Miner Extractable Value and Maker's Lock-In

Along with Odds & Ends and Thoughts & Prognostications

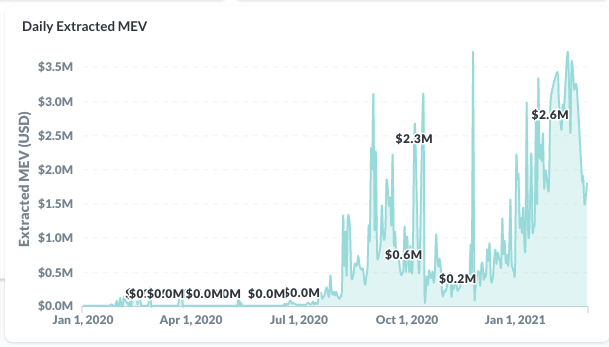

Chart of the Week: MEV rising

A chart of Miner Extractable Value (MEV) growth from the new MEV Dashboard from Flashbots. MEV is the preferential treatment that some miners give to certain transactions due to an on-chain arbitrage opportunity. The chart shows that its growth is closely tied to DeFi - more pools of capital means more arbitrage opportunities. It also appears that miners are becoming more aware of the opportunity.

In the EIP-1559 debate, users and dapps are both largely in favor, while Ethereum miners are against (EIP 1559 Community Call last week). While the fee burn may cut into miner fees, the mechanism would lead to more consistent gas prices and an overall better UX, which is why some ‘bespoke’ miners, like F2Pool, are actually coming out in favor of EIP1559. The more usage on Ethereum, the more arbitrage opportunities, which means more MEV available for miners.

Tweet of the Week: MKR financials

Maker is a dinosaur, but for DeFi protocols with lock-in, that’s a good thing. There’s just under $2.5bn Dai in circulation and while it may trail its centralized stablecoin brethren in size, it’s hard to imagine it losing its network effects in DeFi, where its as prevalent and liquid as USDT or USDC. Stability fees have finally been raised - they’ve been at zero since Black Thursday, which is why the interest income has gone up in the table above. This is good for MKR holders and also opens the door for Maker to use the Dai Savings Rate (DSR), which was just raised to 0.01%. Maker has spent the last year trying to hoover up collateral to print Dai, and next it will try to get all that Dai parked in the DSR.

Odds and Ends

Furucombo post-mortem Link

On-chain stablecoin volume surpasses $360 billion for February Link

dYdX launches perpetuals on Layer 2 built by StarkWare Link

Matter Labs announces Series A, led by USV plus DeFi projects/wallets Link

GasToken days may be numbered after Vitalik proposes removal of refunds Link

Aave teams up with Balancer to allow idle assets in its V2 to earn a yield Link

Compound unveils Gateway, a new substrate blockchain Link

a16z leads $25m Series A for Optimism Link

Thoughts and Prognostications

THORChain (RUNE) Analysis [Multicoin Capital]

DeFi needs trust minimized money [Stefan Ionescu/Bankless]

Dynamic Automated Market Making [Kyber Network]

Miners will accept EIP 1559, here’s why [Hasu & Georgios Konstantopoulos/Deribit]

The fractionalization of NFTs will lead to better social tokens [Bryan Flynn/Jamm Session]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. It may be early, but I’m ready to put winter behind me and look to spring - I can already start to feel the longer days.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao. All content is for informational purposes and is not intended as investment advice.