Tweet of the week: Where to start

The massive, massive news of the week is the revelation that FTX lent customer deposits (!!!) to Alameda research…who apparently lost it all? The hole in FTX is (gulp) $10bn, according to the WSJ. Like, everyone else I’m glued to Twitter for scraps on the latest.

The tweet above from Brent Xu is the same conclusion that we drew after the collapse of 3AC: the tragic catastrophe of CeFi makes the argument for DeFi.

As I texted my (normie) college friends today about the difference between CeFi & DeFi:

My crypto is not with a centralized exchange, where you don't know what they're doing with it. When I put money in a DeFi product:

1. I can see what they're doing with the assets bc it's on the blockchain. There is no black box.

2. There is no "pause withdrawals" button bc it's controlled by an autonomous smart contract and no one can change the code.

Even Binance is now embracing proof of reserves, arguing that transparency is key to financial market stability. A Dune dashboard puts their on-chain holdings at $42bn. Smart contracts are still better, but it’s a start.

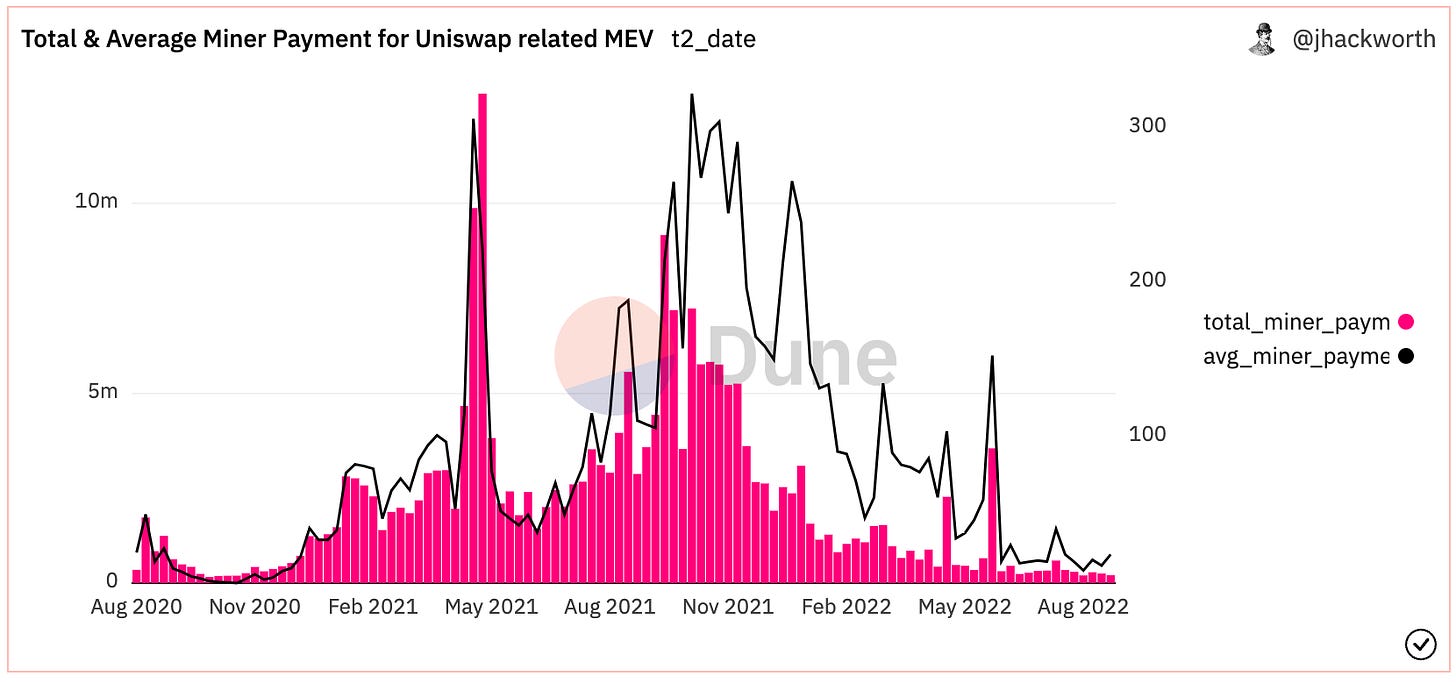

Chart of the week: MEV on Uniswap

For a nice distraction from the FTX collapse, we turn to a chart that shows the declining amount of MEV profits being squeezed out of Uniswap over the last six months. Miner payments were much higher in 2021 than 2022 even though volume numbers were comparable. For instance, Uniswap saw $62bn of volume in October 2021 which led to miner payments of $16.6m; whereas in May 2022, Uniswap saw $63bn in monthly volume but miner payments were only $5.7m. Perhaps traders did a better job of guarding against MEV?

The whole dashboard, put together by @jhackworth, has a lot of great information on MEV on Uniswap, although all of it is pre-merge.

Odds & Ends

DXdao* Month in Review Link

Senators moving forward with SBF-backed bill after FTX collapse Link

LUSD Chicken bonds see $35m in inflows but LUSD still trading at $1.04 Link

CowSwap achieves 11% of aggregator market share over last week Link

A new batch of banned addresses for USDC is released Link

ETH Lisbon Hackathon winners Link

Thoughts & Prognostications

Uniswap LPs are getting rekt (still) [Alex/Friktion Labs]

Proposed milestones for rollups taking off training wheels [Vitalik]

How Aave can leverage staked aTokens and Balancer to bring GHO to market [Traver Normandi/Messari]

Ethereum endgame [Salomon Crypto]

The settlers of Canto [Chase Devens/Messari]

The market opportunity of modular blockchains [Denis Suslov/Dose of DeFi]

That’s it! Feedback appreciated. Just hit reply. Written in Nashville. Whew, between the midterms and FTX, it’s been hard to pull away from Twitter the last few days- not even counting for Elon and the changes at Twitter itself.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.