Quite a day and a hell of a week. Ethereum dropped more than 20% and Bitcoin slide more than 15% on Monday.

Today’s carnage comes after both BTC & ETH more than doubled the previous month. I believe the technical term is “Getting out ahead of your skis”, or as many people feel today, “I should have seen this coming”.

It’s always fun to opine on market prices, but short-term price movements are almost always more noise than signal (even in traditional markets). Why did an asset go up or down today? Most of the time the answer is ¯\_(ツ)_/¯.

A couple broad thoughts on trends that we can extrapolate on:

AMM LPs weather volatility better than most

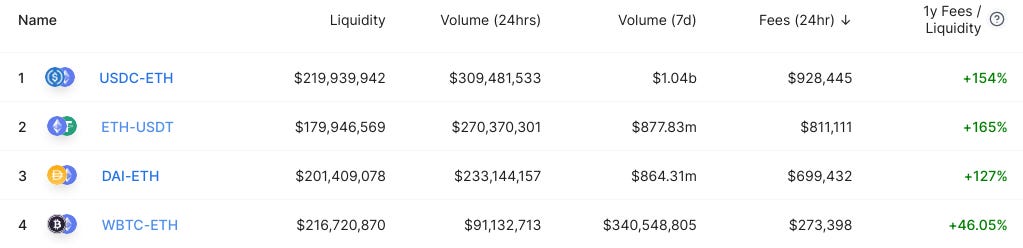

Much has been said about the dreaded ‘impermanent loss’ for AMM liquidity providers, because LPs ‘miss out’ on some appreciation when only one asset moons. Of course, on the way down, the opposite is true. Losses are mitigated if only one asset is plummeting, which is only true for pools with stablecoin pairs.

Missing in the impermanent loss discussion is the increased volume and fees during times of market volatility. When the market starts to move, traders rush to close positions, while others try to catch the falling knife. The best place to be may be an AMM. LPs earn fees without having to pay the astronomically high gas prices.

Check out the 24hr fees on Uniswap:

And Sushiswap:

HT: @martinkrung

Will soaring gas prices finally push liquidity to more scalable solutions?

a16z Crypto’s Chris Dixon likes to talk about “technology’s infrastructure-app feedback loop”. The initial success of the app layer demonstrates the promise of the underlying technology and it’s limitations.

Investors and developers will pour resources into making the infrastructure better after the app layer has found initial product-market-fit. So, Instagram’s success makes Apple invest in cameras for the iPhone, which makes Instagram better and the cycle continues.

The crypto parallel is fairly obvious: DeFi has found product-market-fit but the Ethereum mainnet is incredibly expensive (and slow) to use, so that should drive investment and developers to scalability solutions (sidechains, Layer 2’s and other L1’s).

We have talked about this before (several times, actually), but what to expect from scalability solutions in 2021?

No hope on the short-term horizon. There is a lot of money flowing into Layer 2 projects, but nothing is ready for prime time (yet). Loopring is the furthest along with an AMM on Layer 2, but it’s siloed from the rest of DeFi. Synthetix is launching on Optimism’s “not” testnet this week, but again, no composability. The cavalry is on its way, but high gas prices will be a ceiling for DeFi (and Ethereum’s) growth for the next 6 months.

Liquidity will be fragmented. The pent-up demand and the lack of suitable options means liquidity will slowly flow out of mainnet into the different Layer 2 silos as they go online. While there may eventually be “one winner” in the scaling wars, it’s hard to see that emerging this year. Developers and investors should prepare for a multi-chain world.

Related:

Chris Dixon on the Bankless Podcast, “The Fourth Crypto Cycle”

Delphi Digital’s Layer 2 Report (requires subscription)

