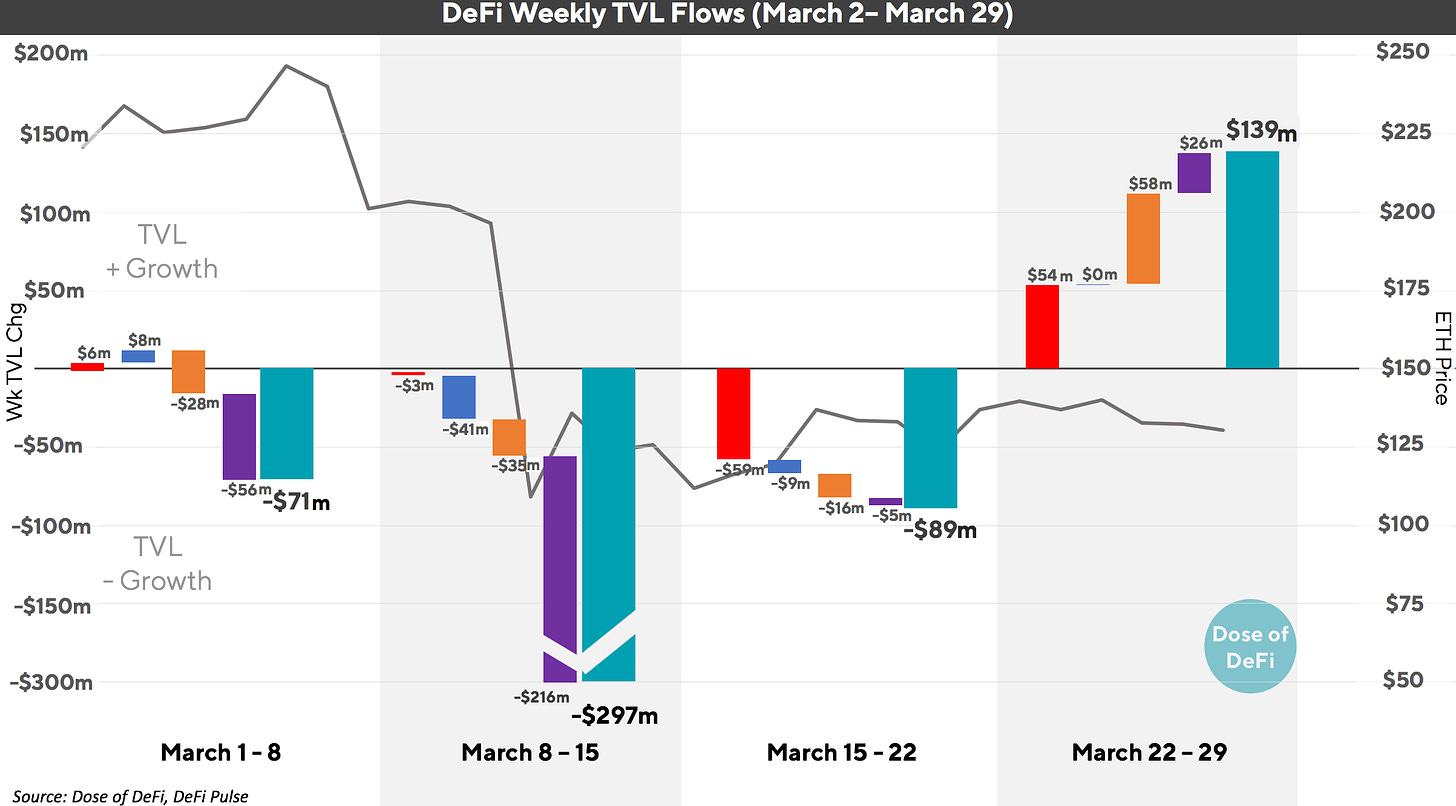

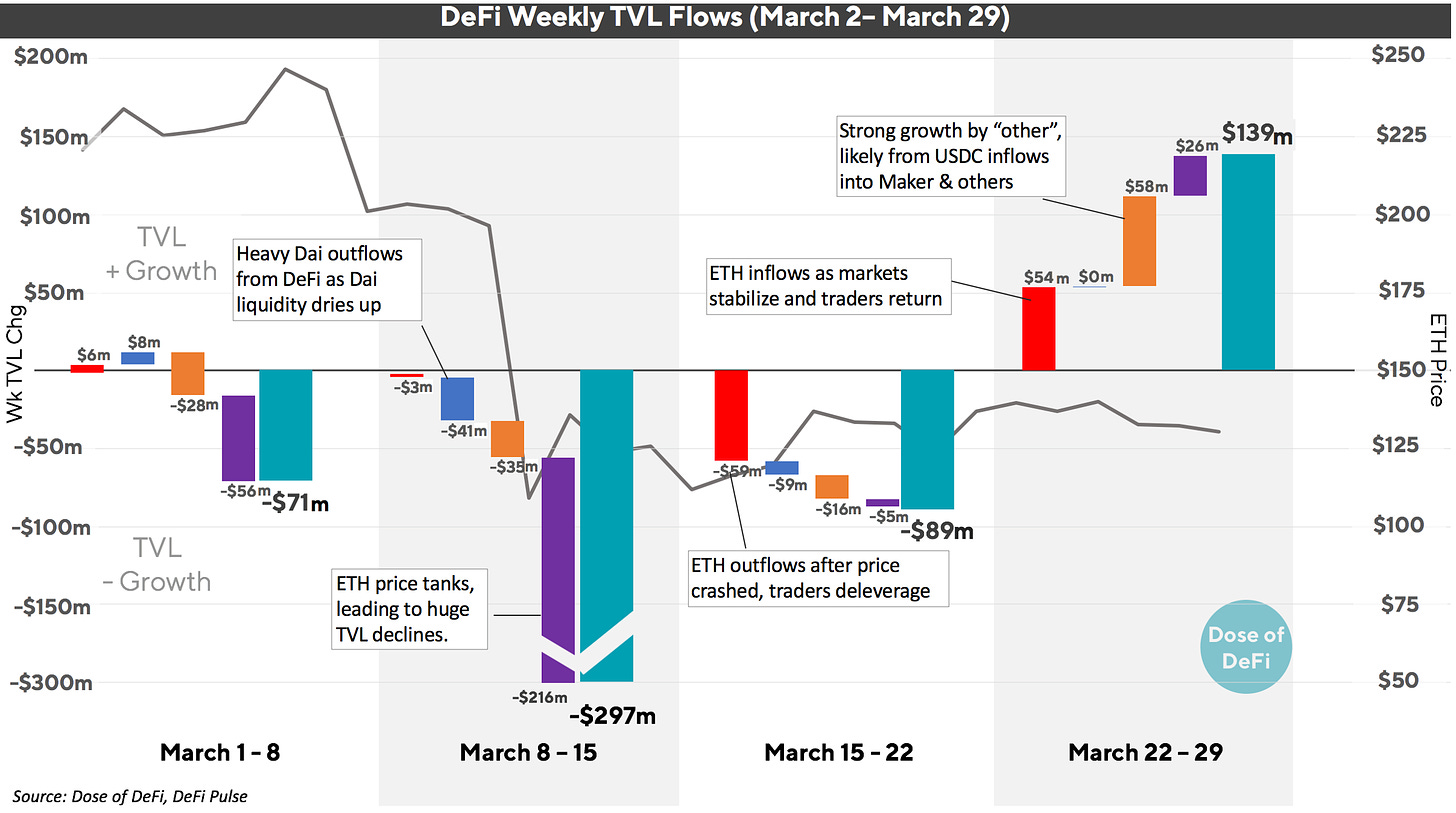

March 2020 is shaping up to be the longest year of my life. Every day seemed to pack in a week’s worth of activities and DeFi was no different. I went through DeFi Pulse’s Total Value Locked (TVL) to see how funds changed in DeFi over March.

First, explanations for the data series:

“ETH In/Out flows” - New ETH (in USD) that has flowed into DeFi over the week (inflow) or the amount of ETH (in USD) that has left DeFi in the week (outflow)

“Dai In/Out flows” - New Dai that has flowed into DeFi over the week (inflow) or Dai that has left DeFi in the week (outflow)

“Non-ETH/Dai Change” - The difference between the USD value of all non-ETH/Dai assets now and one week prior. This statistic does not distinguish between new asset flow or capital appreciation/loss. Includes USDC, SNX, WBTC and all other tokens, not including Dai or ETH.

“Gain/Loss from ETH price change” - the TVL change that is attributed to the rise (or fall) of the value of ETH; does not account for new flows.

“Total TVL Change” - add (or subtract) the items above to get the weekly increase or decrease in the DeFi’s Total Value Locked.

“ETH Price” - ETH price

All data was gathered using Concourse Data. Breaking this out by segment should help us understand why and how TVL changed over the course of March. Here’s an annotated version of the chart above:

There are big movements in each of the major categories over the month:

“ETH In/Out flows” - After the market turbulence, lots of ETH flowed out of DeFi protocols (almost 500k ETH or ~$59m), but that ETH flowed back into the system just over the weekend

“Dai In/Out flows” - There was a clear Dai liquidity crunch in the second week with over $41m leaving DeFi protocols. A lot of this is because the utilization rate on lending protocols was approaching 100%, so there wasn’t much Dai locked in secondary lending platforms.

