets to borrow and lend. Obtaining COMP — either to sell or hold — is the end goal, and astute farmers borrow and lend whatever asset yields the most COMP.

Early on, the crop of choice was BAT and to a lesser extent, ZRX and WBTC. Farmers borrow BAT and then lend the borrowed BAT, decreasing their short exposure and increasing their collateral and borrowing limit – rinse and repeat.

Unsurprisingly, there isn’t a lot of natural demand for borrowing and lending BAT (or ZRX, WBTC), so these markets on Compound became distorted to maximize COMP extraction. USDT (Tether) markets were also being used to farm COMP, but it cannot serve as collateral on Compound, inhibiting recursive borrowing.

Incentives Matter

Compound’s goal is to distribute COMP to users AND incentivize growth of the platform. As farming pioneer and Synthetix founder Kain Warwick put it, “Every single incentive Synthetix has designed has been gamed in some way, it’s why we do small scale trials then iterate.”

Compound hopes to build money markets for a new financial system, one that is presumably not built on the backs of the BAT debt market. US dollars dominate traditional credit markets and the recent growth of crypto dollars suggests that stablecoin borrowing and lending will power DeFi and crypto markets for the foreseeable future.

Enter Dai

The launch of COMP also coincided with Compound’s shift to on-chain governance, which has been very active at updating and fine-tuning the protocol and the liquidity mining incentives. It increased the USDT reserve factor first to 10% and then to 20%, deterred BAT, ZRX & WBTC farming by increasing their reserve factors to 50%, and most recently, raised the WBTC Collateral Factor from 0% to 40% (by a razor thin margin).

The most consequential governance decision for Dai and Maker was an adjustment to how COMP rewards are calculated:

The COMP distribution patch was intended to make crypto dollar borrowing and lending the most attractive for yield farmers, but Compound uses different interest rate models for Dai, USDC and USDT, as Maker’s Head of Risk Cyrus Younessi highlighted on the Maker forums:

The Dai interest rate model is different because it uses Maker’s stability fee as a base rate (Dharma hopes to “rationalize the interest rate models”). The tighter borrow/lend spread makes Dai the most attractive crop for recursive borrowing. Here are the COMP APYs for crypto dollar markets on Compound:

Increased demand for Dai is bad?

At first glance, insatiable demand for Dai doesn’t seem like a problem for Maker, especially since the Dai Savings Rate (DSR) has been stuck at 0% for months. The problem is that Dai COMP farmers neuter Maker’s ability to manage the peg. In a perfect world, Maker lowers the DSR and lower the stability fee if Dai trades above $1.00, but Dai deposits on Compound are the DSR on steroids and MKR holders can’t vote to lower the incentives (although they could signal their displeasure or threaten emergency shut down).

Maker, in its current form, is unable to maintain the peg when Dai demand soars outside of the protocol, and while some advocate for a more free-floating peg, the Maker Foundation sees the $1.00 peg as core to its social contract. The Dai peg has struggled since Black Thursday in March, and there has been tension brewing between the Foundation, who want a tight Dai peg for 3rd party integrations, and those in the Maker governance community, who favor a more laissez faire approach to the peg.

