DeFi is a great meme. It also features some truly groundbreaking technological developments. Automated Market Makers (AMMs) like Uniswap have been called DeFi’s “Zero to One innovation”, but I think it’s broader than just decentralized exchanges.

DeFi’s real breakthrough is programmatic on-chain liquidity pools. Whether it’s facilitating trading, lending or any other financial instrument, the ability to pool assets in a smart contract will create a new market structure.

Dan Elitzer was one of the first to see the potential of on-chain capital pools. He wrote about superfluid collateral in February 2019 where he argues that DeFi Protocols should have collateral that’s used for multiple purposes. An idle asset is a wasted opportunity.

Fast forward to last month:

Liquidity protocols or on-chain capital pools will be the building block for nearly all DeFi products and services. Just as traditional companies use its balance sheet to expand, on-chain capital pools will be used to create more and more financial products. Innovation will come from increasing the capital efficiency of the capital pool.

Balancer v2

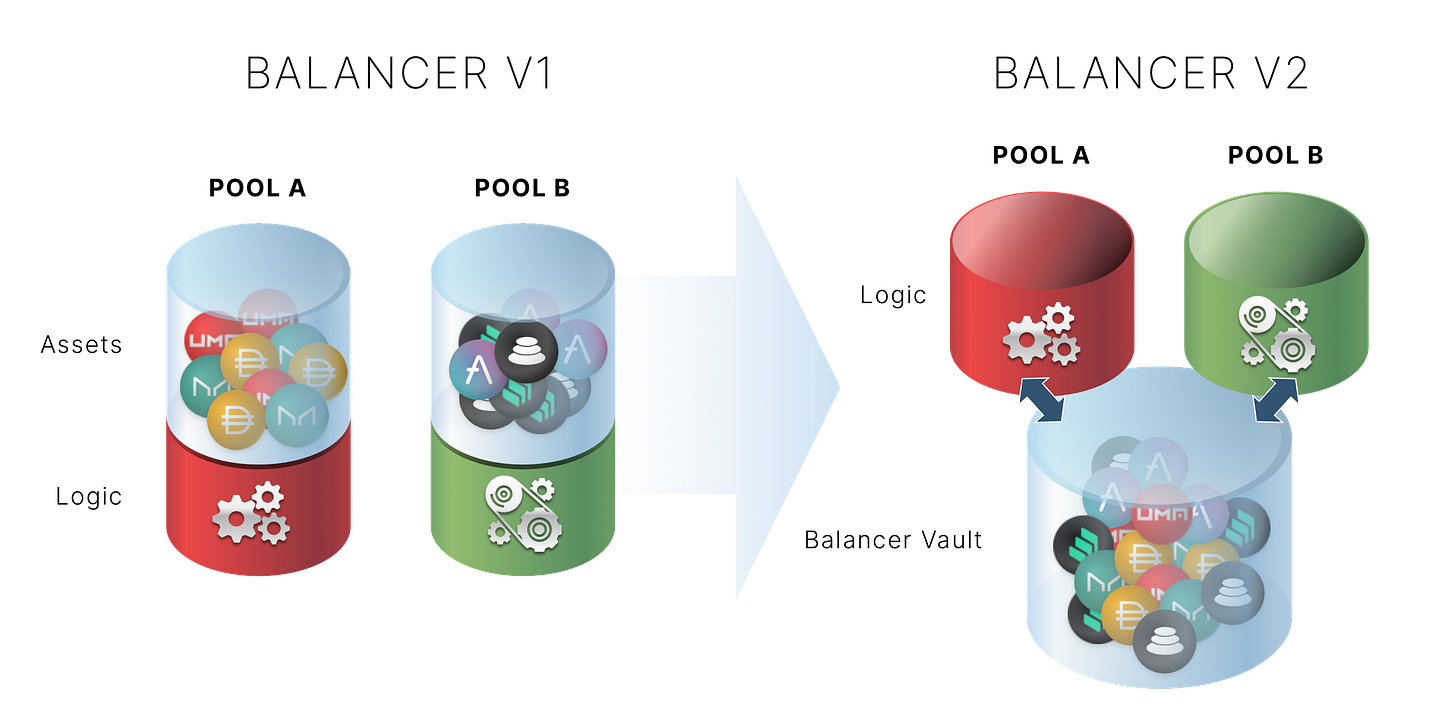

Liquidity pools are largely siloed now. Balancer’s v2, which was announced last week, hopes to change that by moving the architecture to a “single vault that holds and manages all the assets added by all Balancer pools”

