DeFi has grown considerably in 2020, to say the least. It’s been 3 months since the launch of COMP set off a never-ending stream of farms, forks, crashes and heists. The growth in the space has been hard to keep track of with new launches weekly, as is calculating market sizing with asset rehypothecation through the system.

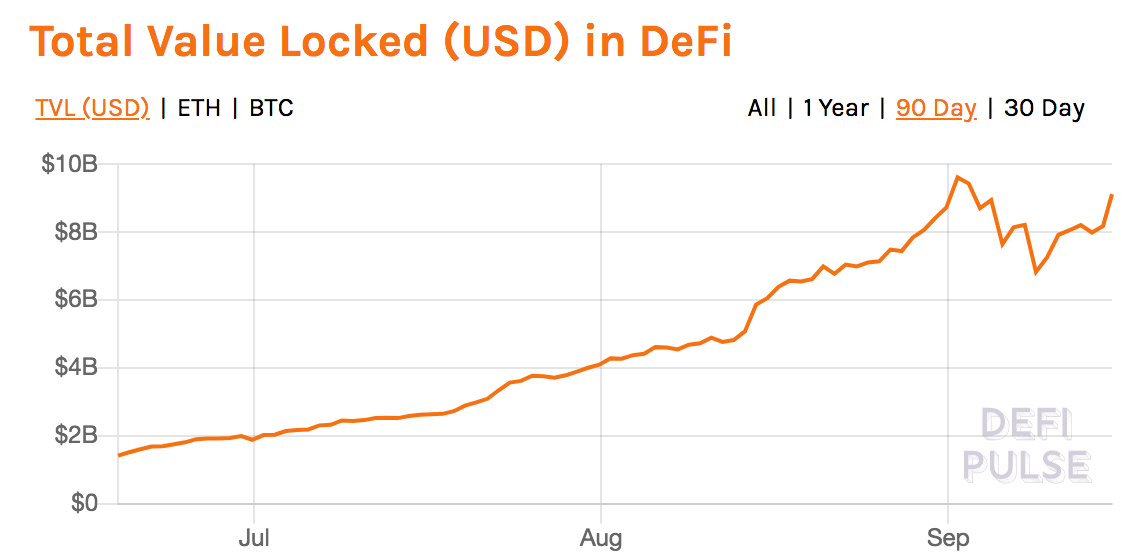

Roughly speaking, the DeFi market has at least 6x’ed in the past 3 months with DeFi Pulse’s latest industry TVL at $9.1bn USD – up from $1.27bn the day before COMP launch.

While some of this increase is from asset appreciation, not all of the growth can be attributed to Twitter’s speculative echo chamber. New assets and investors have poured into the space, increasing usage of DeFi platforms and the amount of collateral and liquidity supplied.

At the beginning of the year, I said that Bitcoin and Tether were the two most important assets to DeFi growth in 2020. Yield farming has been the catalyst, but BTC and USDT inflows have been the largest source of fresh capital.