“Non-ETH/Dai Change” - It’s not possible to break out by number of units, and since this category includes SNX, BAT, WBTC and other volatile assets in Compound/Uniswap/Bancor/etc., the $ change is reflective of a bounce back in prices. But, it’s also clear that a lot of the $58m in growth in the last week of March was from stablecoin flows, both from Maker’s addition of USDC collateral and a general rush to stablecoins, particularly USDT, in times of market panic.

“Gain/Loss from ETH price change” - More than flows, the declining price of ETH had the biggest effect on DeFi TVL, knocking out more than $200m in value during the second week of March.

Next week I’ll look at fund flows at specific DeFi protocols.

UMA’s “Priceless” Synthetic Tokens

UMA is out with a new synthetic token designed to minimize oracle usage. Their blog post outlines a new oracle model that does not rely on an on-chain feed. Synthetix, for instance, needs to post the price for ETH, BTC, Gold and every other synthetic asset it offers on-chain. Likewise, Maker, Compound and other DeFi lending protocols all use on-chain price feeds to enable the incentives for their collateral liquidation systems.

UMA’s new design does not use on-chain price feeds. Instead, liquidators are assumed to be correct unless they are contested. Liquidators must post a deposit when they try to liquidate an undercollateralized account. There is a delay (~hours); during which anyone can dispute the liquidation. UMA Co-Founder Allison Lu summed it up:

If this design was used for Maker on Black Thursday, liquidations would have occurred immediately, but the payout would have been delayed for several hours, pending any disputes. The delay introduces a “liveness requirement” where a liquidator’s ETH is locked for a period to disincentivize malicious liquidation.

In the event of a dispute, an oracle is still needed - UMA dubs theirs “Data Verification Mechanism”. Presumably, this will operate in a decentralized way with appropriate token governance but these details are not clear right now.

They haven’t exactly reinvented the wheel, but on-chain price feeds are expensive to secure, so it could offer the same efficiency trade-offs as optimistic rollups.

Stablecoins, Stablecoins, Stablecoins everywhere

As traditional investors turn to cash, crypto investors turn to stablecoins. Lots of action over the last week.

Is everyone FUDing into Stablecoins? - Santiment on the growth of stablecoins in March

Will negative interest rates affect fiat-backed stablecoins? - Short answer, no, but Hasu goes into further detail in a Coindesk column. Yes, they may lose some revenue from interest but the overall market is likely to grow much more and stablecoin issuers can implement fees for redemptions. Besides, dollars will always be more efficient collateral than volatile assets like ETH.

Tron launches its own MakerDAO system, Djed - it’s tough not to snicker at the copy paste job but it’s interesting that it’s USDJ, and not RMBJ or YenJ. Tron is not intending to use this for gambling and games. And no BTT accepted yet.

Lastly, this tweet from Vitalik:

@factcheckmypost Alternatives to maker with more minimalist governance are quietly beong worked on, so people will have all parts of the trust spectrum to choose from.

@factcheckmypost Alternatives to maker with more minimalist governance are quietly beong worked on, so people will have all parts of the trust spectrum to choose from.Presumably, this cryptic tweet from Vitalike includes MetaCoin, which released its first update in 6 weeks, but is he hinting at any others?

Odds and Ends

Uniswap-like DEX, Balancer Labs, raises $3m from Accomplice & Placeholder Link

DeFi Saver introduces new interface for Maker collateral auctions Link

Coinbase Wallet integrates Compound and dYdX Link

Synthetix discloses bug found by Samczsun Link

Kyberswap integrates oauth service Torus for easier on ramp Link

Gitcoin Grants Round 5 Link

Dharma announces optimistic rollup L2 solution for fast payments Link

Furucombo is a customizable DeFi transaction packager Link

Odds and Ends

Daos Ex Machina: An In-Depth Timeline of Maker’s Recent Crisis [Tom Schmidt/Dragonfly]

Latin American Bitcoin Trading Follows the Heartbeat of Venezuela [Matt Ahlborg]

The BitMEX Liquidation Spiral [Coin Metrics]

How the Compound Team Optimizes Infura Usage to Power Their DeFi Protocol [Geoffrey Hayes/Infura Blog]

Decentralized Finance: On Blockchain- and Smart Contract-based Financial Markets [Fabian Schär/University of Basel]

Trust Spectrum [Tony Sheng & Ben Sparango/Multicoin]

That’s it! Feedback appreciated. Just hit reply. More charts coming, lmk how these waterfalls worked. Written in Brooklyn where I appreciate Prospect Park.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.