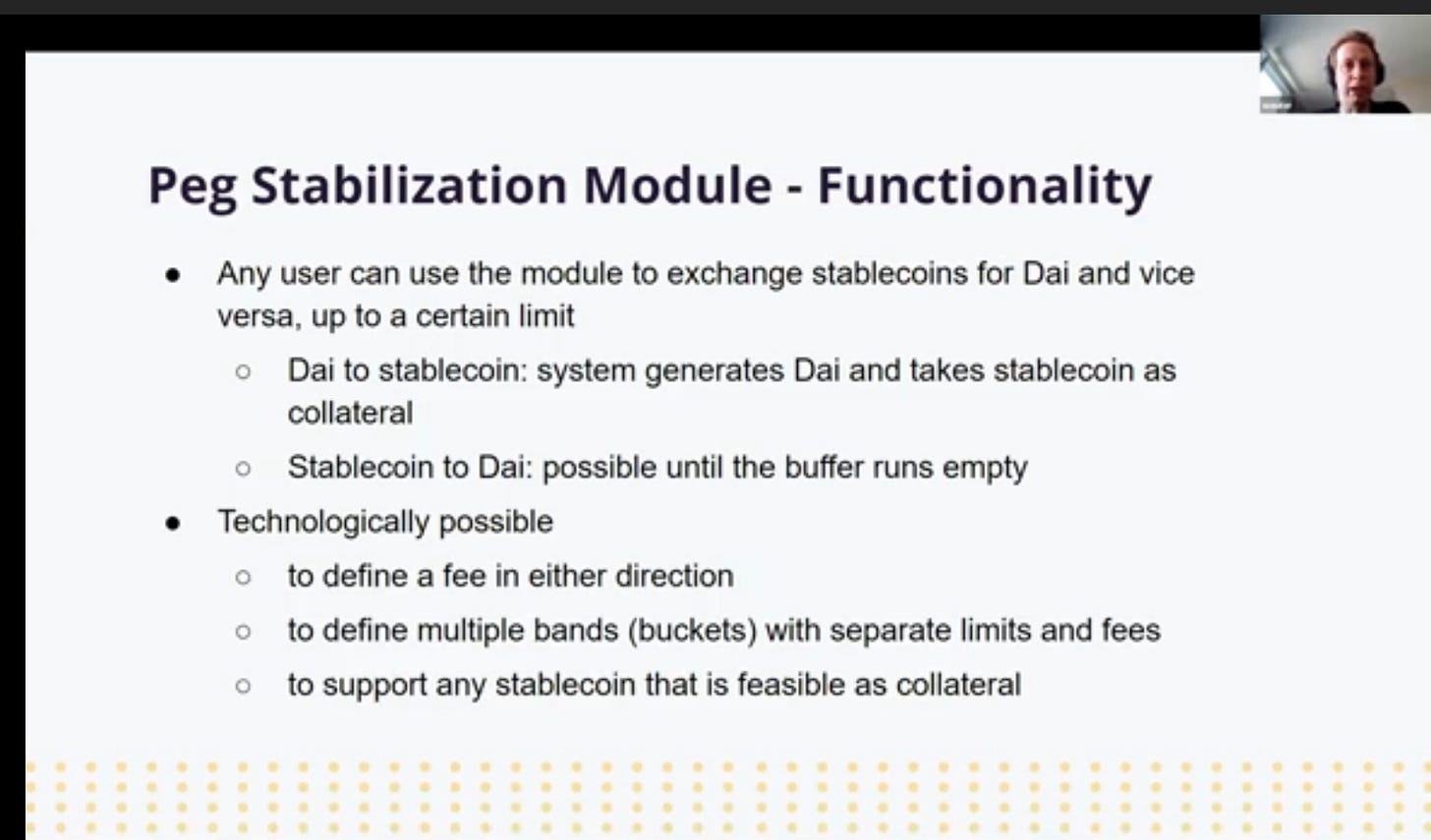

The concern over COMP farming and Dai has brought these tensions to the surface and led to a much more drastic proposal to restore the peg, the Peg Stability Mechanism (PSM). The PSM is a Curve-like AMM that creates an easy mechanism for liquidity providers to obtain Dai if the peg is off.

Maker’s Head of Engineering Wouter Kappmann presented the PSM on last Thursday’s governance call:

Maker Foundation CEO Rune Christensen laid out his reasoning for supporting the PSM in the Maker forums:

It means Maker governance will always have a “fix the peg” button available at all times, as an option…..

…This dynamic of guaranteed liquidity in fiat backed stablecoins at the peg is also crucial in cutting through the chicken and egg problem that exists with onboarding real world assets as collateral to the system, as real world loan originators need a large amount of liquidity before it becomes worth it to spend the enormous amount of effort that it would require to learn how to engage with the Maker protocol

The alternative is to let the peg fail, or work towards implementing negative rates. To continue to let the peg fail is suicidal, as it is eroding the organic growth that the project has built up for years, and this erosion is happening at an accelerating pace as we now approach month 4 of a broken peg. I know the numbers look good right now on daistats, but what we’re seeing is that organic users are being replaced by artificial demand driven by compound.

Yet the dogma is that maker governance should just continue to let the peg fail, on the basis of an emotional argument that “centralized stablecoins are of the devil, and ETH is pure”, and keeping maker “pure” is more important than the delivering on the one promise that Maker governance has made to its userbase, which is to keep Dai stable at 1 USD.

The systemic reliance that ETH and BTC has on Tether and Binance is conveniently overlooked every single time someone argues against USDC as collateral, but the fact is that USDC, PAX and other regulated and legit stablecoins are among the only options for hedging the indirect exposure that Maker has to Tether and Binance right now.

Apologies for the long quote; emphasis is mine.

There was a poll to gauge the community’s reception, and while 57% indicated support for immediate implementation, since it failed to meet the 2/3 threshold, it will come to a formal vote at the end of July.

While Rune and the Foundation strongly support the PSM, Charlie Noyes of Paradigm Fund (a big MKR holder) signaled his opposition to PSM implementation and suggested negative rates and a public MKR poll, rather than a forum poll.

