The battle to build scalable solutions on and off Ethereum is heating up. Fees were a non-issue for most DeFi users at the beginning of 2020; then DeFi Summer kicked off a year of runaway growth which led to higher and higher gas fees. We analyzed the emergence of this issue back in March in Bridging to a multi-chain DeFi world. At that point, cripplingly-high gas fees on Ethereum were starting to push every developer and investor to look for faster and cheaper blockchains, to lower costs for their users. Since then, that scramble has only intensified, with scores of development teams building scalability solutions to reach billions of users.

The rush of interest this year in sidechains, Layer 2s and faster base-layer blockchains came suddenly, though for industry veterans, the conversation was nothing new. In fact, the development of faster and cheaper blockchains – and bridges that connect them – has been receiving the lion’s share of crypto VC investment for over five years.

So while the bottlenecks in the current environment were foreseen, what wasn’t understood then was what the product landscape on blockchains would look like. For the past several years, it felt like infrastructure was being built without a clear idea of what would run on it. With a market maturation in progress, we now have that clarity: fast blockchains are needed to scale use cases centered around stablecoins, DeFi, NFTs and DAOs.

What's now exciting to ponder is what all this will mean for decentralization, the dominance of Ethereum, and the focus of regulators. Some pontifications on these shortly.

The race to scale: An update

DoD’s March article on the multichain world holds up pretty well (in our 100% unbiased opinion), but there have been a couple of key developments since then:

Sidechains like Binance Smart Chain and Polygon experienced runaway growth, and then, increasing concerns over decentralization and security. Polygon is currently trying to solve these, and Binance is not. Fantom could slot in here too.

Ethereum Layer 2s finally arrived. There were lots of false hopes and delayed launches, but Arbitrum, dYdX and Optimism have proven true Layer 2s, with $2 billion in TVL today. And these solutions look set to be only the first of many Ethereum Layer 2s to emerge over the next few years (not to mention ETH2 itself).

Solana burst onto the scene as the most feared Ethereum killer, and a favorite among high-speed traders. Solana has attracted a Murderers’ Row of financial stakeholders and validators, subsequently building liquidity and expanding network capacity.

Terra built a self-contained DeFi ecosystem centered around a stablecoin that’s integrated into the underlying network, which can also power synthetic assets. Celo is another blockchain focused on the mobile payments market that saw some recent success.

EVM-compatible chains like Avalanche have shown that the EVM moat is much wider than Ethereum’s, and that well-funded chains can use both a simple bridge interface and liquidity-mining incentives to grow an ecosystem.

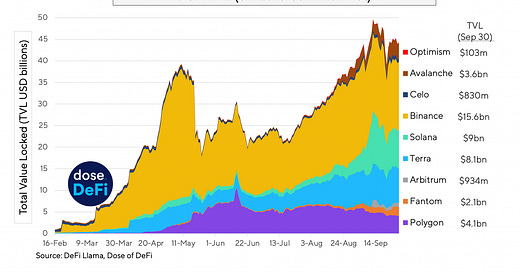

The narrative around these competing chains dominated the conversation at Messari’s Mainnet last week. But unlike in years past, the now-continuing discussion is not a hypothetical shouting match over transactions per second. Instead, it’s now focused around the competing chains’ DeFi market share. The industry has matured, and for the first time, it’s possible to have a legitimate conversation about market share between blockchains (where TVL is a good, if imperfect metric).

Ethereum is still king

It’s easy to overlook just how dominant Ethereum mainnet has become in just a few years. No other smart contract platform created its ecosystem organically. And almost all TVL growth in competing chains can be tied back to projects and ideas that were pioneered on Ethereum.

Ethereum’s biggest moat is the almost $500 billion in assets that call it home. For any burgeoning DeFi system, on-chain assets are the most precious commodity, and Ethereum has a large, well-diversified asset base across ETH, stablecoins and other ERC20 tokens – to say nothing of NFTs.

These assets are tied to Ethereum, but most competing chains find it easier to attract flows from the Ethereum ecosystem of crypto die-hards and DeFi degens than uninitiated retail and institutional investors. This is why the first piece of infrastructure that any chain should build is a bridge to Ethereum.

Bridges are the missing infrastructure piece

While investment has been pouring into the development of new base-layer blockchains and into scaling Ethereum, less focus has been put on how to connect them. However, now that these blockchains have found product-market fit around financial services, liquidity and capital efficiency have become of the utmost importance. And this translates to a need for bridges that are fast, decentralized and permissionless.

