DeFi is a liquidity revolution.

In the traditional world, you buy and hold assets and hope the asset appreciates. Maybe you have some dollars in a yield-generating bank account, but for the most part, assets that you own are not “being put to work”.

In DeFi, this is totally different. Hodling an asset is just the first step. Any investor can be a liquidity provider by depositing these assets in a smart contract where they are “put to work” to earn additional returns. These liquidity providers realize returns from either:

Lending out the asset

Facilitating trades as a market maker

So if you have SNX or MKR, you could deposit those into Compound and earn interest from lending them out, or you could deposit SNX or MKR into an AMM like Uniswap, Balancer or Bancor and you’d get fees from the trades that your deposits supported - plus any appreciation of the underlying asset.

The yield farming frenzy has obscured this under-appreciated fact: DeFi has enabled anyone to be a liquidity provider.

A liquidity providers’ perspective

The first generation of DeFi protocols were built with the end product in mind. Maker is designed to produce Dai, while Uniswap’s overarching goal is to facilitate trading. DeFi products are in fact two-sided marketplaces and the “liquidity provider” market may be bigger than the market for trading.

Aggregators and trader-friendly front-ends further separate the trading demand from the liquidity supply. Uniswap serves traders and LPs equally, because Uniswap.org attracts direct retail flow, but for most AMMs, like Balancer, Bancor, Curve and Sushi, their real user is liquidity providers. Most of their trade flow (and fees) will come from 1inch, Matcha or another aggregator.

How to make liquidity providers happy

Liquidity providers are looking for two things

Returns on the underlying assets

Leverage

The first has been the driving motivation for AMMs since the beginning: how to do more with less. In 2020, Uniswap enabled 50/50 pools with any two assets, while Balancer allowed adjustable weights and fees and Curve implemented a more efficient trading algorithm specialized for stable assets and utilized lending protocols. Each of these enabled more trading volume (and thus fees) on more assets.

There are a host of similar improvements for liquidity providers on the way. Balancer v2 allows unused inventory to be simultaneously lent out (much like Curve does), while Uniswap v3 promises the moon and to constantly tease us.

Leverage on my favorite assets

One of the more popular ways to invest is to buy all the tokens/assets that you think will go up in value and use them as collateral to take out a loan. You could take out this loan in dollars and then re-purchase those same tokens/assets that you think will go up to lever up. Presumably, you guess correctly and the asset’s appreciation will pay off the loan. Or alternatively, you could take out a loan in assets you don’t like, sell the asset, reinvest the proceeds and then later repurchase the asset (hopefully, at a lower price) to pay off the loan.

This is a capital efficient way to invest in the traditional world, where a prime broker will manage its own inventory and offer products and services off of that. But in DeFi, there’s no one at Compound, Aave or Maker looking for ways to leverage their huge balance sheet of ETH & WBTC.

Instead, DeFi needs to unbundle the prime broker by integrating loan collateral with automated market makers.

Aave and Maker lead the way

Collateral-backed loans are crypto’s secret growth hack. Cryptoassets are fantastic collateral, trades 24/7 and available in every country in the world - it’s why BlockFi is worth $3bn. AMM LP tokens could become excellent collateral and unlock additional supply. Most loans are backed by ETH or BTC, so wouldn’t a WBTC-ETH Uniswap LP token be better?

Of course, it’s a little more complex, particularly around the oracle pricing and liquidations if the value of the collateral drops, and the demand for borrowing an LP token is less than the underlying assets, but borrowing against LP tokens will be a superior way of getting leverage.

Maker and Aave are moving the most aggressively in this direction. Aave announced the release of the Aave AMM Market last week, which is a standalone lending protocol for Uniswap and Balancer LP tokens. It supports the LP tokens for 14 Uniswap pairs and 2 Balancer pairs. Users have not rushed in yet, but there is $5.1m of outstanding loans against the LP tokens.

MakerDAO, meanwhile, is looking to expand its initial trial:

After adding LP tokens as acceptable collateral for Dai loans last month, Maker is coming back to increase the debt ceiling after initial demand outstripped supply. Six LP token pairs maxed out the $3m and Maker’s Governance Facilitator just started an on-chain poll to increase this to $30m for each pair.

Capital efficiency improvements like this will drive DeFi flows, particularly when the yield aggregators start fully integrating them.

Tweet of the Week: Sushi Rewards Delayed?

So, Sushi’s farming contract vests SUSHI rewards for 6 months and the first release is upcoming in April. To prevent against “parasitic farms” that would just sell Sushi to pump their own token, Sushi withholds 2/3 of the rewards. Projects must apply to Sushi receive rewards that they are supposed to already receive, as Scott Lewis points out. Quite a lot of yield aggregators have been using Sushi to LP and many have even paid the unvested Sushi rewards out. It will be interesting to see how projects react. One of the largest and earliest, Harvest Finance has a compromise proposal up today, which would allow it to claim, “claim the Sushi from the Merkle distributor and then hold the entirety of the claimed SUSHI with a 1 year lockup and 2 year vesting (on top of the previous 6 month vesting).” Something to keep an eye on.

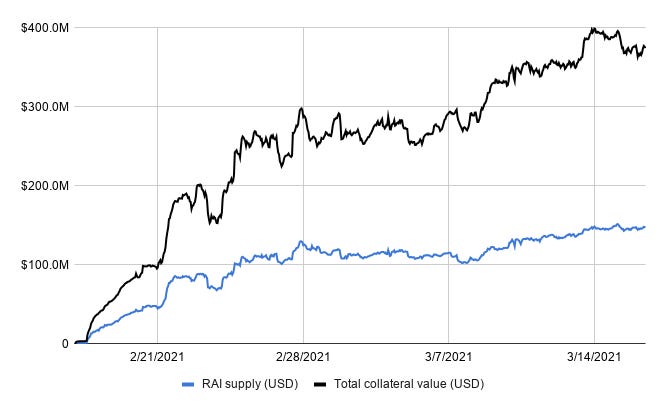

Chart of the Week: RAI grows after launch

Chart plucked from (especially valuable this week) Our Network. Rai seems like the right antidote to these frenzy times. Stability amidst the mania, promising predictability more than anything else. The PID controller design could kickstart a wave of truly automated protocols. Of course, it will be hard for them to find product-market-fit.

Odds and Ends

DXdao* introduces DXventures Link

Flashbots transparency report - February 2021 Link

Tally raises $1.5m for on-chain governance aggregator Link

CREAM: Postmortem Report of DNS Hijacking Link

USDC market cap surpasses $10bn Link

Gnosis introduces SafeSnap for easier Snapshot multi-sig signal votes Link

HydraDX completes a liquidity bootstrapping pool (LBP) on Balancer Link

Thoughts and Prognostications

Participants in a DeFi protocol ecosystem [Vadym Nesterenko/Atomica]

The Anchor launch and what it means for Terra [Jonathan Erlich/Delphi Digital]

Bancor - The World Token [Nicholas Koh & Wangarian/Deribit Insights]

Stories, Scarcity and Mimetic Desire [Nick Tomaino/1confirmation]

Poor Wojak’s Almanack [Arthur Hayes/Bitmex]

A Year After the Crash [Nate Maddrey/Coin Metrics]

BlockFi, Grayscale & Shadow Banking Illustrate Why DeFi Really Matters [Jeff Dorman/Arca]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. Happy Spring! So excited to see the world come alive again.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.