Most “Web3” ideas need web-level scale before they can offer a viable product. Blockchains and decentralization are cool, but no one is going back to dial-up. ETH2.0, Polkadot, Solana, NEAR, amongst others are racing to launch a blockchain that can scale to serve internet consumers.

DeFi is different. Users aren’t happy with the slow transactions, but they put up with it. Only a handful of transactions are required to lend or borrow assets; liquidity pool DEXs are also hospitable to the infrequent DeFi user.

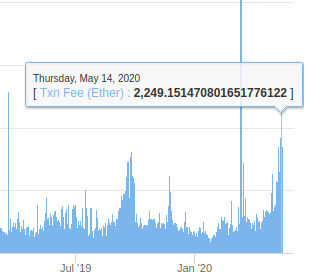

Users will accept slow transactions, but not expensive transactions, which has been an inescapable reality since March 12’s market free fall.

Before March, Ethereum gas prices were generally in the 2-8 Gwei per unit of gas, which means standard transfers cost less than $0.05 for users, while more complicated DeFi transactions like depositing into a liquidity pool will use up more gas but were still small ($0.25-0.75) and compared favorably to fees on centralized options. If you’re not in the know, all info taken from ETH Gas Station.

Since Black Thursday, gas prices have remained stubbornly high, rising to 120 Gwei during network congestion but mostly hovering in 15 – 20 Gwei price per a unit of gas. Simple transfers are still manageable ($0.10-0.30) but DeFi protocols use more gas because it requires more computation.

At currently accepted gas prices (25 Gwei), a simple deposit into Compound is estimated to cost the user $4.00. High gas prices make DeFi unusable to all but large investors, because tx fees do not scale with size.

Where does that leave us?

“Wow, gas is high” would have been a better response from Dear Leader, but Vitalik does have a point. A congested network with high transaction fees means there is significant demand for the Ethereum network, which is a good thing. Tether paid $1.2m to Ethereum miners over last 30 days.

The concern is that there doesn’t seems to be any hope for a short-term solution. Higher gas prices may be here for several months. Some implications

Layer 2 – At Vitalik said, Loopring is a L2 solution live on miannet; meanwhile, Synthetix is demoing a L2 solution developed with the Optimism team. IDEX also has a scalable solution. These lower trading fees and are good for market makers because cancelling orders is cheap and easy, but Layer 2 solutions siphon liquidity into different L2 channels, essentially destroying composability. Still, higher gas prices will push traders into lower cost solutions, but the landscape may look closer to crypto exchanges where a user must deposit and withdraw, rather than the money lego set that has enabled DeFi innovation.

Gas optimization – Developers have already found tricks and shortcuts to make transactions less resource intensive, but that will become even more important. Transaction packagers like Zapper will focus more on making the most popular DeFi transactions more efficient. Likewise, smart contract wallets like Argent, which announced a huge release today, may have to limit the transactions it pays for its users.

EIP 1559 – there is no “set” gas price on the Ethereum network. Wallets suggest a minimum gas price, typically by looking at what gas prices miners accepted in the previous block. If it makes economic sense, for say a large arbitrage trade, some users will increase their gas price to increase the likelihood of the transaction being mined and executed. When the network gets congested, gas prices can sky rocket in a race to get important tx included. EIP 1559 is a proposal to bend the cost curve. Instead of relying on an auction, there would be a set basefee for the gas price for each block; it increases or decrease based upon how full the previous block was. In times of congestion, the price will increase, but in a predictable block-by-block way. Users are still allowed to tip miners to increase the likelihood of inclusion on top of the basefee. The basefee is burned, which prevents miners from manipulating the gas price and also establishes ETH’s economic value. Anyway, this proposal has attracted some interest but it’s never “crossed the chasm” to the coredevs, but consistent high gas prices may change that.

Tough times. Low interest rates and high transaction fees, DeFi will need to adapt.

Rai of Light

Reflexer Labs released a whitepaper for Rai: A Low Volatility, Trust Minimized Collateral for the DeFi Ecosystem. Reflexer Labs is an initiative by Stefan Ionescu and Ameem Soleimani, who has laid out plains for a new governance-minimized stablecoin, MetaCoin.

It appears Rai is the first part of the money lego stack with the goal to provide an algorithmic, volatility minimized asset that is more stable collateral for DeFi protocols than ETH.

