Aave's new stablecoin GHO & ETH's value as Ethereum scales

Plus Odds & Ends and Thoughts & Prognostications

Ahoy from Nashville! My family and I have relocated down south, still unpacking and adjusting to this heat, but grateful for the additional space.

A programming note: Dose of DeFi will be off for the summer and returning in September.

- Chris

Chart of the week: Stablecoin wars reignite

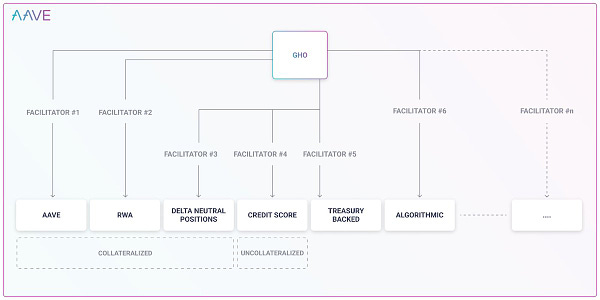

A big announcement from Aave today that they are launching a new stablecoin, GHO, which as Austin from Shipyard crew points out, can now only be minted and burned by the Aave lending protocol, but in the future other “facilitators” could also generate GHO. This would open the door for other ways to back GHO in the future, like real-world assets or market neutral positions.

Aave is the second largest DeFi platform according to DeFi Llama in terms of TVL with $6.2bn in TVL and it is going squarely after the largest DeFi protocol: MakerDAO ($7.6bn). The move is a no-brainer for Aave, considering the protocol already has the risk management & infrastructure to manage on-chain liquidations. Aave has long been aggressive on the product front. It was the first lending protocol to brand “flash loans” and the first to accept Uni v2 LP tokens as collateral. It has also had less fruitful efforts to expand into uncollateralized lending and the institutional market.

The question many are asking: what about Compound? It previously sketched out a stablecoin (CASH), but that was planned for the unreleased Compound Gateway. Gateway was supposed to be its own standalone app chain, but development has been indefinitely paused (substrate limitations reportedly). The focus on Gateway came at the expense of Compound’s multi-chain strategy. It’s still only on Ethereum mainnet. Aave, in contrast, has successful deployments on Polygon, Avalanche, Arbitrum, Optimism among others.

Compound is looking to catch up. Just last week, it released the code for Compound III, “a version of the Compound protocol that can be deployed and run on all EVM compatible chains”. It is reportedly more gas efficient to mint/burn cTokens, while also enabling isolated collateral. Given it is playing catchup, Compound will need a go-to market strategy. Might Compound resurrect its shelved stablecoin CASH? And how will MakerDAO respond? Presumably it will shut of the Direct Deposit Module (D3M)?

Other: Ryan Watkins explains, “All about cost of capital. You either pay depositors to source stablecoin liquidity or you mint it yourself (for cheaper),” while ChainLink God wonders if Curve will create its own stablecoin and Austin wonders if dYdX could replicate the UXD model.

Tweet of the week: App chains & ETH accrural

The Epicenter host and cancer survivor providing fresh perspective on how E TH value accrual will change as blockchains scale. Mehrer speculates that once the L2 universe is built out, ETH will suffer the same fate as ATOM, the original Cosmos hub that “ATOM stagnates, while Terra (and now Osmosis) became new centers.”

There are some good technical responses from Vitalik and Martin Köppelmann that go over our head. The big question is how dapps will be built and run. There’s a lot of theoretical discussion about it, but it’s hard to know until a cross-chain app reaches scale.

Odds and Ends

DXdao* Month in Review Link

Infamous 0xb1 account unmasks itself, used Celsius funds to farm Link

The first Solana MEV dashboard Link

Overview of crypto philanthropy Link

L2Bridge risk framework Link

Aztec launches DeFi privacy bridge Aztec Connect Link

DXdao* announces Infinite, a hacker-first hackathon Link

Thoughts and Prognostications

Valkyrie: MakerDAO and our side of history [Luca Prosperi/Dirt Roads]

Quest for a lost Event [banteg/yearn]

The crypto banking system [Crypto Banking Network]

Ethereum Proof-of-Stake [foobar/The Variable]

A roadmap for UNI holders to take control of Uniswap protocol [mhonkasalo]

(Lecture slides) Financial Aspects of Proof of Stake [Tarun Chitra/Gauntlet]

BNB Chain: The evolving juggernaut [James Trautman/Messari]

That’s it! Feedback appreciated. Just hit reply. Written in Nashville, where the smell of summer is strong.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao* and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.