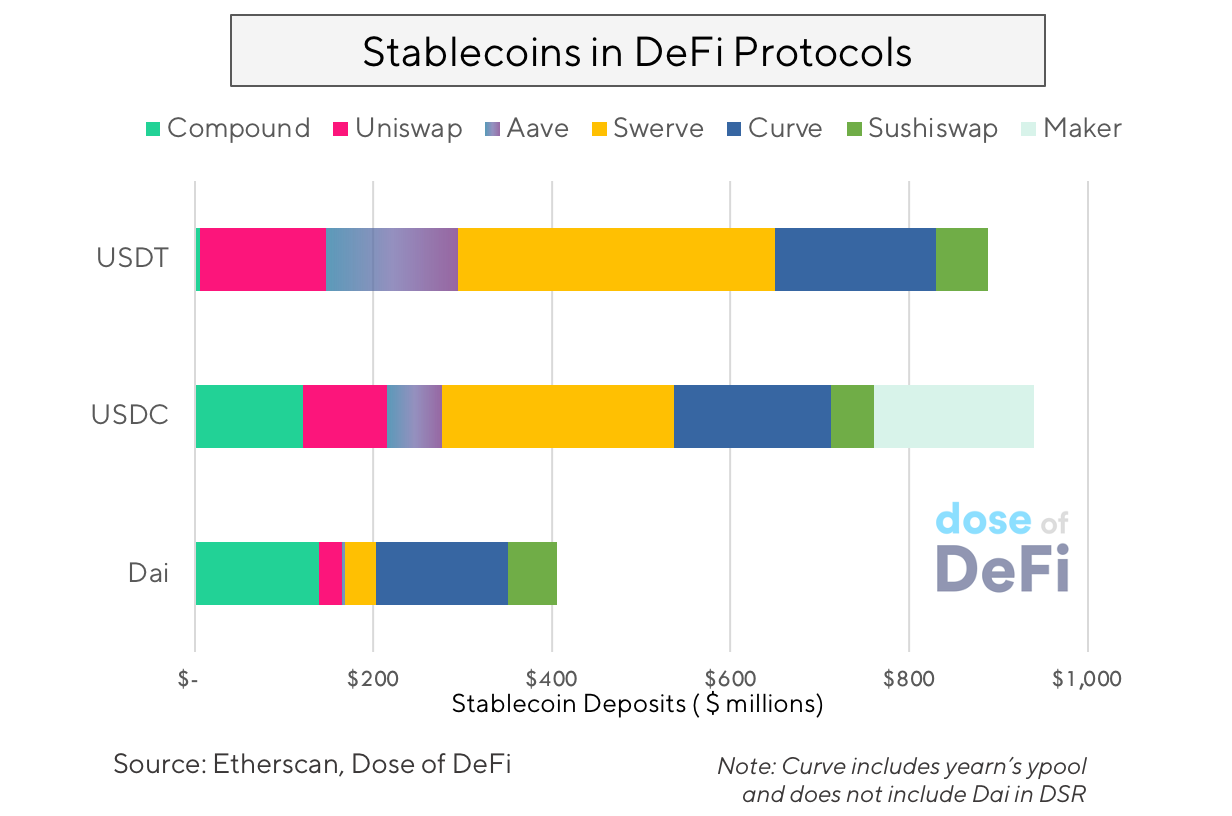

Tether has long dominated the centralized world but had little presence in DeFi, where Dai and USDC proliferated, but in the last three months, USDT usage in DeFi has exploded with almost $900m locked up on-chain. Tether’s DeFi journey was jumpstarted by Compound; hundreds of millions of USDT flowed into Compound after it approved USDT borrowing and made Tether the crop of choice to farm COMP.

Tether moved on from Compound but stayed in DeFi and now has a larger presence than Dai and competing with USDC.

The DeFi inflows were from Tether’s base in Asia and its prevalence amongst traders - both segments hopped on the yield farming hayride in full force over the summer. With the further gamification of DeFi, Tether could see increased usage in the degenerate gambling space, if sUSD doesn’t beat it there.

In addition to Tether, Bitcoin synthetics have been the other asset with strong organic inflows into DeFi. It remains most useful as another source of collateral, and Bitcoiners are perhaps the most hospitable market because so many are already using it as collateral to take out loans in the centralized world.