Maker vs Compound

Whatever Maker implements will address the short-term problem of peg instability, but the COMP subsidy could be a long-term threat to Maker’s ability to attract more collateral. Even with interests rates at 0%, it is more attractive to take out an ETH-backed Dai loan on Compound, because the COMP received should be more than the interest accrued on the loan.

In the liquidity mining rush, what can Maker offer investors to deposit their assets into the Maker protocol?

Idle Dai in Compound is actually deposited in the DSR, but earlier this year most Dai in the DSR was from organic flow. Obviously, lowering the DSR to 0% in March dampened demand, but COMP farming has made Compound the best place to store your Dai.

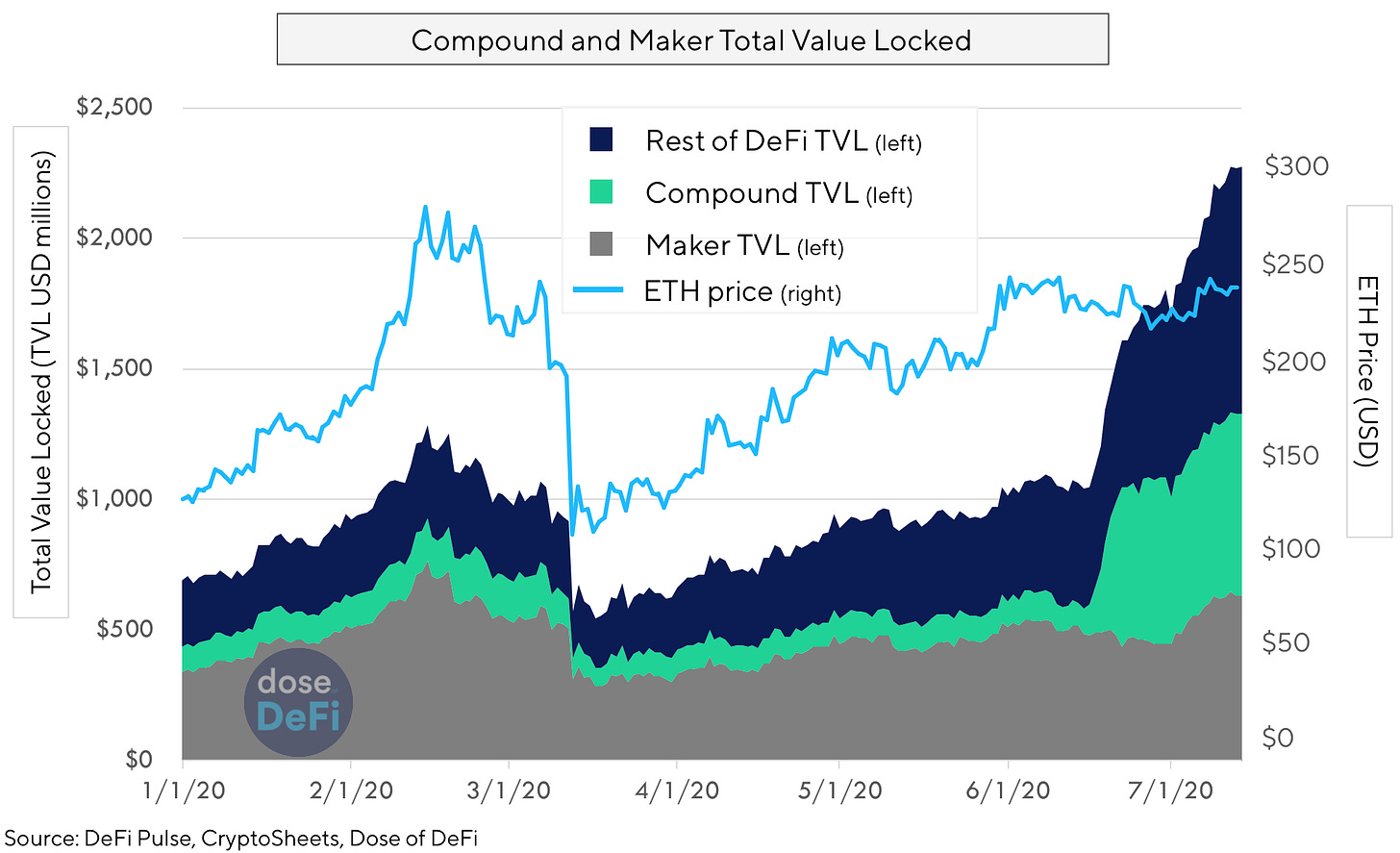

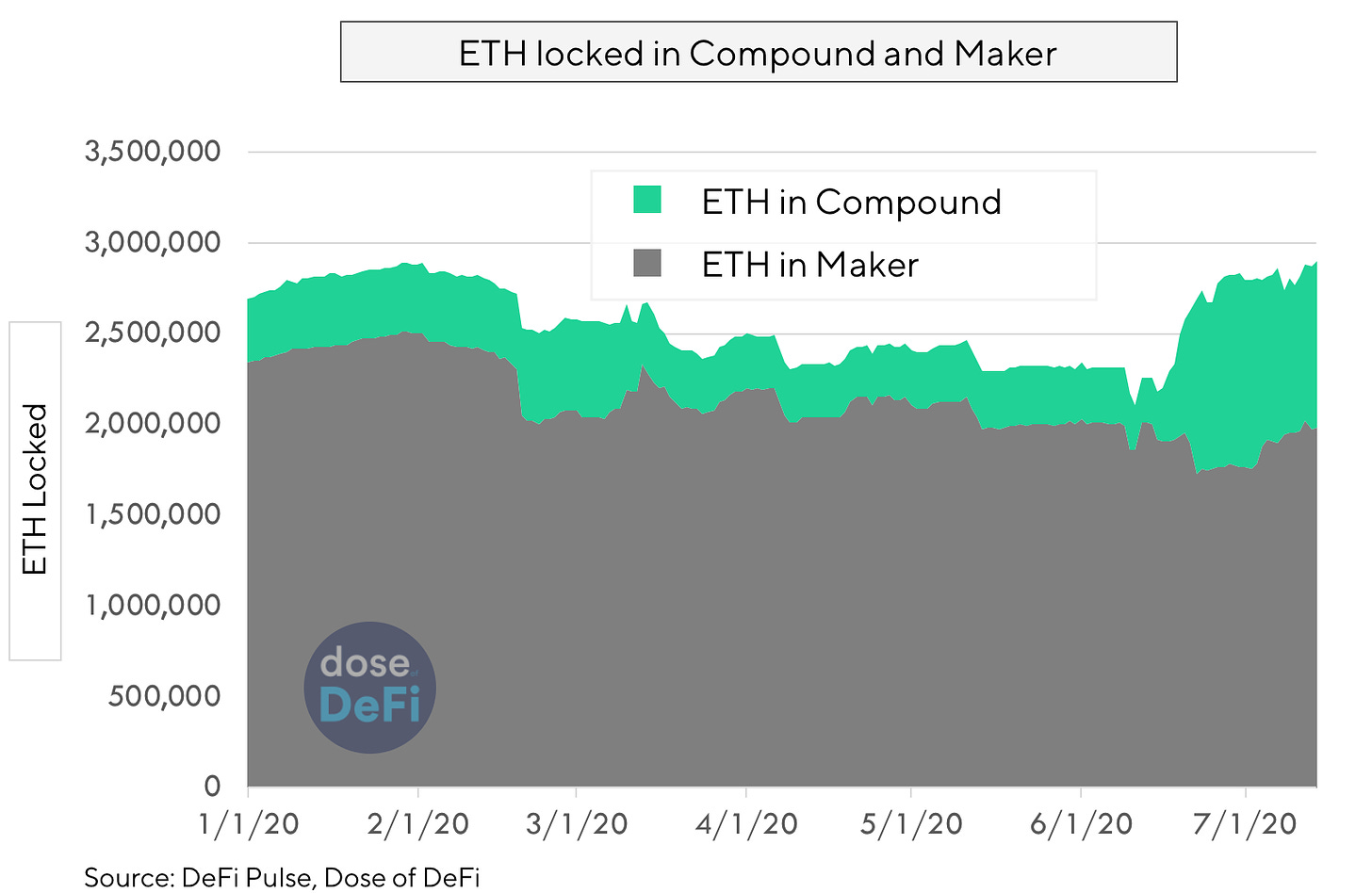

More concerning, however, is Maker’s share of the ETH market. Given that leverage is still the primary use case for DeFi lending protocols, managing the most ETH has the strongest moat, and it’s clear that ETH has flowed from Maker to Compound since farming season began.

Maker has options. Compound, of course, doesn’t have its own stablecoin, but Synthetix is hot on Maker’s heels for the most decentralized stablecoin. Dai backed by WBTC has helped, but that demand may flow to Compound after it approved it as a collateral.

Maker is far ahead anyone else in bringing real-world assets on-chain as acceptable collateral, and it remains the best way that it can safely increase Dai supply.