Rai is a reflex bond, which Stefan Ionescu laid out last month and was previously explored by the original Maker architect Nikolai Mushegian. The Rai whitepaper explains how they are similar but different to stablecoins:

In most cases, there will be a difference between the market price of a stablecoin and its redemption price. These scenarios create arbitrage opportunities where traders will create more coins if the market price is higher than redemption and they will redeem their stablecoins for collateral (e.g US dollars in the case of USDC) in case the market price is lower than the redemption price.

Reflex bonds are similar to stablecoins because they also have a redemption price that the system targets. The main difference in their case is that their redemption will not remain fixed, but is designed to change while being influenced by market forces

The “redemption” price or when a vault can be liquidated changes in relation to the market price of the underlying collateral.

There are essentially two major changes to the Maker system:

Stability, but no peg – Rai does not track any asset; its value is supposed to be a “stable” version of the collateral backing in (in this case ETH). If the price of ETH rises or falls, the debt of vaults is repriced, which will raise or lower the price of Rai, but magnitudes lower than the price change in the underlying asset, which would minimize the impact of Black Thursday-like price swings.

Automated, algorithmic monetary policy – there are no interest rates to vote on for Rai; the borrow rate is fixed and the only thing that changes is the redemption price. Of course, one can back in to an interest rate based on the relationship between the two, but the monetary policy lever in Rai is raising or lowering the lever. Rai promises to build a proportional-integral-derivative controller (PID) that can respond to price fluctuations and demand to algorithmically raise and lower redemption price.

The paper points to central banks that essentially use PID-like strategies to maintain their currencies’ stability, but Rai aims to build a system that can function with minimized governance:

Given the difficulty and financial risk of tweaking the parameters of a live reflex bond system, we plan to leverage computer modeling and simulation as much as possible to set the initial parameters, but will also allow governance to update the tuning parameters if additional data from production shows them to be sub-optimal

A contrast to Maker’s heavy-handed governance would certainly be welcome by the community, as well as their intention to make ETH the only acceptable collateral for Rai, but Rai is concentrated on building a system that needs minimal governance, rather than a solution for minimal governance.

There will still be controversies and disagreements over technical issues that need to be decided for the initial parameters, and Reflexive Labs will need to focus on how it makes decisions in a decentralized way, rather than just building the decentralized infrastructure.

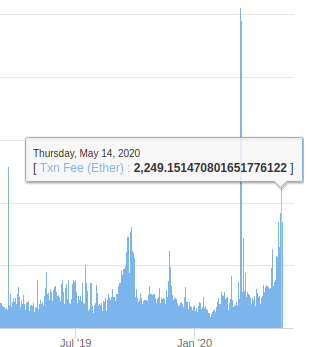

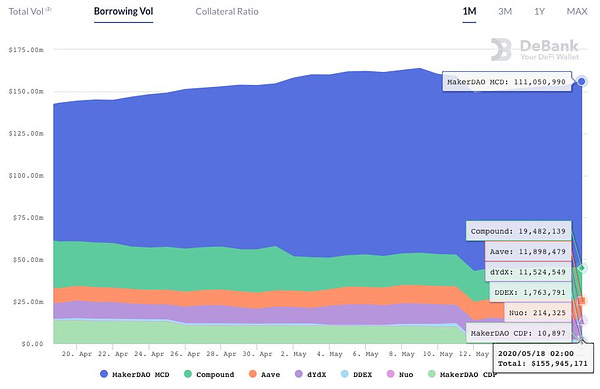

Tweet of the Week: Demand for leverage

It’s not that no one is borrowing from Maker anymore; no one is borrowing at all. DeFi is dependent on Dai, but it is even more dependent on borrowing. DEX trade volume has picked up and leverage will return but lending protocols need to find more borrowers.