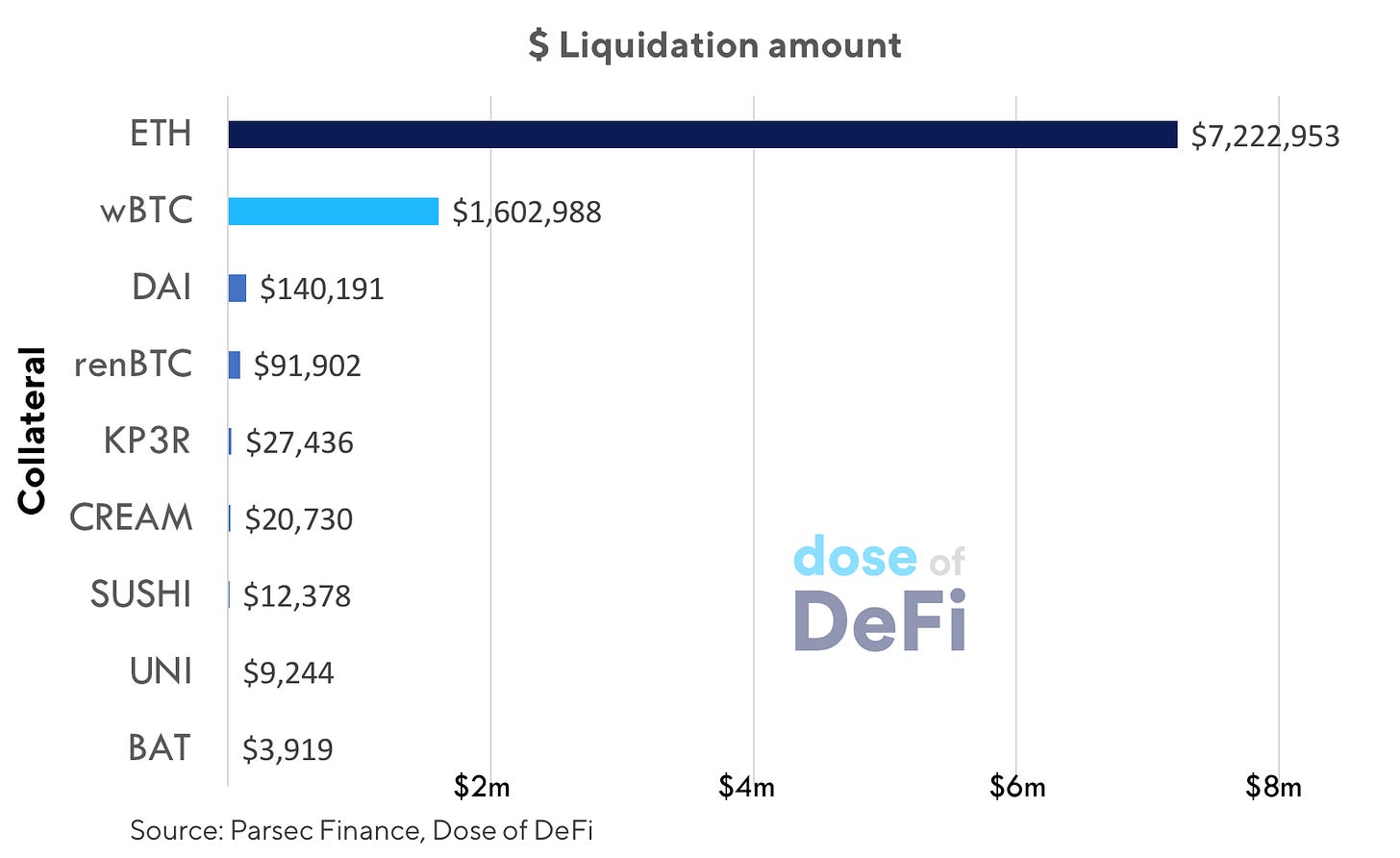

Chart of the Week: DeFi Liquidations on Compound & Cream

Pulling data from Parsec Finance, all liquidations over the last 24hrs on Compound and Cream – totaling just over $9m in collateral wiped out. With the 5% reward incentive, that’s $450k in on-chain revenue for liquidation bots in a day. One unfortunate address lost $2.7m in ETH collateral; the lucky liquidator earned $137k, but they paid 74k gwei for gas to win the transaction ($47k tx cost). Maker and Aave also had a lot of liquidations.

Tweet of the week: Sushiswap’s Liquidity Mining Matures

The yield farming craze has not died down, but it has grown up. Uniswap shut off its Uni subsidies and Compound is rejiggering COMP rewards again, and now Sushiswap is introducing vested rewards to make liquidity sticky. These projects are able to make their rewards less attractive because of their size and success. Smaller projects will still need to offer free-wheeling rewards, because they can’t guarantee the liquidity that the big boys can.

Sushiswap is on quite the tear lately. They just released a 2021 roadmap, and Andre has a fresh blog post about impermanent-loss insurance and single-sided exposure for Sushiswap.

Odds and Ends

0x unveils v4, sets token vote for January 16 Link

Shapeshift scraps KYC, goes full DeFi Link

Alpha Homora launching V2 in January Link

COVER launches new token, activates compensation plan Link

Loopring Monthly Update Link

Thoughts and Prognostications

An Incomplete Guide to Rollups [Vitalik]

A Beginner’s Guide to NFTs [Linda Xie/Scalar Capital]

Ethereum’s Gambit: A Proof by Contradiction [Karen Scarborough/molecu]

Parasitic Stablecoins [Tim Swanson]

Stability, Elasticity, and Reflexivity: A Deep Dive into Algorithmic Stablecoins [Benjamin Simon/Mechanism Capital]

John Kelleher of DXdao* on Building a True Decentralized Autonomous Organization [FTX Podcast]

Understanding Staking Pools and their Tokenomics [Kirill Kutatov/Crypto Testers]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where it’s cold outside and dry inside. Counting down the days until January 20 (and hopefully sooner).

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.