DeFi: The State of the Meme

DeFi appears to be settling into a new order. A year of slow builds and a busy summer led to a more than 15x in DeFi TVL. There are a few more users and a lot more capital. The biggest change, however, is the attention ‘DeFi’ gets from entrepreneurs and existing companies – many of which have heard tall tales of runaway success in the strange land of DeFi.

This underscores the power of DeFi as a meme. As I wrote in May:

Memes create virtuous feedback loops. A name enables people to start talking and writing (🤔) about DeFi, which then leads to more users and then more developers building applications. New projects allow for new content that kicks off a cycle of sustainable growth. Attracting new users is easy because of the simple-to-understand name, which also acts as a cohesive gel to a community and industry.

I’d argue that we’re headed to the 3rd DeFi build cycle. The first cycle, or the Proof-of-Concept phase, saw teams building financial products on Ethereum without a catchy name; many spawned from the euphoria of 2017 (or before). Projects like Maker, 0x, Kyber, dYdX, Synthetix, Uniswap and Compound were built only to be later referred to as DeFi.

In 2018, they were just one of many projects on Ethereum, sometimes bundled under the “Web3” moniker, but not particularly memorable. Their success, in particular Maker and its Dai stablecoin, created an organic community that soon rallied under the ‘DeFi’ banner, jointly conceived by teams at Set, Dharma and 0x as the name of a telegram group.

DeFi Pulse launched in February of 2019, creating a central hub and a data point – Total Value Locked or TVL – to compare projects, even though at the time, almost all of assets in DeFi were parked in MakerDAO. This led to increased media attention. Forbes wrote an article about DeFi in April and DeFi was all the rage at NYC Blockchain Week 2019 in May.

There is no better marker in crypto of “having arrived” then when Justin Sun crashes the party.

Also that week, I organized Morning Dose of DeFi and there were several other DeFi events. Those that attended will recall the palpable enthusiasm and the sweaty, jam-packed rooms. Around this time, several DeFi media outlets also shot up: The Defiant, DeFi Prime, Dose of DeFi, DeFi Weekly and DeFi Rate.

This resulting ecosystem kicked off the second DeFi build cycle, Composability and Specialization (Summer 2019 – Spring 2020), Projects like Maker, Compound and Uniswap embraced the increased interest in DeFi and launched major protocol upgrades that made it easier to operate with other DeFi projects.

Synthetix and Kyber became the first DeFi trending tokens, while Aave rebranded and relaunched as a DeFi-first brand. Meanwhile, Curve and Balancer expanded the product universe and demonstrated the innovativeness of liquidity pools and AMMs.

The DeFi meme amplified this activity. The new media outlets helped (Bankless newsletter launched in September 2019), but ‘DeFi’ also proliferated in investor pitches and company strategy sessions. It became short-hand for any financial activity on any blockchain and we saw the first inklings of the ‘CeFi Movement’, particularly in how CeFi and DeFi differed on Black Thursday.

During this time, developers were building at a frantic pace, but user growth had not arrived. DeFi grew into the rest of the Ethereum community but it still had not broken through to the general crypto investor, let alone a mainstream audience. It needed a new meme.

The launch of COMP birthed a new meme: yield farming. Of course, liquidity incentives were nothing new, but the meme was and quickly spread like wildfire throughout the crypto community.

And then the DeFi Summer happened. Speculation on its current status is better found on crypto twitter, but the Summer of DeFi has kicked off another round of DeFi meme growth.

In September, I wrote about how the emergence of the DeFi Curious (traders like SBF, Arthur Hayes and Three Arrows) and the shift in tone of the Crypto Center (as seen in Laura Shin’s UnChained Podcast, Epicenter and Mr. Crypto Center himself Mike Dudas).

This corresponded with an uptick of interest from the Crypto Adjacent, which I’ll define as traditional finance folks who have well-articulated opinions on Bitcoin and Crypto. Bloomberg did a story two weeks ago on DeFi and Uniswap. Meanwhile, Joe Weisenthal, Patrick O'Shaughnessy and Demetri Kofinas – who all host finance podcasts – have tweeted something along the lines with “What’s Going on With DeFi?”.

Weisenthal is perhaps the most illustrative. A Twitter search of DeFi in his Tweets shows a couple in August 2019 and then nothing until he tweeted “What are some interesting non-speculative applications of “DeFi” that are actively being used right now?” at the height of this summer’s farming frenzy.

Downstream meme effects

I think DeFi is the best meme in crypto since Bitcoin. It’s short and catchy, of course, but also vague enough so anyone can see themselves in it. As a meme, DeFi has and will evolve. ICOs used to be cool but quickly turned crass. DeFi has now gone through a couple cycles and does not appear worn out. It still feels fresh.

