There’s a remarkable stability forming in the current market sentiment, or perhaps “new normal” is a more apt description.

DeFi summer and the bull market have flooded Ethereum with activity and kickstarted a new round of reflection on the current pain points and where the market is headed. Almost all of these revolve around scaling blockchains, and more specifically, the dapps and users on Ethereum.

Chris Burniske described this crypto-wide awakening well:

Ethereum has real users and assets but it’s prohibitively expensive to transact for all but large whales. The cat is out of the bag though. DeFi, on-chain liquidity pools and programmatic assets have arrived and the race is on to build products and chains that can scale.

It’s a crowded field of L2s, sidechains and standalone chains. All are grappling with two legacies of DeFi’s success on Ethereum mainnet:

EVM compatibility - solidity and DeFi smart contracts have been battle tested, with billions of dollars flowing through them. This is also very important in wallet integrations

Source of Assets - ETH, of course, plus almost $100bn of ERC20 assets native to Ethereum, without counting stablecoins. All scaling solutions will thrive or die off of their bridge to Ethereum.

Scaling needs have outpaced scaling tech

ETH2.0 is supposed to solve this, but its scalability developments are still years away. Most unbiased observers (okay, Vitalik) argue that EVM-compatible ZK-rollups are the long-term solution to Ethereum scaling and are an easier path than the full ETH2.0 implementation. Although teams like Matter Labs and StarkWare are working on it, EVM-compatible ZK-rollups do not exist now, and product teams are not going to wait. Users are getting priced out now.

For projects and users looking for an alternative to Ethereum main net they can use in 2021, there are three trade-offs to consider

Security/decentralization

Bridge transfer/withdrawal speed

Composability

Loopring has been running a ZK-rollup for more than a year, first as an order-book exchange and now an AMM. It has the security properties of Ethereum and has withdrawal times under 30 minutes. It lacks composability and is not EVM compatible. dYdX also just unveiled a perpetual contract on a ZK-Rollup developed by StarkWare. These are both scalable, standalone products but how do they interact with other products?

Wallets and cross-chain liquidity needed to maintain composability

Composability is a buzz word that describes how DeFi products just fit together (like legos). Users feel like they have one account that interacts with different dapps; complex transactions, like flash loans, unlock capital efficiency, while tokenization enables protocols to interact with each other.

These are important end-product features that are now expected by users, but they do not need to be bundled together in one scaling solution. Users will rely heavily on wallets and cross-chain liquidity solutions to access the speed and cost-savings of other chains while maintaining some composability.

As an aside, specialization is okay. High-powered products like orderbook exchanges or payment networks may not trustlessly integrate with everything at the protocol level, but they will open up new liquidity avenues and third-party services (or trustless ones) will connect them with other pockets of economic activity.

The bridging experience will drive product development

All new chains will connect to Ethereum mainnet, which will remain the source of the deepest liquidity for most assets, but liquidity will splinter. It’s easy to imagine a sizable ecosystem developing on Binance Smart Chain and xDai, which are live now and EVM compatible but come with lower security guarantees.

Andre and the Yearn ecosystem seem geared to drive users towards Fantom. Meanwhile, several DeFi projects have already announced plans to launch on Arbitrum and Optimism, which are battling to be the first EVM compatible Layer 2 to launch (or Polygon?). And, of course, Loopring and dYdX are likely to have sizable liquidity on their ZK-rollups, while other projects, like Curve, may launch later in the year on a ZK-rollup with some smart-contract functionality. Plus, competing L1s, like NEAR, Solana and Polkadot, are likely to have sizable liquidity.

All these liquidity sources will need to be connected and the different chains abstracted away to the end user. Product teams will need to deploy to different chains and ensure continuity in token addresses and block explorers. Wallets, meanwhile, will need to do most of the heavy lifting in connecting the user to different networks. Metamask announced a major product release last week that will make it a lot easier:

Our new Custom Networks API is our latest step on the way to seamless cross-chain user experiences in MetaMask. It allows developers to recommend a variety of chains to their users...networks are then added to the user’s network menu with a simple confirmation, and the user is able to switch between networks using the familiar network switching menu.

Cross-chain liquidity solutions

Depositing assets in sidechains/L2s and withdrawing them will be important for individual users and major liquidity providers. For mainstream adoption, fiat on and off-ramps directly into a chain could build a healthy liquidity pool on a chain. Binance Smart Chain kinda has this given you can withdraw from Binance. On xDai, you can get small amounts through a credit card or debit card but it’s limited.

Sidechains like BSC, xDai and Fantom will attract DeFi power users that are not whales, but much of Ethereum is waiting for Layer 2 networks that maintain the security properties of Ethereum. This includes optimistic rollups, like Optimism and Arbitrum, which are nearing launch. Their use of fraud proofs comes with a significant withdrawal delay (24hrs - 7days) during the challenge period. This is untenable for the power user but two interesting solutions announced recently.