Trade pricing is calculated in an external contract, while the actual tokens sit in a unified vault, as opposed to Uniswap or Balancer v1, where trades are calculated using the token balances of separate pools. This essentially introduces a “T+x” settlement process, where a trader can have internal balance changes that don’t actually swap tokens (saving gas and keeping the liquidity in the Balancer system).

The architecture change also unlocks a couple other capital efficiency improvements:

Customizable AMM Logic - AMMs use a single equation to price a trade. For Uniswap, every trade follows the X*Y = K constant product formula. Curve showed how certain assets, such as stablecoins, could use a customized equation to be more capital efficient. Volaile assets will have different trading algorithms than assets with a tight correlation. Balancer v2 allows external contracts to introduce unique pricing/trade algorithms.

Lending idle assets through “asset managers” - Balancer v2 also promises the ability to deposit unused tokens in lending protocols, generating a yield for liquidity providers (LPs) on top of the trading fees.

Other capital efficiency enhancements

Balancer isn’t the only one trying to make collateral more useful.

MakerDAO added the Uniswap’s ETH-DAI, ETH-USDC and ETH-WBTC LP tokens as acceptable collateral for Dai loans. All three quickly reached 100% utilization. These are not exactly ‘superfluid’ but the money legos interact seamlessly. Maker is poised to add more LP tokens.

Aave’s governance staking module introduces an insurance system where the underlying collateral is put to work. Aave v1 also accepted Uniswap LP tokens as collateral, but it never really took off.

C.R.E.A.M. Finance has added several Sushiswap and Uniswap LP tokens as acceptable collateral

Yearn’s Stable Credit is a galaxy brain idea that is a lending protocol with native AMM integration (presumably Sushiswap) that also supports impermanent loss (IL) insurance.

On the horizon

With Balancer v2 announced, we’re left waiting for Uniswap v3. Two other things to keep an eye on in the capital efficiency race:

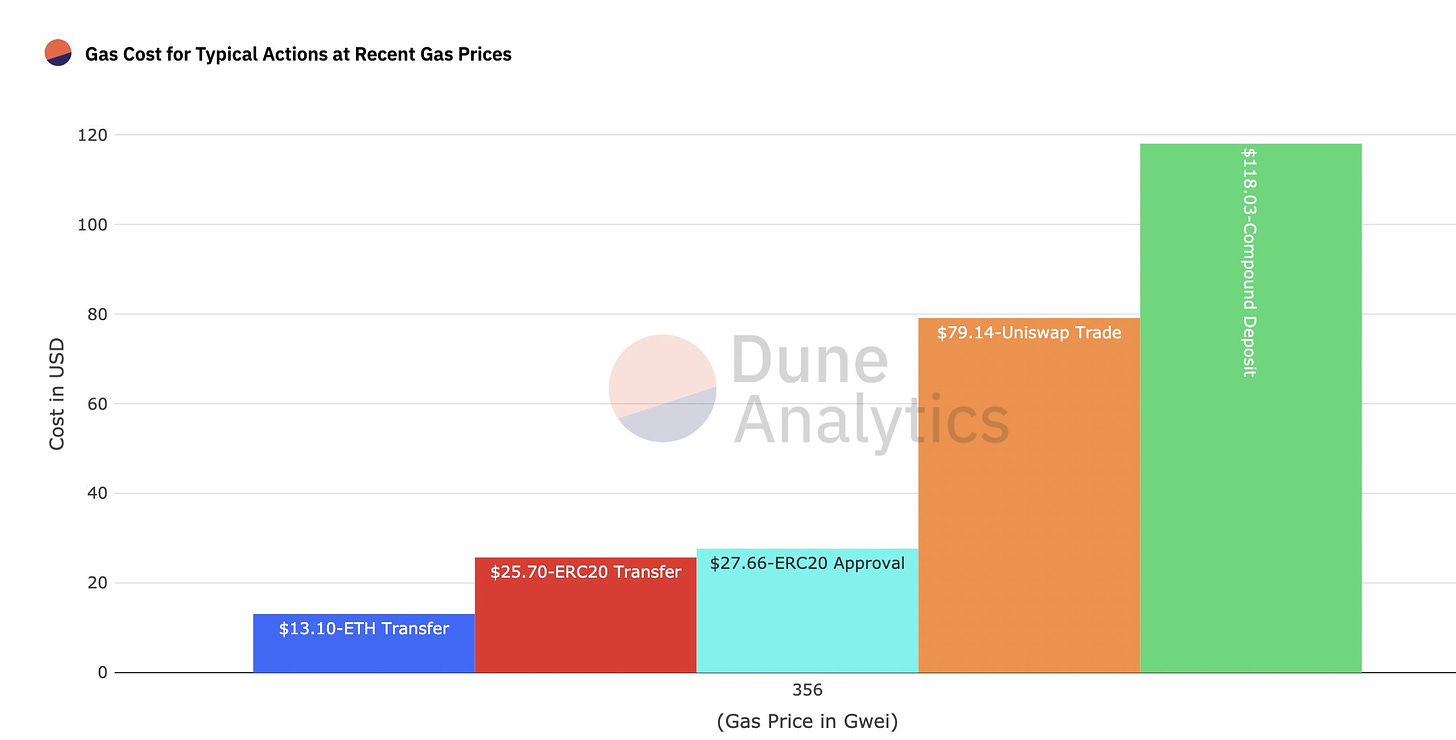

Layer 2 migration - gas costs are on everyone’s minds these days. Who knows how or how quickly liquidity will flow to Layer 2, but it will lead to more siloed liquidity. The cross-chain dynamics will be the next capital efficiency hurdle.

Risk management and governance - improving capital efficiency inherently means taking on more risk. On-chain capital pools have so far been programmed to function under any market condition, but adapting the logic to the current state of the market could earn more yield. Managing the risk will be tricky and will likely involve giving LP’s a say.

Tweet of the Week: Stablecoin transfers

What’s exciting about this bull market is the different narratives independently driving interest. There’s the king (BTC) and then everything with DeFi/Ethereum (see above), but stablecoins have their own mass-adoption story, which is enhanced by but not dependent on the DeFi narrative. Stablecoins are likely to move aggressively to Layer 2 and other chains. USDT, USDC and Dai all have strong momentum. USDC’s Jeremy Allaire was on the Bankless podcast last week talking all things stablecoins (or crypto dollars…)

Chart of the Week: Gas crisis

Because “numba go up” ain’t great for everything. The congested network and rising price of ETH has already priced out many. To quote the legend Yogi Berra, “Nobody goes there anymore. It’s too crowded.” The migration away from Ethereum’s base chain has been long speculated but it’s still unclear how it will shake out. Presumably, Layer 2’s like Arbitrum and Optimism will gain traction this year before EVM compatible ZKrollups are ready. The other question is what will mainnet be like? Will large capital pools remain? I think the Manhattan = Ethereum analogy is the best heuristic.

Odds and Ends

DXdao* Month in Review Link

0x Labs raise $15m, led by Pantera Link

Ren Protocol devs join Alameda Link

Options protocol Opyn raises $6.7m, led by Paradigm Link

Yearn exploit vulnerability disclosure Link

The Block: Aragon faces its biggest trial yet Link

MCDEX unveils v3 Link

Thoughts and Prognostications

MEV and Me [Charlie Noyes/Paradigm]

Yearn’s yveCRV explained [0xdef1.eth]

Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets [Federal Reserve Bank of St. Louis]

How Ethereum governance “works” [Micah Zoltu]

Aave: Road to Billions [Lucas Campbell/Bankless]

That’s it! Feedback appreciated. Just hit reply. Written in the winter wonderland of Brooklyn. Russian speakers! check out Dose of DeFi translator Denis at Биткоин растет, а что с DeFi?

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.