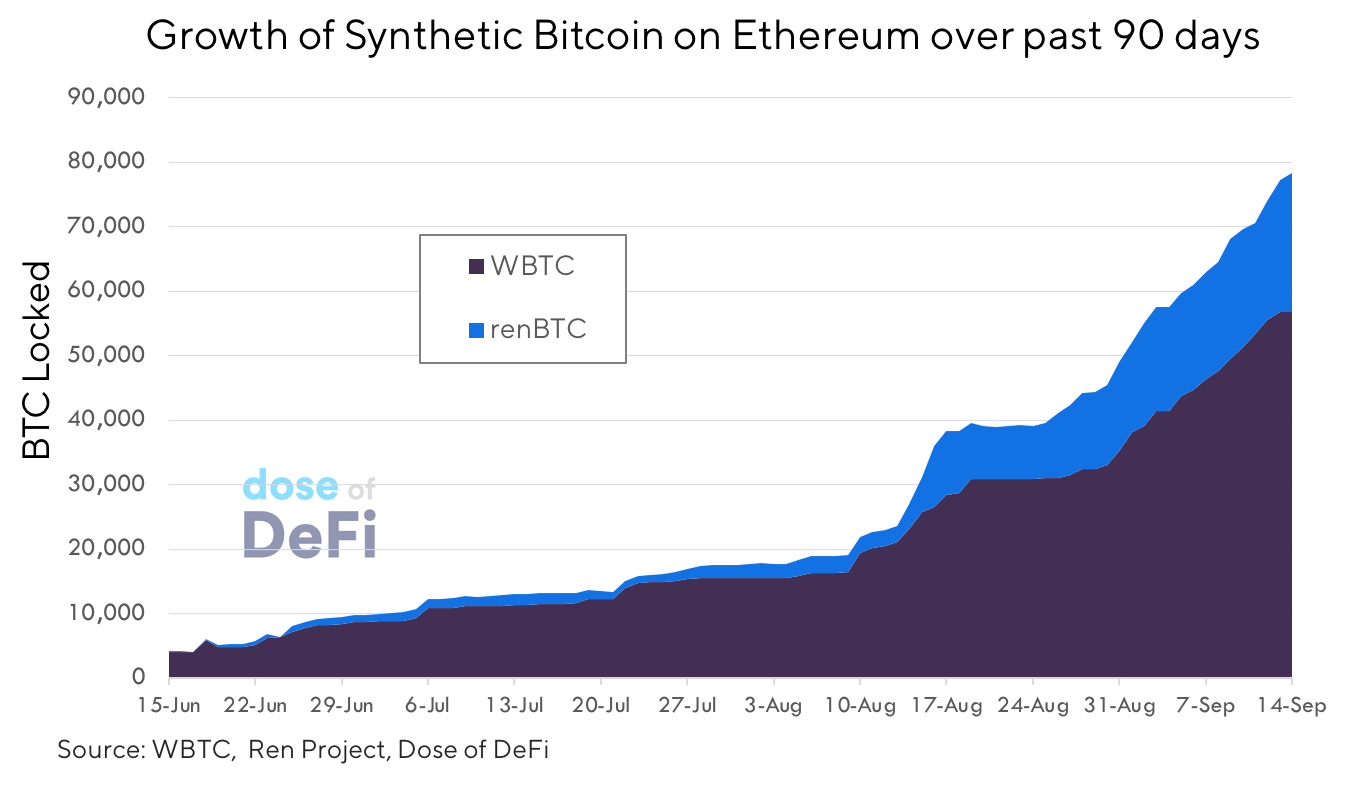

The Bitcoin on Ethereum market has also exploded, growing from $45m in mid-June to almost $1bn in synthetic BTC today. WBTC, a custodied BTC wrapper, is the largest with renBTC providing the first non-KYC’d bridge for Bitcoin to Ethereum.

