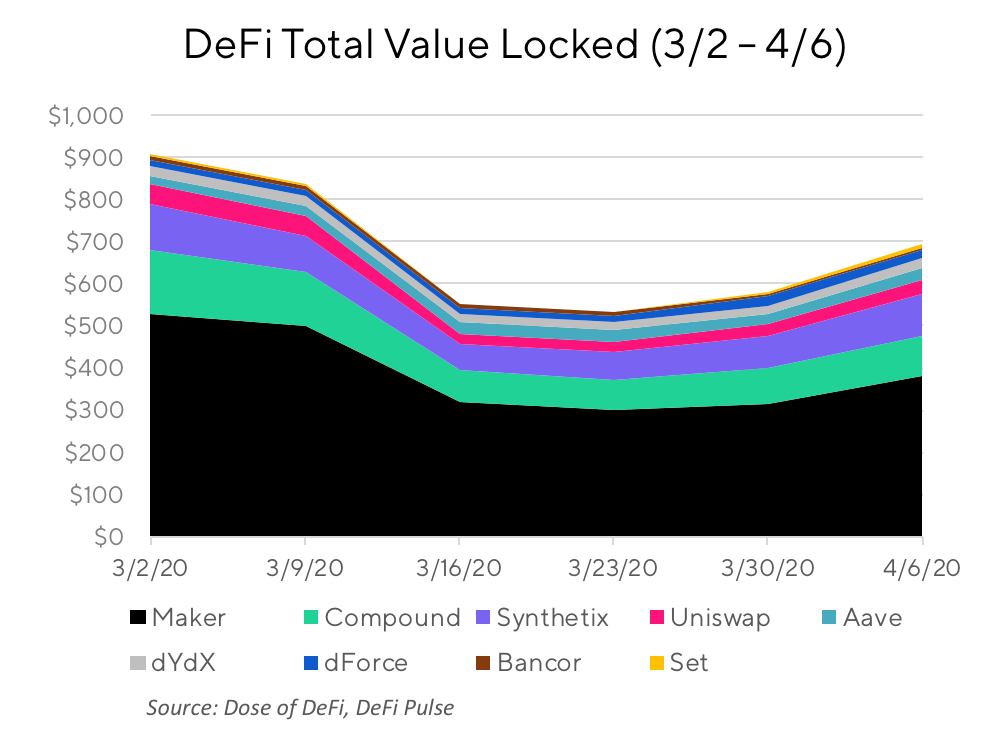

Continuing on last week’s post on the industry’s fund flows, this week we look fund flows at the individual project level. Projects can see their Total Value Locked (TVL) fall and raise thanks to in flows from new users and appreciation of the underlying assets or outflows and asset price declines. Here is how the TVL of the top 9 DeFi projects* faired over the last 5 weeks**.

There was a significant decline in TVL in the middle of the month as the price of ETH tanked but it was able to recoup some of these losses over the last two weeks.

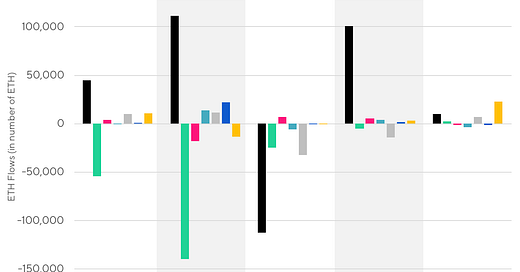

While all protocols are affected by the price of ETH, there are still variations between protocols. The chart below shows the week-on-week growth in the TVL of major DeFi protocols, broken up by lending protocols and DEXs/AMs.

There’s a stronger correlation in TVL amongst DEXs & asset managers than among lending protocols. Intuitively, this makes sense. Their weekly TVL increases and decreases are from price changes in ETH and other tokens.

The lending protocols, however, tell a different story. Aave had an impressive month, growing TVL by 50% to $25m despite the less-than-appealing markets. Much of this was due to inflows of collateral in LINK and Aave’s native LEND token.

Each protocol’s TVL is related to the price of ETH, but also from heavy in and out flows of ETH as users optimize the best lending rates.

March 9 - 16 saw the most volatility - “Black Thursday” was March 12. Over that week, Maker saw 100k ETH flow into its protocol, much of it from Compound, which bled ETH over the first half of the month, seeing almost 200k flow out.

This was likely due to investors rebalancing their leverage. Given that most DeFi users are taking out a Dai or USDC loan, assets will flow to whatever protocol offers the lowest borrowing rates. As the market tumbled and Dai liquidity dried up, Maker’s Dai Stability fee kept stable at 8% (7.9% APR), while secondary lending platforms Compound and dYdX saw their Dai borrowing rates soar to 20%+ as utilization rates approached 100%.

dYdX actually saw ETH inflows despite its high borrowing rates, but this may be because traders needed additional collateral to close their trades.

All lending platforms saw ETH outflows during the week of 3/16-23. Traders were likely deleveraging and storing ETH in wallets for easy transfer during the volatility.

Then, ETH flowed back into DeFi and specifically Maker, which can typically boast the lowest borrowing rate with its 0.5% stability fee. Maker actually gained ETH over the last 5 weeks despite the turmoil.