The point is the state of the DeFi meme is strong. The summer’s activities have turned some away but the DeFi brand has (so far) avoided the trajectory of ICOs, and we are now gearing up for a third cycle of building.

The summer’s downstream impacts will be long-lasting. The growth of the DeFi meme will fund new projects and create more CeFi integrations because every crypto fund and company now needs a “DeFi Play”. What’s more, the expansion of the media ecosystem - compare the number of DeFi podcasts to 6 months ago - will slowly indoctrinate another wave of believers. The power of the meme.

Tweet of the Week: Harvest shenanigans

A lot of discussion across crypto twitter after Harvest was exploited for $33m. DeFi Pulse founder Scott Lewis is unequivocal in his assessment, resulting in the most lively discussion in his replies at least. Julien Bouteloup gives the other perspective in his long post on Rekt, bending over backwards to call this an arbitrage. Just looking at it from the meme perspective, it’s not a good look. Check out Harvest’s “Flashloan Economic Attack Post-Mortem”.

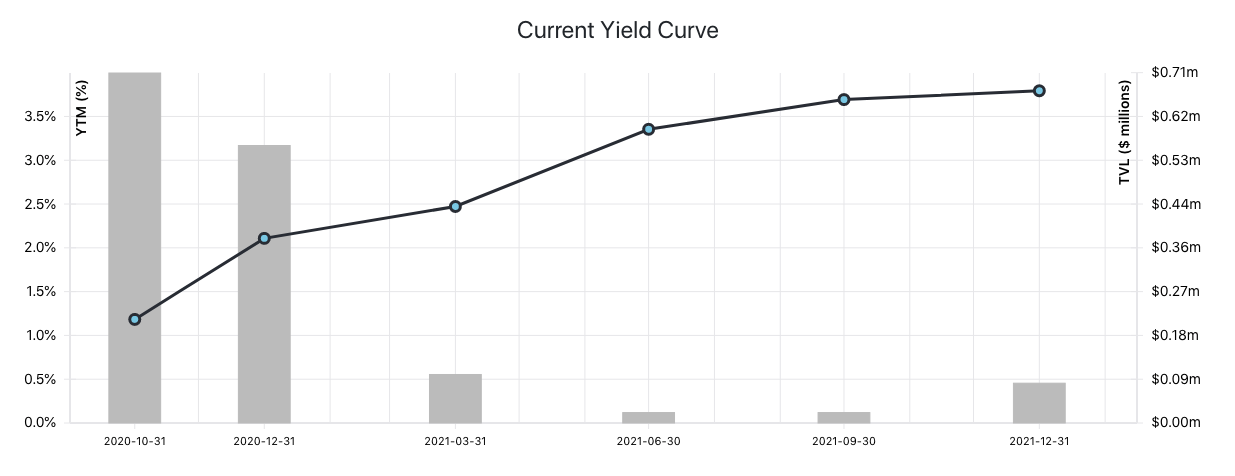

Chart of the Week: A forward-looking curve

A chart from Omar Bohsali mapping the Dai interest rates across different maturation dates, after the launch of the Yield Protocol last week. And just today, Notional, backed by the likes of Polychain, Coinbase Ventures and ParaFi, launched another fixed-rate lending protocol. The key to both is their new AMM designed specifically for maturing products with the hope that it can build liquidity where other fixed-rate lending protocols like Dharma failed. A reliable yield curve could set off another Cambrian explosion of DeFi products.

Odds and Ends

Coindesk: PoolTogether Opens Up to More Coins, More Prizes Link

MakerDAO unveils new voting and governance portal Link

DeFi Prime: Most interesting DeFi projects at ETHGlobal Hackathon Link

Balancer will build on NEAR Protocol Link

YAM Finance completes $250k on-chain purchase of DPI token Link

Dharma submits Retroactive Proxy Contract Airdrop proposal to UNI governance Link

Thoughts and Prognostications

The Road to L2 Interoperability [Starkware]

Crypto Index Fund Construction [Overanalyser]

Derivatives, the Second Half of DeFi [Incuba Alpha Labs]

Gitcoin Gratns Round 7 Retrospective [Vitalik]

Thoughts on governance, CBDCs and DeFi [Maple Leaf Capital]

Why Optimism? [Kain/Synthetix]

Cross-chain interoperability, building on Bitcoin, ETH2 and DeFi disillusionment [James Prestwich/The Defiant Podcast]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where I voted this weekend!

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao. All content is for informational purposes and is not intended as investment advice.