I want to apologize. Two weeks ago, I wrote:

It appears that everyone has settled on liquidity mining as the meme to describe incentive programs that reward investors for storing assets in a DeFi protocol to bootstrap liquidity (some still want to make liquidity farming happen).

I’m not sorry for the Mean Girls reference, but clearly the farming meme won out, and rightfully so. After last Monday’s launch, the price of COMP skyrocketed but the rewards dished out by the Compound Protocol have been predictable, “like watching paint dry” or yes, tending every day to a plot of land.

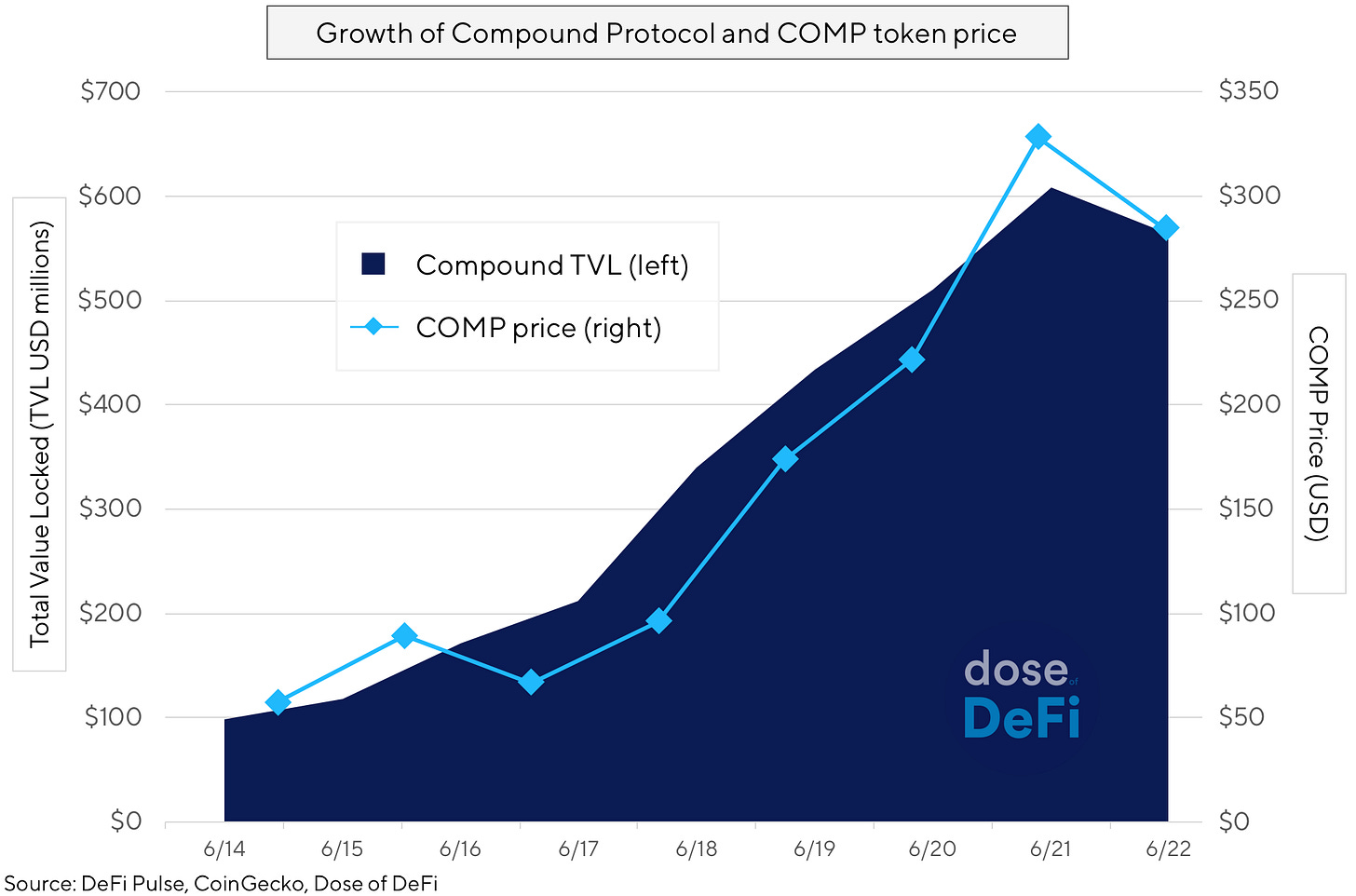

The predictable distribution means that most of the interesting activity is on the Compound protocol and in the price of COMP:

Yes, COMP began trading on Uniswap last Monday, but the cheapest way to get COMP has been from borrowing and lending on the Compound platform. When the price of COMP goes up, the size of the subsidy to users grows, encouraging more activity on the protocol.

Negative rates

Higher yields will attract more lenders, but Compound’s liquidity farming subsidies enable borrowing at negative rates because COMP rewards accrue at a higher rate than a borrower’s interest (depending on the price of COMP).

No where was this more true than USDT, the third largest cryptocurrency and one with an already established lending market in the CeFi world, but with the launch of COMP farming, Compound became the cheapest place to borrow USDT and essentially any other asset by paying users to take out loans.

A common crop rotation:

Deposit ETH (earn negligible amount of COMP)

Take out USDT loan (earn COMP, pay USDT interest)

Trade USDT -> Dai/USDC

Deposit Dai/USDC (earn COMP, earn Dai/USDC interest)

Take out USDT loan (earn COMP, pay USDT interest)

Repeat

The stablecoin swap was the most popular strain of COMP farming, sending USDT borrowing rates soaring to double digits. Still, leveraged borrowers harvested COMP faster than their interest could accrue.

Incentivizing good behavior? Several centralized exchanges have tried “transaction mining”, but these were easily gamed and not sustainable. So how does a user borrowing USDT at 24% help Compound? Because the deposit yield is incredibly attractive to any USDT holder (outside of DeFi).

