In the US, Memorial Day is the unofficial start of summer and Labor Day the unofficial end. According to the sun and the earth’s tilt, however, summer starts on the solstice on June 20 and ends tomorrow on September 22.

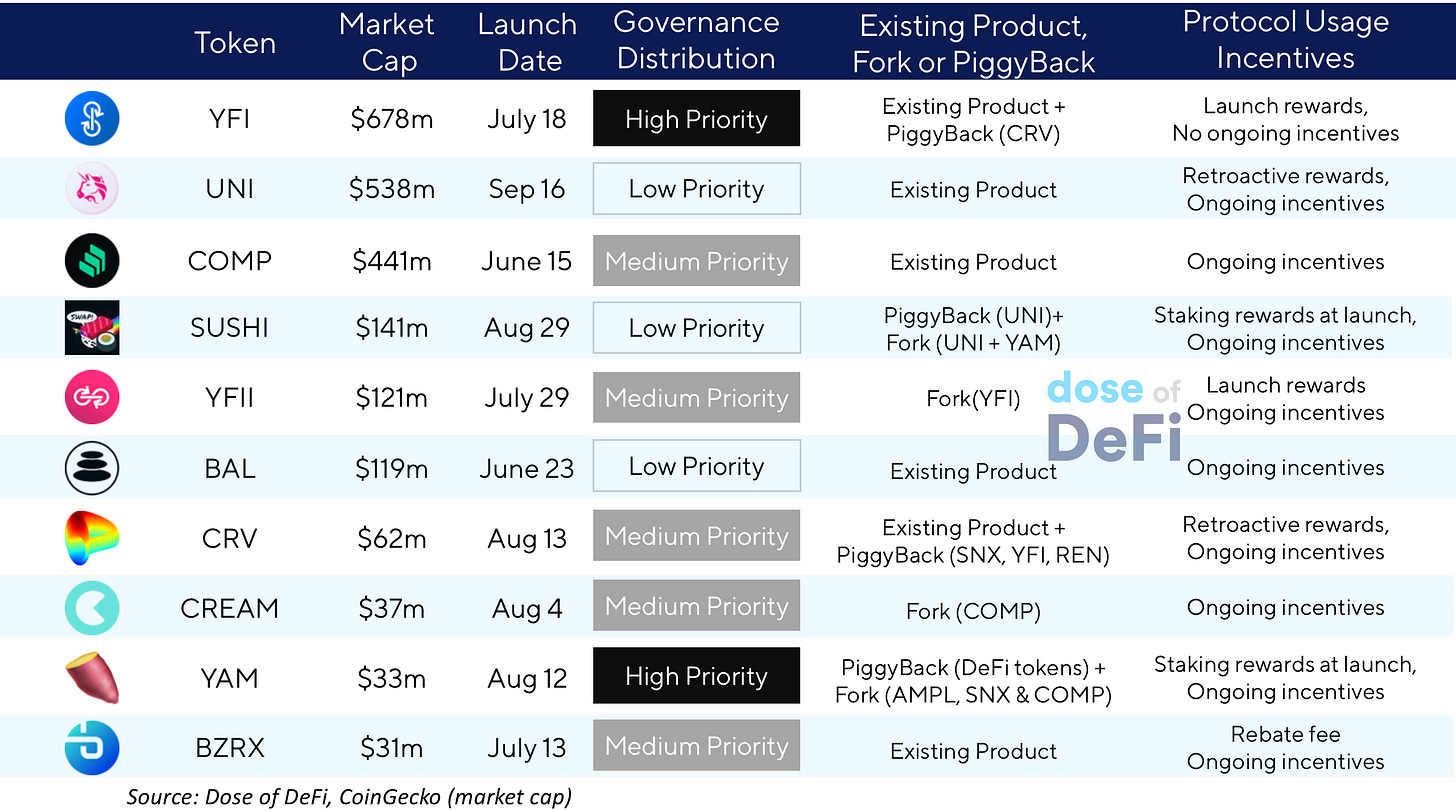

There should be no confusion for the DeFi Summer of 2020; it kicked off with the launch of COMP on June 15 and ended with the surprise launch of UNI, a governance token for Uniswap, last Wednesday.

It has been a dizzying summer. To recap, the last three months has seen the launch of COMP, BAL, bZrx, MTA, YFI, CRV, YAM and of course, YFII, Swerve, Sushi – all with liquidity mining campaigns.

Broadly speaking, there are three ways to look at these launch strategies:

Platform usage incentives

Whether it is an existing product, fork or community piggyback

Importance of Governance distribution.

DeFi Summer 2020

Platform Usage Incentives

At its core, yield farming is a way to distribute tokens to encourage more usage of a product or platform. Synthetix was the first to offer token rewards for on-chain activity. It gave SNX to any address that supplied liquidity to the sETH/ETH Uniswap pool.

Compound took this model but distributed tokens based protocol usage, while simultaneously launching COMP. It has adjusted its liquidity mining parameters several time, and still provides a consistent subsidy for borrowing/lending.

Balancer had a similar concept but BAL rewards starting accruing several weeks before the launch of BAL (just as things started to heat up). Balancer has just under $500m deposited in its pools. Its liquidity mining campaign distributed rewards based on trade fees and Balancer’s flexibility is farmer friendly.

Curve was closer to Compound in that it had an existing protocol with assets, but unlike Compound, CRV was given retroactively to liquidity providers since the launch of Curve. This made LPs happy, but Curve has run into other problems.

Curve may have hoped to get the reception that Uniswap received when it retroactively rewarded early Uniswap users with free UNI. Anyone that interacted with the protocol – including addresses with only failed transactions – received 400 UNI and liquidity providers going back to v1 were rewarded commensurate with liquidity supplied. This dividend created good will in the community.