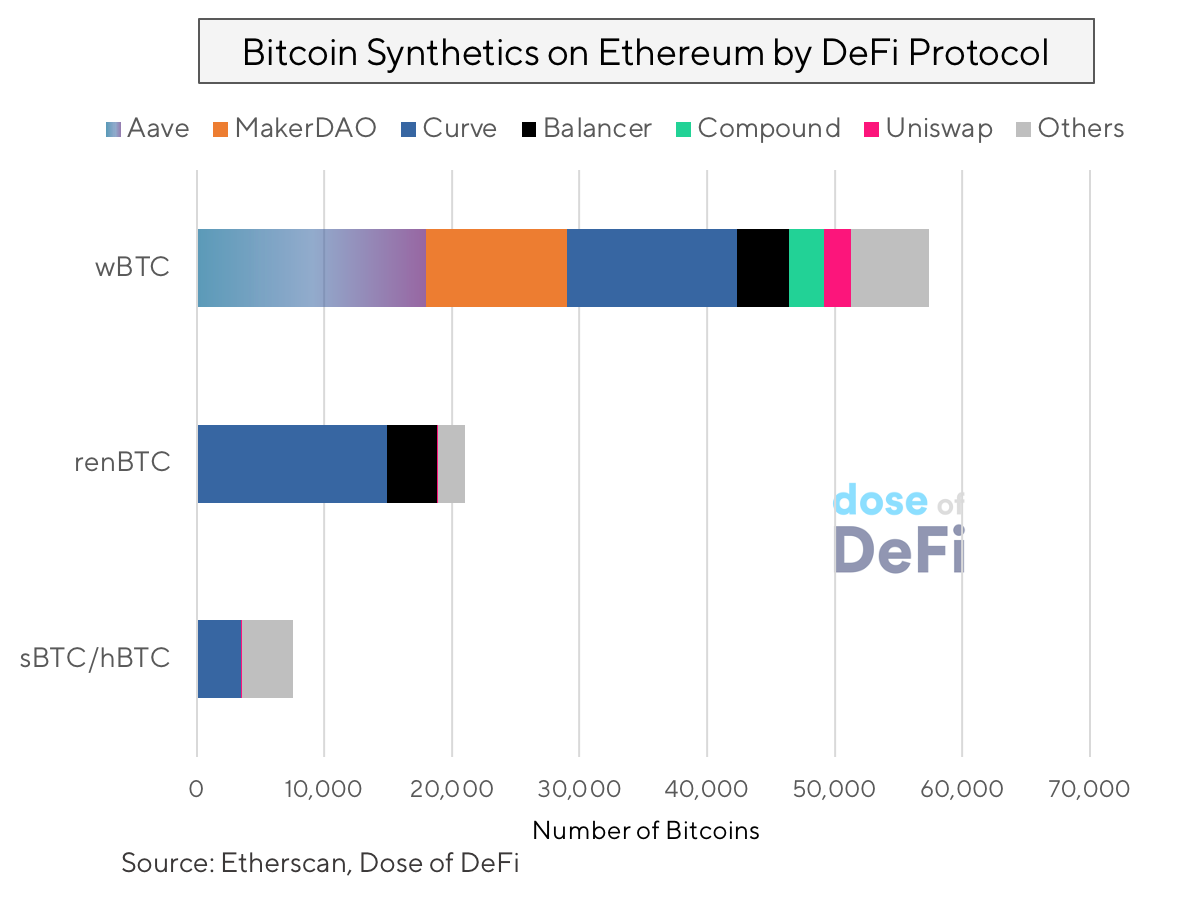

Amidst the summer’s farming craze, a consistent flow of Bitcoin has flowed onto Ethereum. About half of it is used as collateral for on-chain loans, while most of the rest is farming CRV. Synthetix’s sBTC and Huobi’s hBTC have tried to entice investors with attractive farming yields, but they have not gotten much liquidity outside of subsidized pools.

CREAM, a Compound fork, accepts renBTC as collateral but has only $3m in renBTC deposits. WBTC is far ahead on the BTC as collateral in DeFi – largely in Aave and Maker.

Altogether, almost $1.5bn of Tether and synthetic Bitcoin has flowed into DeFi over the last 3 months. Looking forward, Bitcoin and Tether still has room to grow in DeFi and should remain top targets for any DeFi product.

Investors: new players for DeFi games

Tether and Bitcoin powered the organic inflows that drove the farming craze and new value creation from token launches, but who was driving these flows? And who are the next group to fall under the DeFi spell.

The DeFi Curious. Something clicked in May and June. Perhaps it was the quarantine, Balancer and Uniswap v2 launch, the efficiency of Curve, or the COMP distribution, but DeFi started appearing outside of core DeFi fanatics and creeped into adjacent crypto communities.

DeFi has an obvious appeal to the crypto trader crowd. Bitmex CEO Arthur Hayes loves $YFI but is also willing to jump on whatever new food coin emerges. Three Arrows Capital is a more buttoned-up outfit that has gone heavy into DeFi – and quite successfully. And of course, perhaps no one has gone more DeFi than FTX CEO and SushiSwap maestro Sam Bankman-Fried. Luckily for him, the DeFi label is self-applied.

The counterpart to the crypto trader is the crypto VC. VCs are not exactly new to DeFi, but activity has increased and their role has moved on-chain with the rise of fair launches. There is a growing rivalry between VCs and traders centered on DeFi – is it a consumer product with network effects or a complex financial instrument (why not both?). Gauntlet CEO Tarun Chitra said it was “reminiscent of the previous talent ‘war’ between HFT and online ads”.

The Crypto Center. If the DeFi Curious hope to get in on a rocket ship taking off, the Crypto Center pride themselves on driving the crypto topic du jour. The most obvious place to start is Laura Shin’s Unchained Podcast. The last three podcasts have been DeFi-focused, featuring Yearn.Finance’s Andre Cronje, Polychain’s Olaf Carlson-Wee and a joint appearance with Dragonfly’s Haseeb Qureshi and Paradigm’s Dan Robinson.

Epicenter, a more technical podcast, has featured a DeFi-heavy lineup throughout 2020, including episodes on Aave, Opyn, Nexus Mutual, UMA, Balancer and Loopring.