Magnetic pull of DeFi

Some have called Ethereum a black hole that attracts assets by maximizing their capital efficiency. In this case, it’s the added yield from COMP rewards pulling assets into Compound.

USDT was the first asset sucked into Compound because of high rates, but the same scenario is unfolding with BAT and ZRX. Never mind whether or not someone should borrow BAT at 33%, if lending rates are 25%, it’s hard for any one holding BAT to not deposit into Compound and let it idly earn interest, while also farming COMP.

Protocol Sink

COMP farming mania has also reignited enthusiasm around cTokens (cUSDT, cUSDC, cZRX, etc), which are transferrable tokens (like Chai) that represent a claim on underlying assets (USDT, USDC, ZRX) in Compound. Holders of cTokens also automatically harvest COMP rewards.

Last week, Poloniex and FTXlaunched a USDT/cUSDT trade pair, which creates an easy on and off-ramp from the centralized world, without relying on gas costs

Someone seeded a Balancer pool with cUSDT, cDAI and COMP. It now has $1.6m in deposits, farming COMP and BAL.

Is Balancer managing the underlying asset or Compound?

cTokens are Compound’s effort to lock up base assets and allow derivatives to be build on top of it – what David Hoffman called “The Protocol Sink Thesis”. While individual DeFi enthusiasts have been the primary users of the protocol, Compound hopes cTokens will be used to create an array of financial products for retail investors and large institutions.

Increased DeFi activity may actually come from CeFi companies serving as a middleman. Nexo is the poster child of the CeFi farming DeFi movement. It has a $9.3m WBTC-backed Dai loan on Maker and deposited $60m of USDT to farm COMP.

There are centralization risks. Exchanges have already claimed a huge share of the staking market, and they could use similar “soft staking” models to optimize returns for investors. Furthermore, with ETH2 on the horizon, the COMP farming ecosystem of financial services and products may be a precursor to the ETH staking ecosystem.