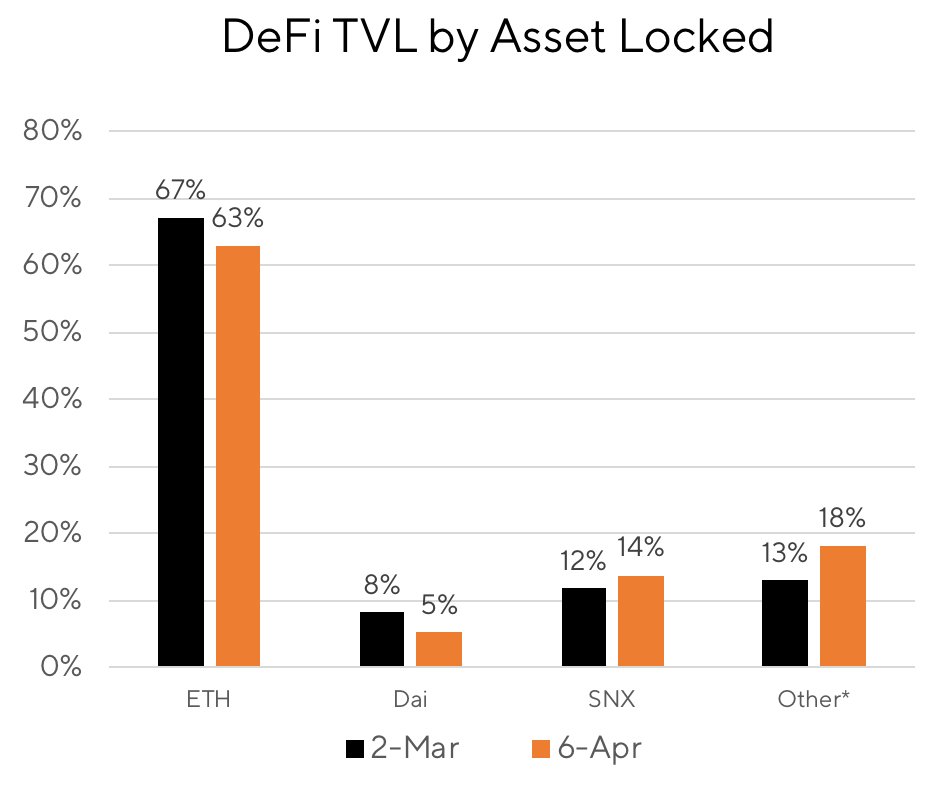

Lastly, the change in the asset makeup of DeFi over the past 5 weeks. The Dai decline is due to the liquidity shortage, while ETH’s decline can be attributed to the rise of “other” in two particular areas. 1. USDC inflows into Maker and 2. Additional collateral inflow from new tokens (like Aave).

Maker Foundation looks to make itself redundant

MakerDAO Founder Rune Christenson laid out a vision MakerDAO and Dai without the Maker Foundation with the hopes of starting the dissolution process in two years.

The blog post and Rune’s presentation at the Governance and Risk meeting unveil the next step in decentralization after the launch of Multi-Collateral Dai last November. Given the already existing MKR vote and governance structure, Maker sees three additional components of a DAO structure:

Elected Paid Contributors are essentially “Core Devs” and other non-coders that support MakerDAO (like the risk team). Maker Improvement Proposals are modeled off of Bitcoin Improvement Proposals (BIPs) and Ethereum Improvement Proposals (EIPs). And Vote Delegates are essentially politicians who vote on behalf of those who have pledged their vote to them.

It’s still too early to speak definitively about any of these governance structures, but the key to effective long-term governance for MakerDAO and other decentralized protocols is token distribution. What do MKR holders want? To make money? To democratize finance? Probably a bit of both.

It’s not unusual for a company to have a guiding mission that is later pushed aside as it scales (see the last decade in Big Tech). The concern for Maker is that large token allocations to return-seeking capital allocators neuter mission-specific goals.

Finding a distributed set of zealot token holders that believe in the cause but are also looking for financial upside is key to effective protocol governance. It's why Bitcoin and Ethereum have been so successful.

Related: Maker is looking for community signals on a host of proposals related to stability fee adjustment and Black Thursday Vault loss compensation.

Tweet of the Week: Vitalik on ETH lending market and PoS

Ethereum’s “impending” upgrade to Proof-of-Stake it will open up another capital opportunity for idle ETH alongside DeFi lending. Vitalik, however, is skeptical of any security vulnerability from a deadly combination of staking and lending.

Odds and Ends

tBTC creator, Thesis, raises $7.7m from Fenbushi, Paradigm Link

Decentralized automated market maker, Balancer, goes live Link

Augur v2 deployment details Link

Coinbase invests USDC into Uniswap and PoolTogether Link

RealT passes $1m of tokenized real estate on Ethereum Link

Jelly unveils Butler, an automated market making software bot Link

Using DeFi & Atomic Loans to pay of BTC mining bills Link

Tellor’s best practices for oracles users on Ethereum Link

Consensys’s Codefi introduces Inspect for greater DeFi transparency Link

Thoughts and Prognostications

What Winter Looks Like [Joel John/Outlier]

DeFi Needs More Value [David Hoffman/Bankless]

The Potential of Pandemic Prediction Markets [Ben Davidow]

DappRadar’s Q1 DeFi Report [DappRadar]

Ethereum will eat Wall Street’s settlement layer [Josh Johnson/Bankless]

NFTs need DAOs to help solve the liquidity gap [Jake Brukhman/CoinFund]

*InstaDApp, WBTC and Lightning Network omitted. All data acquired through Concourse Data.

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn (again) where I enjoy the parks.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.