No deep dive today but an exciting announcement: Dose of DeFi can now be read in Chinese!

The last three editions have been translated and upcoming editions will be accessible a day or two after the original post is up. Ping Xiong (平兄) is doing the translation. Check it out and forward along to anyone interested:

Also, if you didn’t know, Dose of DeFi can also be read in Russian. Denis Suslov translates DoD every week to a Telegram Group.

Tweet of the Week: MEV and Lower gas

Like dangling food in front of starving people, Stephane posits that the relatively low gas prices may be because arb bots that normally compete in Priority Gas Auctions (PGA) and clog the network for all Ethereum users are instead directing their arb transactions directly to miners, or the 60% using Flashbots Geth. By sending the transaction directly to the miner, the arb bot does not need to set a high gas fee with hopes of getting selected in the mempool. Of course, arb bots are still paying the miners for prioritizing their transactions, but this happening off-chain, so it doesn’t raise prices for everyone else using Ethereum.

It’s way too early to tell if this is true, but it certainly seems possible that extracting the high-value transactions lowers the cost to use for all. Flashbots’ end goal is to auction off transaction priority, but there was a spicy Op-Ed in CoinDesk by Cornell Professor Ari Juels that said Flashbots’ “front-running as a service is theft”. Jules and Co. argue that more research can be done to create a fairer system for transaction ordering. This seems like just the beginning, especially as migration to Layer 2 begins. Arbitrum’s Ed Felten chimed in with his take, Five theses about transaction ordering, MEV, and front-running. Robert Miller has an excellent tweet thread on a MEV ‘sandwich tx’ that scored 300 ETH.

Paradigm’s “MEV and Me” post from February is also worth revisiting. If you’re just getting started on MEV, check out the Flashbots github, dashboard, November announcement and this helpful MEV explainer video from Phil Daian.

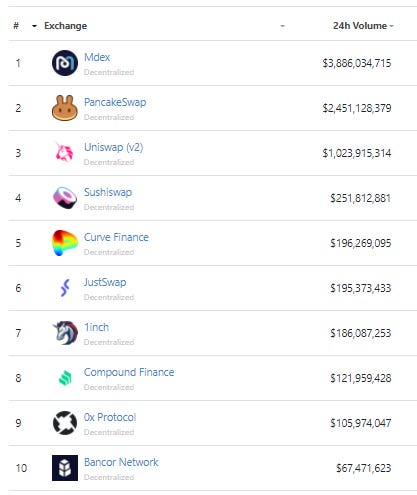

Chart of the Week: BSC and Pancakeswap rise

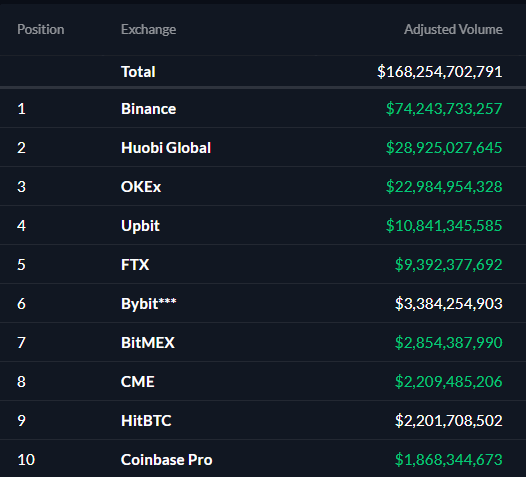

Andrew Kang leading the charge during the Great BNB, Pancakeswap and BSC Bull Run of 2021. The Binance ecosystem has continued to grow in users, TVL and volume since DoD’s Feb 22 “Binance Smart Chain begins the multi-chain DeFi era”. ETH diehards are screaming bloody decentralization, but ultimately this could play out similar to the Sushiswap saga, where the vampire attack brought in new users and drove TVL for all projects. Some say BSC apps have better UX for mainstream users BSC is onboarding tons of new users to DeFi (or Metamask), particularly in South East Asia. It’s also a potential preview of the new markets/customer segments that Layer 2 solutions unlock as they roll out later this year.

Odds and Ends

Ribbon launches Theta Vaults, automated covered calls in one click Link

dYdX launches perpetual contracts for UNI, AAVE Link

CryptoBriefing: BasketDAO storms the DeFi Index scene Link

Scaling Ethereum hackathon Link

Aave proposes “mint Dai with aDai” integration to Maker Link

Defiant Media raises $1.4m Link

Fei Protocol Vulnerability Postmortem Link

Thoughts and Prognostications

Summoning the Money God: Deep Dive into Rai [BlockScience]

The State of Protocols [Kerman Kohli/DeFi Weekly]

BSC dapps are still copycats [Ryan Watkins/Messari]

What DeFi businesses need [Andrew Beal/30,000 Feet]

zkEVM & zkPorter with Matter Labs [Zero Knowledge Podcast]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. Extremely grateful for the work that Denis has done to get Dose of DeFi 中文 up and running. More to come!

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.