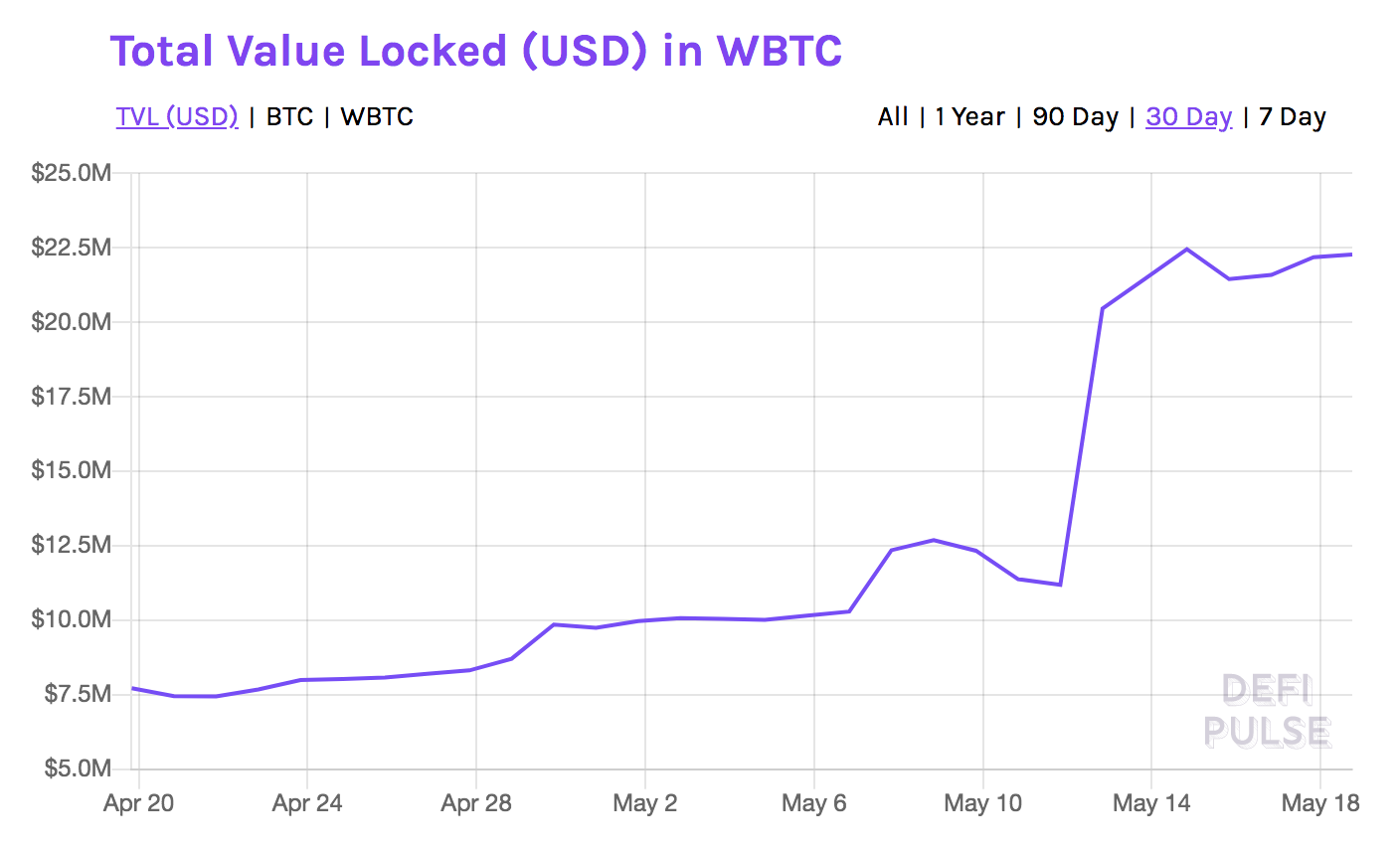

Chart of the Week: WBTC rises

WBTC has almost tripled in size over the last two weeks, thanks in large part to Maker adding it as collateral. Just under 5% of WBTC is deposited in Maker and it is clearly way out in front in the synthetic BTC race.

Odds and Ends

Uniswap v2 launches on Ethereum mainnet Link

Argent releases major update, one-click support for DeFi protocols Link

Staked integrates Synthetix rewards delegation dashboard Link

tBTC halted two days after launch Link

Balancer Announces Governance Tokens BAL for DEX Liquidity Mining Link

dYdX launches BTC-USDC perpetual contract Link

Kyber passes $1bn in total volume since launch Link

Thoughts and Prognostications

Cash Flow and Governance, DXdao raises 624 ETH, plans to fork Uniswap [Chris Powers/Govern This]

Beginner’s Guide to (Getting Rekt by) Impermanent Loss [Nate Hindman/Bancor]

Stablecoin Heatmaps Show Tether is Mostly Used During Asian and European Market Hours [CoinMetrics]

Why Reddit building on Ethereum is bullish for DeFi [Ken Deeter/Electric Capital]

How to Value Cryptoassets [Lucas Campbell/Bankless]

Curve.Fi outperforms Coinbase Dai-USDC market 80% of time [Jake Brukhman/CoinFund]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn (again). Don’t forget to subscribe to Govern This.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.