And of course, no one represents the Crypto Center like Mike Dudas, founder of the Block. Dudas has gone full DeFi degen, months after begrudgingly allocating some of his precious BTC into ETH. Just this weekend, he tweeted, “DeFi is the most interest thing happening in cryptocurrency and digital assets today”. The link is presumably broken since Dudas auto-deletes his tweets.

Who’s Next?

To be clear, there is still ample room for DeFi growth from these existing crypto communities – just as Bitcoin and Tether remain attractive targets for DeFi projects, but the question is who catches the DeFi bug next and what will they bring? A couple groups:

Fintech – Dudas also has a foot in what could be an adjacent source of talent, capital and compliance. The decade life cycle of fintech is coming to an end with big exits and companies with large user-bases. Some of the venture funding chasing fintech could shift over to DeFi, but the bigger opportunity is DeFi integrations with existing, popular consumer products. Robinhood and the Cash App allow easy BTC & ETH purchases, but one of the large fintech’s could integrate Compound or allow easy Uniswap/Balancer liquidity provisioning.

Wall Street – Wall Street is slowly embracing an institutional approach to Bitcoin, and presumably ETH is next, but traditional financial institutions seem far away from building and using blockchain-based financial products and services, outside of hodling. Still, Wall St traders could become a strong source of flow from their personal capital and institutions will make venture and equity investments. The one area to watch is the on-chain derivative space. There is a lot of interest and experimentation now, but it could benefit from outside expertise (or directed investor flow).

Gaming (and sports) – Perhaps this distinction is moot now because so much of DeFi has been gamified (is this a financial product?) but DeFi protocols could find inflows from a larger, entertainment-first mainstream audience. Sports are the most popular way to gamble; maybe prediction markets can see this flow. Perhaps growth from such a market is dependent on layer 2 scaling and lower transaction costs.

Geographies - DeFi’s promise is a digitally native, globally accessible financial system, but adoption is likely to occur country by country. Tether, of course, is primarily an Asian phenomenon, as is all of the DeFi Curious (Arthur Hayes, Sam Bankman-Fried, Three Arrows Capital). Country-level restrictions could drive larger flows into DeFi, or alternatively, a central bank digital currency could create an easy on-ramp into the DeFi world. Given the infrastructure already in place, any project with a local banking relationship and fiat on-ramp, could reach scale through the retail market. No-loss lottery PoolTogether’s largest market is reportedly Indonesia.