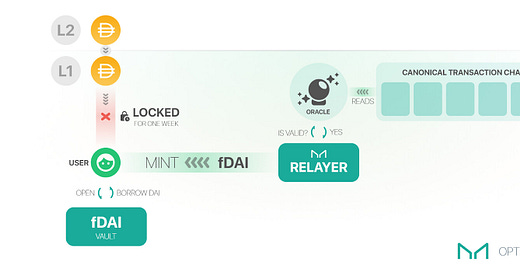

MakerDAO aims to eliminate Dai withdrawal on Optimism

Sam MacPherson posted this design in the Maker forum this morning:

The withdrawal period for Optimism is 7 days, but in theory, anyone could check a withdrawal’s fraud proof off-chain in minutes to determine if tx are legitimate. Maker is essentially saying that it will have an off-chain oracle validate the withdrawal transaction in the L2 rollup and mint fDai on L1, which can be locked in a vault and exchanged for regular Dai. As Sam says, “In effect we will have a stream of 1-week, very safe loans flowing out of Optimism and back into L1.” This is a smart move by Maker to make Dai the on and off-ramp to Optimism, and while not trustless, it relies on the same trust assumptions (the Maker oracle) as using Dai.

Connext announces fast withdrawals for Arbitrum testnet

Connext aims to solve the fragmented liquidity problem by building a liquidity network that plugs into different chains. A quick description:

Connext lets users swap assetA on chainA for assetB on chainB using conditional transfers. This happens in a few simple steps:

Alice, a user of Connext, sends a conditional transfer of assetA to Bob.

Bob, a liquidity provider (aka a router), sends an equivalent amount of assetB to Alice.

Alice unlocks her conditional transfer to receive assetB, which in turn allows Bob to do the same.

Routers are essentially liquidity providers, so Connext will need them to scale, but this model could also easily do L2 <> L2 transfers, where routers’ fees could be lucrative and still less than withdrawing to Ethereum. Hop.exchange is trying to do something similar.

Interoperability has always been the end-game

[Insert two astronaut meme] Ethereum’s high gas fees did not kick-off the multi-chain world. Atomic swaps and cross-chain interactions have long been a research interest in crypto land. All of the scaling research hinges on breaking up computation at the consensus layer and solving data availability across shards/zones/chains/rollups.

Bridging tokens is just the first step, though and the end game is a base-layer blockchain that can trustlessly interact with different chains. And that is a crowded landscape that features Thorchain, Cosmos, Polkadot and now Compound.

Tweet of the Week: More chains = positive for ETH

While sidechains don’t necessarily accrue value to the native chain, Dovey is arguing that the competitive flow of sidechains will drive adoption for all just as SushiSwap’s ‘vampire attack’ on Uniswap actually led to more inflows to Uniswap. HECO is Huobi’s EVM-compatible sidechain. I don’t imagine Coinbase launching a sidechain, but it’s interesting that the major Asian exchanges believe in private blockchains (can we call it that?).

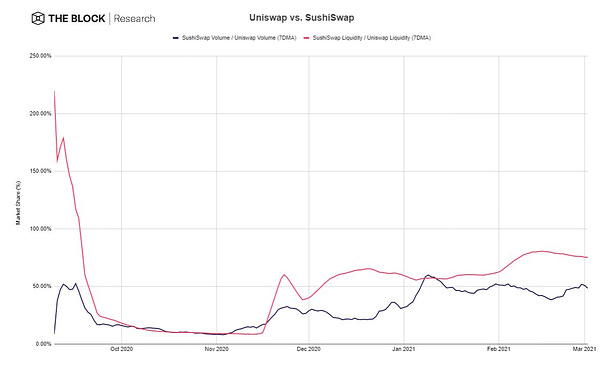

Chart of the Week: UNI vs. SUSHI

A few key metrics from The Block’s Mika Honkasalo compared across Uniswap and Sushiswap, which shows Uniswap still pretty far ahead in potential fee-generating activity. SUSHI is up big today, thanks to the Coinbase listing. Here’s a $500 SUSHI bull case.

Odds and Ends:

DXdao* agrees to Governance 2.0 upgrade Link

DODO recovers some funds after attackers exploit bug for $3.8m Link

BadgerDAO completes $21m DAO treasury diversification Link

Keep and NuCypher announce an ‘on-chain protocol hard merge’ Link

EIP-1559 accepted into the London Ethereum network upgrade Link

Balancer announces intention to launch on Polkadot’s Moonbeam Link

Yam Finance unveils ‘DAO House’ for DAO treasury management Link

Thoughts and Prognostications:

Off L1: Multichain Money legos in action [Makoto_inoue/ENS]

Money scarcity means someone goes hungry [Frances Coppola/Coindesk]

Ownership of Cryptonetworks [Pat Rawson/Curve Labs]

Bitcoin at the Tipping Point [Citi]

The Cartoon guide to Perps [Dave White/Paradigm]

Guide on launching grant programs for token network communities [pet3rpan/1kx]

DeFi exposure for the institutional investor [Ty Young/Messari]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where today it was 60 degrees, but still some snow on the sidewalk. Also check out DXdao’s Month in Review for February.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.