What to look for next?

DeFi > Compound – Are the assets sticky or is this just a sugar high? Switching costs are low, so there may be outflows when the subsidies decline, but aggregating assets builds liquidity for Compound (especially for large institutions). Still, COMP farming brought in hundreds of millions of dollars into DeFi and it’s not going back. The growth of the USDT market could bring serious volume to DEXs and other DeFi products.

When BTC collateral – BTC-backed USDT loans are probably the most popular crypto financial product. Compound, like the rest of DeFi, is limited as long as Ethereum is the primary collateral option. There is a WBTC market on Compound, but WBTC cannot be used as collateral. Given the growth of WBTC liquidity, that may change soon. There’s also a post in Compound forums about adding renBTC.

Maker – just when it started to regain its footing after Black Thursday, Maker is usurped by Compound for 1st place on top of the DeFi Pulse rankings. Maker already has a WBTC collateral option, which it should rely on as Dai backed by ETH refinances on Compound. It’s also further along in real world collateral with the impending inclusion of Paperchain’s tokenized music streaming invoices and ConsolFreight’s tokenized freight invoices. Still, DAI is its most powerful tool to compete with Compound. Might we see a negative DSR?

COMP farming penetrated mainstream crypto – Compound is well-known and ‘DeFi’ has had enough time to infiltrate as a meme, but of course “farming” changes everything because of its simplicity. Whether from BTC, crypto dollars, or ETH not in DeFi, there is still a lot of room to grow within the crypto community.

COMP Governance - changes to the USDT reserve factor and a host of recommendations from Robert on COMP distribution.

More COMP, COMP, COMP:

Robert Leshner cites influences for COMP

COMP Distribution; Potential Approaches to Normalize [Robert Leshner]

COMP Distribution, Key Delegates, New Asset Pages [Compound Digest]

$COMP: Lessons and Learnings [Kerhman Kohli/DeFi Weekly]

COMP Growth Hacking DeFi [Dan Elitzer, Ryan Sean Adams, David Hoffman/Bankless]

Why COMP 5xed on Day 1 and What This Means for a DeFi Bull Market [Kain Warwick, Laura Shin/Unconfirmed]

COMP token distribution and governance [Jed Breed]

Tweet of the Week: Lost COMP

Although Curve saw more USDC/USDT trading on June 20 than Binance, its LPs are not taking part in the COMP farming frenzy, because the contracts were not built to harvest COMP. cTokens make it easier for COMP farming to grow, and COMP capability will be crucial for any 3rd party integrations.