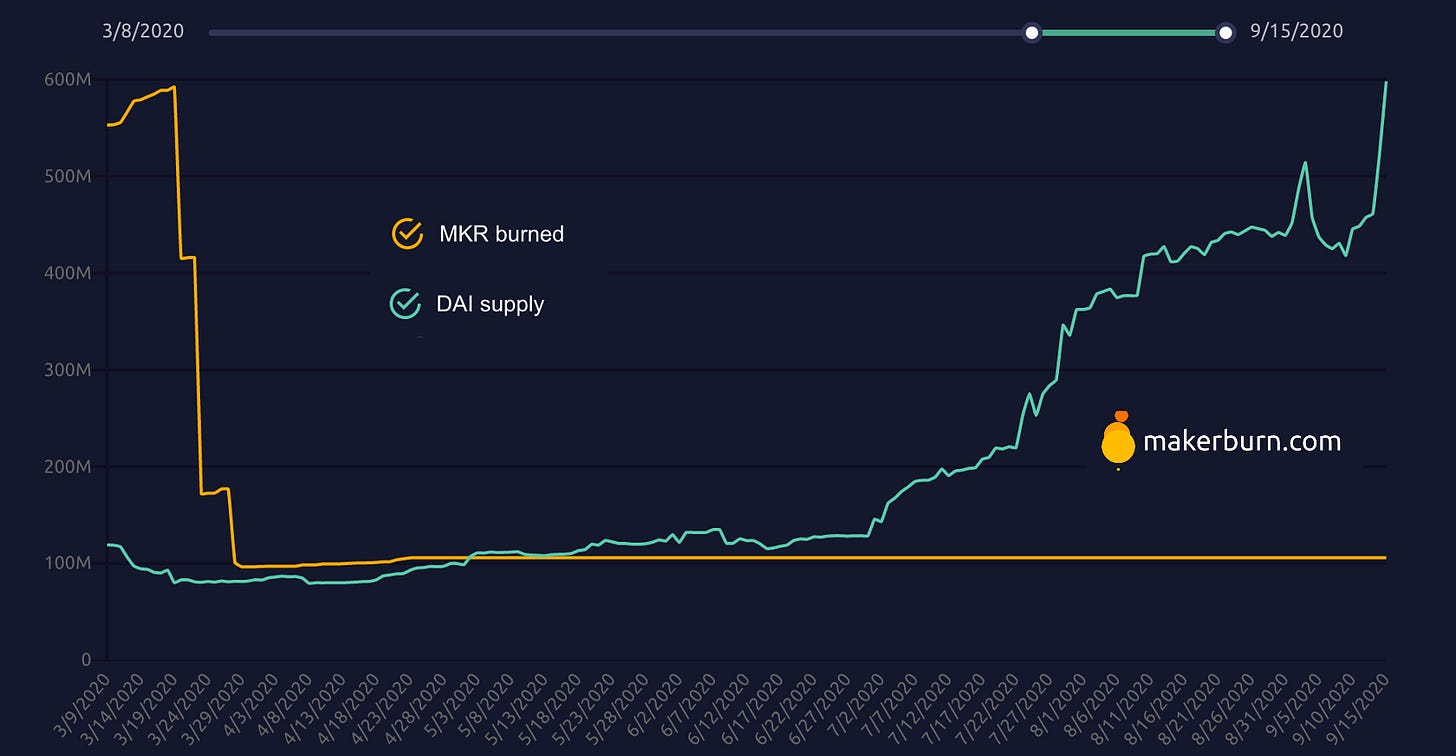

Chart of the Week: DAI > MKR

Beautiful, if depressing chart from Makerburn.com. Dai supply has shot up over the last few months, almost entirely due to the yield farming craze, where Dai is crop of choice - on Compound at least - because it has the least overhang over borrows. Maker has onboarded new collateral types and raised debt ceilings to deal with the strong Dai demand. Unfortunately, MKR has not been able to participate in that growth. With fees at 0 since March, no MKR has been burned, despite the fact that MKR’s risk profile goes up with the supply of Dai, since it’s the ultimate backstop in the event of default. Dai demand remains strong as does its integration into DeFi, but the larger concern is teams building now for USDC and Tether, eroding Dai’s “DeFi’s default stablecoin” status. With another price rise in Dai over the last week, there is currently an on-chain poll for a “Quantitative Easing” initiative, while there is a renewed push to onboard real world assets as collateral. In a Maker forum poll, 56% estimated 200-500m more Dai will need to be printed to meet current demand; 21% said 700m-1bn.

Tweet of the Week:

Perpetual Protocol launched PERP last week using a Balancer Liquidity Bootsrapping Pool (LBP), becoming the first to use the token distribution method. LBPs automatically adjust the weight between a new token and a listing token, in this case PERP and USDC. At launch, the weight is set at 90/10 PERP/USDC, creating a very high price and then automatically adjusts the weight down to deter front-running and whales. Parsec Finance founder Will Sheehan approves, arguing that it creates a smoother price discovery. Market cap does seem a bit high still ($255m), and it appears to have raised $8.5m? Curious as to why USDC and not USDT as Perpetual Protocol is backed by top trading firms (2/3 of DeFi Curious).

Odds and Ends

DeFi Pulse and Set team up to launch DeFi Pulse Index (DPI) Link

Hacker drains $8.5m out of BZX again (and returns it?) Link

Gitcoin Matching Grants Round 7 is live Link

YAM replanting and launch Link

Grand opening of SushiSwap Link

Hegic Launches Initial Bonding Curve Offering Link

Thoughts and Prognostications

Toxic Flow: Its Sources and Counter-Strategies [Su Zhu & TianTian Kullander/Deribit Insights]

Andre Cronje explains Stablecredit [Andre Cronje/Codeup38]

Coordination, Good and Bad [Vitalik]

The Bull Case for Automated Market Makers Tokens [Jack Purdy/Messari]

Gnosis Conditional Tokens [Franco Victorio/Exploring Ethereum]

Coinbase’s Struggles with Apple’s App Store & DeFi [Brian Armstrong]

Tradeoffs in the Decentralized BitMex Space [Tushair Jain/Multicoin]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where I’m kind of excited for fall. Long-ish post to distract from the daily farms. May switch to Tuesday delivery :-/

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao. All content is for informational purposes and is not intended as investment advice.