Dmitriy Berenzon from 1kx has already written the definitive article on blockchain bridges and their advantages and tradeoffs, so we won’t rehash it here. Two follow-up comments:

Capital efficiency is the most important component to success (after security). It’s now clear that fast, cross-chain bridging will be facilitated by a lot of capital.

Cosmos was designed for these times. Cosmos is a crypto OG that’s vision of an interchain ecosystem is finally coming to fruition, with new cross-network communication designs that look awfully similar to the IBC design.

Five burning questions (and early answers) for a multichain future

Will Ethereum mainnet hold its lead of DeFi TVL market share? Right now, according to DeFi Llama, Ethereum has 75% of the market. Even as gas fees continue to rise, it’s hard to imagine any of the big sources of liquidity on Ethereum migrating away. The lending platforms seem firmly entrenched; big liquidity pools (both AMMs and lending) will likely stay, while liquidity providers will continue to tap in to offer cheaper services on lower-cost blockchains. Prediction: Ethereum will still be the largest chain, but no longer have a market majority. By the end of 2022, it will hold around 35% of DeFi TVL.

Will the future consist of application-specific chains? In honesty, we were previously skeptical of this hypothesis. But the runaway success from dYdX on its Layer 2 rollup changes things. Will composability be the magic wand that everyone says it will? Or can the functions of different chains be abstracted away by the front-end. The success of a high-performance trading protocol like dYdX also shows how Ethereum’s moat extends outside the EVM, and an Ethereum maximalists’ best response to an encroaching Solana. Prediction: Ex-Ethereum, by the end of 2022, around 15% of DeFi TVL will be in app chains (Ethereum Layer 2 and Cosmos-based). And then, 20% in non-ETH EVM chains, 15% held by Ethereum EVM Layer 2s, 10% from non-EVM, general computation networks (mostly Solana) and the remaining 5% to other Cosmos-based chains.

Will cross-chain transactions be dominated by centralized entities? Currently, most bridges rely on a small set of validators. While it’s near impossible to reconcile two different blockchains and their consensus mechanisms, it’s nothing that a centralized middle man can’t solve. Large liquidity providers will use trustless protocol bridges to charge fast exit services to individual users. Centralized exchanges might morph into bridges themselves – one could argue Binance already does this. Prediction: Yes – centralized entities will dominate cross-chain transactions for for the time being. Decentralized alternatives will take time to develop.

What about cross-chain governance? This is of personal interest, since DXdao now operates three bases on Ethereum mainnet, xDai and Arbitrum One. But as soon as cross-chain liquidity is addressed, cross-chain governance will be next on the docket. Aave seems the furthest along. Prediction: A difficult problem to solve, one that will rely on slow cross-chain communication, as governance transactions can be slower.

Will the market consolidate? What will that look like? It’s clear that crypto has entered a new stage in its industry life cycle. Established entities are fighting over revenue opportunities, on and off-chain. The culmination of such battles is typically consolidation (of winners and losers), but there have so far only been a few examples of blockchain M&As, and those have not involved millions of users. Prediction: Ethereum Layer 2s and EVM chains will consolidate, but not for a few years. A harder path ahead for non-EVM chains.

We hope to check back in a year to see if these predictions are close. Pontificating is cheap and easy though.

The last point to consider is also the current gossip topic of choice: regulation. It’s unclear whether there is anything specific about a multichain future that would draw the ire of regulators, but what doesn’t these days? And it’s hard to imagine regulators going after base-layer chains, as the track record for miners and token holders is pretty good (save for Ripple). Instead, the increased regulatory scrutiny is targeting front-ends, and so the most successful scalable blockchain might end up being the one that enables the most decentralized front-end that can also resist regulatory pressure.

And that will require a new decentralized technology stack, another stage of development in the maturation of Web3, and demonstrates that DeFi needs more than just financial plumbing.

Odds and Ends

The Block: China’s latest crackdown is most severe yet Link

Coindesk: A new NFT lending market booms Link

Forta, a security-monitoring protocol, spins out of Open Zeppelin Link

Compound comptroller contract sends thousands of COMP by mistake Link

New customized token bridge connects Dai to Arbitrum One Link

Thoughts and Prognostications

Digging into Uniswap DEX Data [Kyle Waters & Nate Maddrey/Coin Metrics]

A possible BTC future [Gavin Andresen]

12 DAO problems [David Phelphs]

Can UST challenge Dai for top spot amongst decentralized stablecoins? [Ryan Watkins/Messari]

How to fix the par value of stablecoins [Sébastien Derivaux/MakerDAO]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn in the full throes of autumn. Special help from Nana this week. Headed to Lisbon in a couple weeks; reach out if you’ll be around.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to DXdao* and benefit financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.

Sator is multichain $SAO