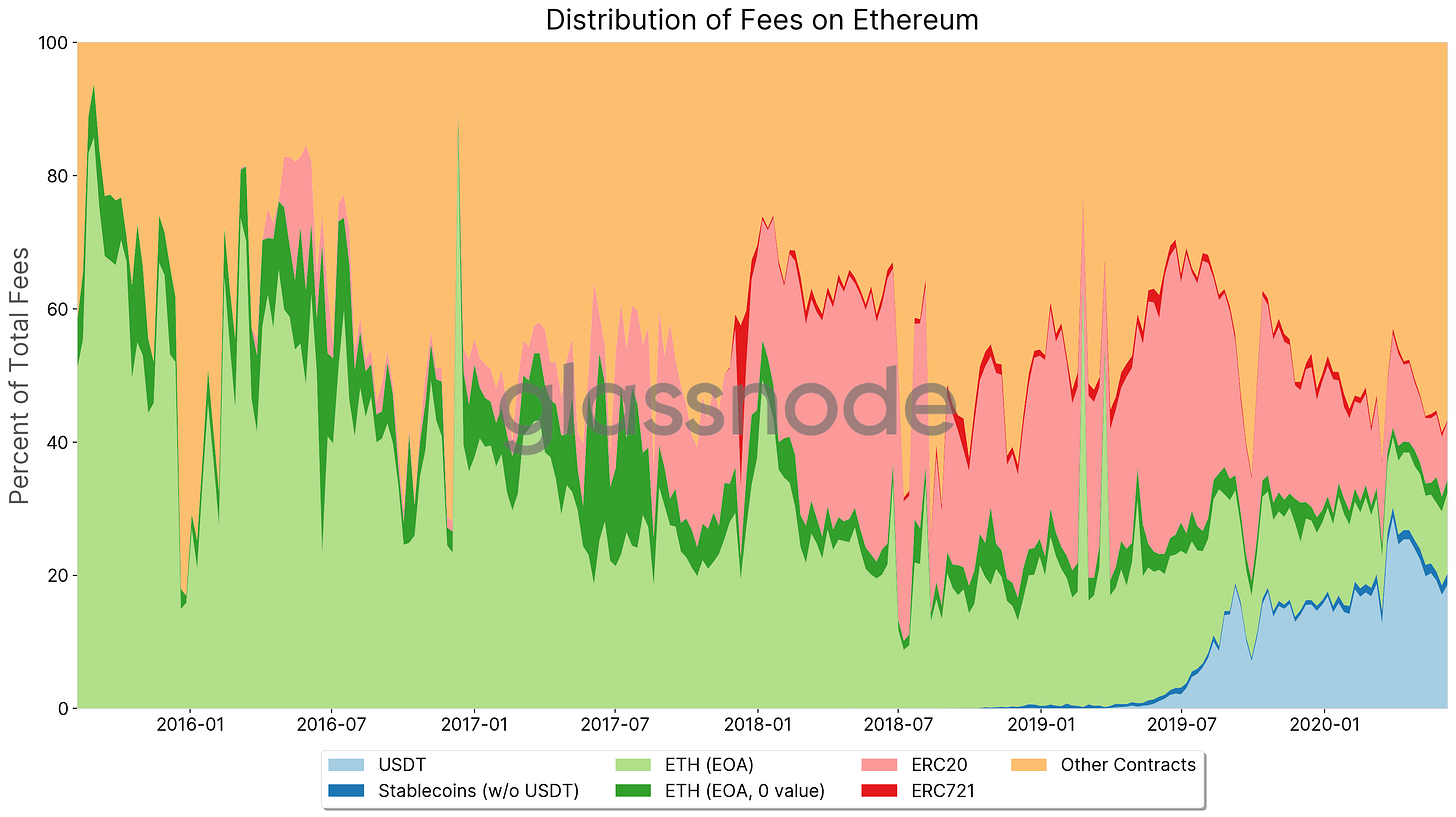

Chart of the Week: Fees on Ethereum

Great chart about the source of transaction fees. Simple ETH transfers have fallen, while stablecoins and USDT power almost 20% of Ethereum network fees. Lots more insight in Glassnode’s full post.

Odds and Ends

dYdX uses Curve to offer USDT onramp to BTC-USD perpetual Link

Calculating Value, Impermanent Loss and Slippage for Balancer Pools Link

Opyn raises $2.6m from Dragonfly, 1kx, CoinFund Link

0x launches OTC desk, Periscope Trading Link

Polymarket predictions market goes live Link

UMA plans to launch COMP-USD oracle, paving way for COMPUSD token Link

Thoughts and Prognostications

How does DeFi cross the chasm [Jesse Walden/Variant]

Liquid Staking Report: Bridging Proof-of-Stake and Decentralized Finance [Felix Lutsch & Brian Crain/Chorus One]

Why the VCs are missing DeFi [Jonathan Joseph/Smart Money]

The Economics of ETH2 [Nick Tomaino/1confirmation]

What PoS and DeFi can learn from mortgage-backed securities [Tarun Chitra/Gauntlet]

Liquidity Provider Returns in Geometric Mean Markets [Alex Evans/placeholder]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. Subscribe to Govern This and look out for post analyzing large voters. Euchre tomorrow. Gloria can’t juke like I can.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.