Uniswap’s usage incentives are unique in two ways. 1. Reward traders, rather just liquidity providers 2. Their incentivized pools are targeted and strategic to Uniswap’s future.

Forks and Community Piggybacks

COMP, BAL, UNI, YFI and CRV were distributed to liquidity providers because deposits enhanced the capability of the underlying platforms they govern. Many other launches, meanwhile, distributed new tokens to those who just staked tokens. These are not used for borrowing/lending of exchanging assets, but simply a proof-of-asset to a new community trying to get off the ground.

Essentially, a new project piggybacks off of another community by offering free money for staking its token.

YAM is perhaps the best example of piggybacking (yes, I’m going to make it stick). YAM was a surprise launch, a modified version of rebasing currency AMPL along with community governance (a fork of Compound). Bolted on top this was a token distribution scheme that used the Synthetix staking contracts. Anyone who staked one of 8 tokens would receive YAMs in 1000% APYs.

It was a fun game, particularly for the communities of the 8 tokens it selected. Free money will make enthusiastic supporters out of these communities. This boost gives the project momentum and broader positioning in the Twittersphere.

SushiSwap actually started as a fork of YAM. Instead of staking regular tokens, SushiSwap got users to stake Uniswap LP tokens in order to farm the newly launched SUSHI. Initially, the “hundreds of millions of dollars of assets locked up in SushiSwap” were only staked to farm SUHI, with the underlying tokens still in Uniswap.

Then, of course, Chef Nomi, SBF and company actually forked Uniswap and migrated over a good chunk of the liquidity and are now paying SUSHI rewards to SushiSwap LPs. In just a month since launch, SushiSwap has $240k in 24 hr on-chain fees, ahead of Compound and Balancer and only behind Uniswap, according to Token Terminal.

CREAM and YFII (now DFI.Money) were also successful forks of Compound and YFI respectively. Cream has been more aggressive about listing assets while DFI.Money is concentrated on the Chinese community. Total market cap of forks from the DeFi Summer: $332m.

Governance importance

All of these tokens have been launched under the “governance” banner, which is either a clever legal trick or due to the rise of decentralized coordination around an on-chain treasury or smart contract admin, but there were varying degrees to as how important governance was to their distribution strategy.

YFI has the highest circulating market cap of any token launch in the DeFi Summer, in part because all the YFI ever to exist has been distributed, whereas there are still years of reward distributions and investor/team lockups for other protocols. To borrow from a prior Dose:

More important than the subsidy for Yearn.finance products, YFI yield farming subsidized the creation of a governance community. Many of the most eager DeFi farmers participated early, instantly creating a small army of token holders financial invested in the long-term success of the platform and willing to shill the project endlessly on Twitter.

The lack of a sale or pre-mine for YFI underscores point #3 above: token distribution is the most important thing for a token launch. Typically, this was done to the team, investors and then in a crowd sale or ICO to disseminate widely, but moving forward, projects should use token launches to pick their token holders, because they will ultimately determine a project’s governance and long-term success.

YFI governance was selected entirely during its distribution. COMP and BZRX come with governance rights, but the development path and primary stakeholders did not change during the token launch. These projects did succeed in moving governance of their protocol to token holders on-chain.

Other projects, most notably Uniswap and Balancer, have limited governance capabilities. Their primary role is the management of the liquidity mining campaigns and could be closer to loyalty tokens. Of course, this is kind of by design. Both protocols have no upgradeability.

UNI token holders can turn on the protocol fee, but that’s it. It’s no secret that the Uniswap team is working on a V3. It’s not clear what role UNI token holders will have in V3 or their role in migrating liquidity.

As this DeFi summer draws to an end, will this be the Eternal September?

Tweet of the Week: Money Lego Yield Farm

Interesting proposal from Staked’s Cole Kennelly about adding the WETH-WBTC and WETH-USDT to MakerDAO as collateral. Maker had previously considered the DAI-ETH pair as collateral but as so far not added any LP tokens. Of course, WBTC and ETH are already accepted collateral, so the risk would hinge on the liquidation capability. It could open up a significant new market for collateral for Maker in its quest to meet increased demand for Dai.

Chart of the Week: UNI volume

A mashup of the CoinGecko UNI page, which shows a staggering $1bn in 24hr trading volume for UNI. This may be a little inflated but not by much. The volumes on Binance and elsewhere show how far DeFi needs to go to tap into the larger institutional market. Regardless, it’s impressive for UNI to reach these volumes less than a week after its launch.

Odds and Ends:

DEXs rake in the retail volume while institutions stay on the sidelines Link

Yield farming aggregator APY.Finance raises $3.6M in seed funding Link

NFT market heats up Link

Gnosis partners with xDai, plans Layer 2 migration Link

DEX aggregator Paradex raises $2.7m in seed funding Link

Algorithmic credit risk & lending protocol Teller announces launch Link

Thoughts and Prognostications:

Stop Burning Tokens – Buyback And Make Instead [Joel Monegro/placeholder]

Gas Wars: Understanding Ethereum's Mempool & Miner Extractable Value [Dan Robinson+Georgios Konstantopoulos+Hasu/Uncommon Core]

Fork Defense Strategies in DeFi [Ian Lee/IDEO Co. Lab/Bankless]

A Brief History of YAM [Trent Elmore/YAM]

Yearn Finance Newsletter #3 [Yearn]

A Rarible Opportunity in The War for NFT Supremacy [Mason Nystrom/Messari]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn at the equinox. I need a haircut.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao. All content is for informational purposes and is not intended as investment advice.