Assets bridged from Ethereum, stablecoins are not like Paypal

Plus Odds & Ends and Thoughts and Prognostications

Lisbon prelude!

I’ll be in Lisbon starting next week and would be great to get together if any of you are in town. I will be at Liscon, the DAOist amongst others.

Holler at me if you want to meet up!

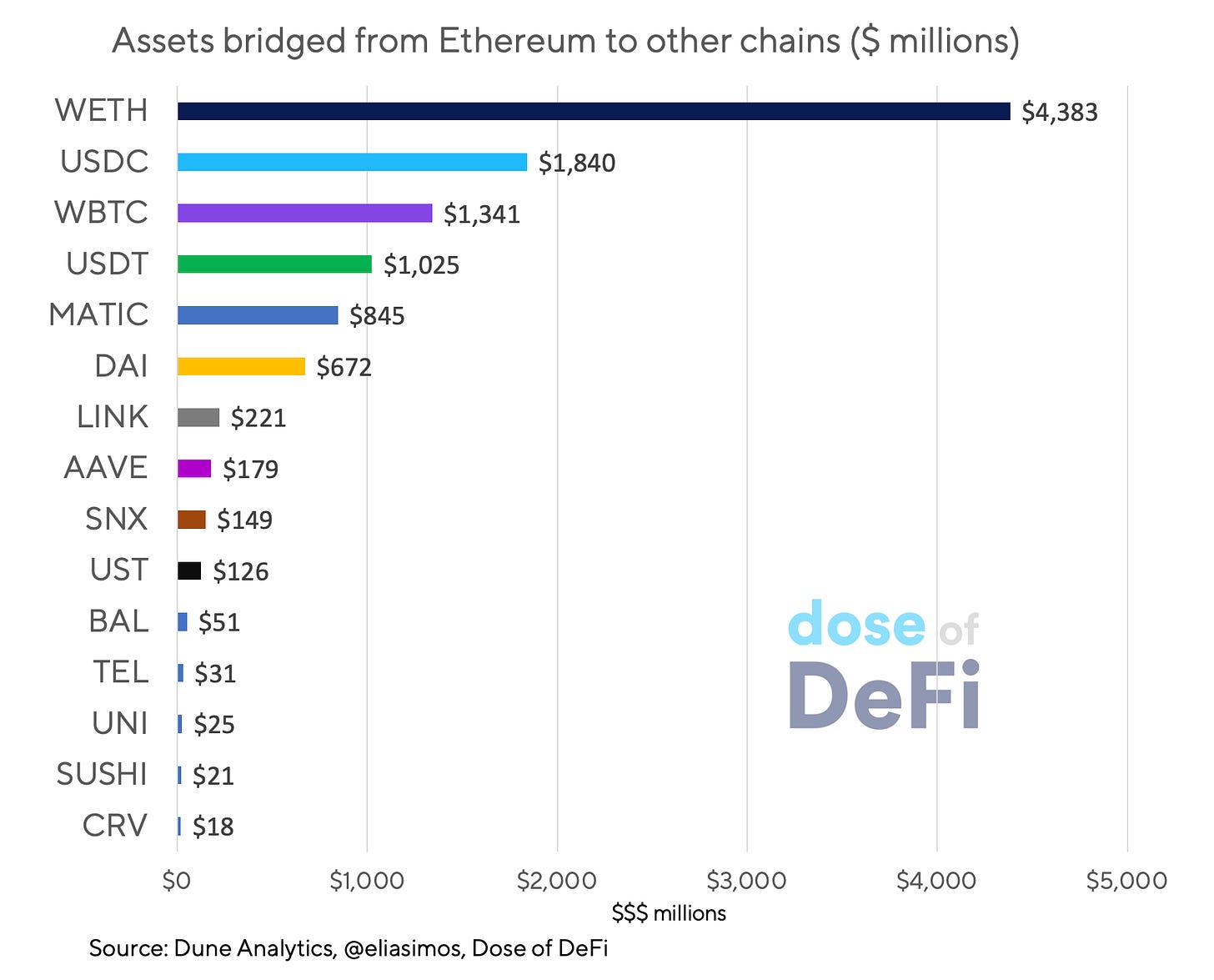

Chart of the week: Assets leaving Ethereum

A chart of data collected by Elias Simos on his excellent “Bridge Away (L1 Ethereum)” Dune dashboard. Bridge away is better than saying they are leaving; the token’s core contract still lives on Ethereum. As multichain activity heats up, bridge balances will be the easiest way to gauge activity.

No big surprises in the data above. It does demonstrate an opportunity for USDC and USDT to issue their stablecoins natively on more networks (maybe for Dai too?). Outside of Matic, SNX has the largest percentage of its token supply bridged away from L1, almost all of which is in Optimism where it was the first project to launch.

Also, if you didn’t get a chance, check out last week’s Multichaining in a Maturing DeFi World for more.

Tweet of the week: Paypal is different

Currency blogger JP Koning points out why Paypal has not attracted the same regulatory ire as stablecoins have despite their similarities. The distinction also highlights why stablecoins are such a powerful concept regardless of how they’re regulated. And that regulation appears to be impending. This week, USDC-issuer Circle Financial revealed it received an “investigative subpoena” from the SEC’s Enforcement Division in July.

Odds and Ends

Undercollateralized stablecoin Fei announces v2 Link

Flashbots Protect launches, targeting everyday users Link

Bug in Compound proposal results in loss of $90m of COMP Link

Thoughts and Prognostications

The case for clean money [Rune Christensen/MakerDAO]

Permission to lend: SocGen and MakerDAO [Luca Prosperi/Dirt Roads]

Breaking down the Olympus Pro upgrade [Chase Devens/Messari]

Exploring the Opportunity for DeFi Interest Rate Markets [Tushar Jain/Multicoin]

To EVM or not to EVM? That is the question [Ramshreyas Rao/Messari]

Yield in the DeFi Economy [Kenton Prescott/Sense Finance]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, admiring the feeling of fall.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to DXdao* and benefit financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.