Tweet of the Week: USDC frozen in ETH address

The first time USDC has blocked an address. While it is certainly a boon for Dai and sUSD, DeFi is still coming to terms with what it means. Aave CEO Stani Kulechov told Decrypt, “Imagine if some of the USDC is sitting in a Maker vault.” Umm Stani, imagine if some of the USDC is sitting in Aave backing a loan — its just as susceptible as Maker. DeFi protocols should be aware of the risk, but fiat stablecoin issuers will likely come up with contingency plans to deal with stablecoins that are ‘stuck’ in a protocol. After all, the money is still in the bank.

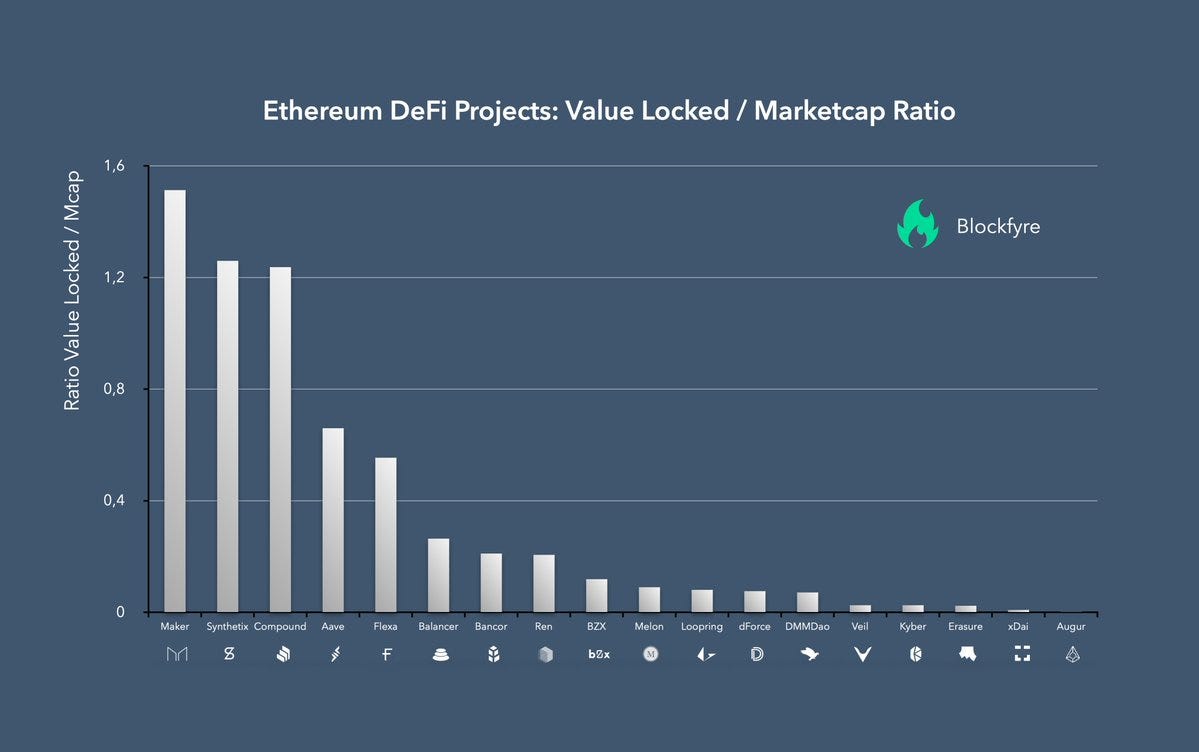

Chart of the Week: Market Cap over TVL

An interesting but imperfect measure from Blockfyre that might be useful for comparing lending and synthetic asset protocols but underscores how bad of a metric TVL is for exchanges.

Odds and Ends

Gelato Gives Developers a New ‘Money Lego’ Tool for DeFi Applications Link

“Will ETH2.0 launch in 2020” prediction market attracts $125k in bets Link

ParaFi invest $4.5m in Aave Link

Synthetix moves research and community discussion to Discourse server Link

Kyber Token’s 8x increase reveals bet on future market-share growth Link

$BZRX token sale on Uniswap Link

Aave launches Credit Delegation to go after under-collateralized lending Link

Thoughts and Prognostications

The DeFi prime broker [Will Sheehan/Parsec Finance]

An outsider’s basic framework on ETH + #DeFi value chain [Maple Leaf Capital]

Supercharging a crypto portfolio with DeFi [Santiment]

WBTC liquidity is deeper than you think [Andrew Kang]

Initial DeFi offering [William Peaster/DeFi Prime]

Ethereum’s past, present and future [Vitalik on Bankless Podcast]

That’s it! Feedback appreciated. Just hit reply. Written in Asheville, NC. Wear a mask. Blacklist = Blocklist & whitelist = allowed list.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.