Rollups are expanding Ethereum's ecosystem - now it's their turn

Following a series of successful testings, rollups are set to multiply, in a race to build a composable ecosystem.

Working out how to scale blockchain to internet levels has been a focal point for researchers ever since Bitcoin launched. There were lots of dead ends (Plasma, state channels, sharding), but the industry eventually coalesced around rollups as the best scaling solution. Rollups have since moved from theoretical discussion to practical development. This month, Denis expands on his analysis of modular blockchains from last November, and examines how the major rollup projects aim to scale past proof-of-concept – and ultimately build sustainable systems that could underpin a new internet.

- Chris

Rollups have emerged as the leading solution to solve blockchain’s scalability dilemma. For Ethereum, Vitalik's vision of a rollup-centric future is gradually materializing.

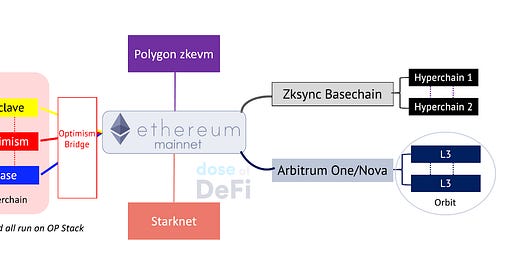

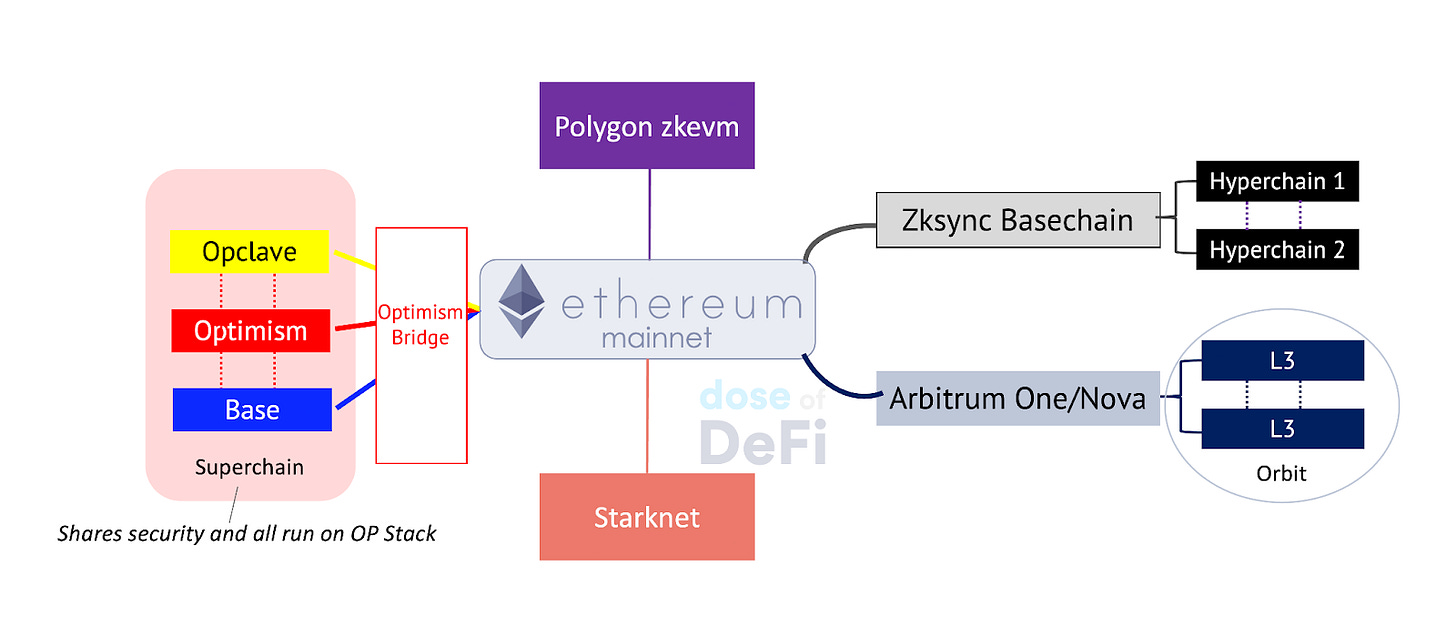

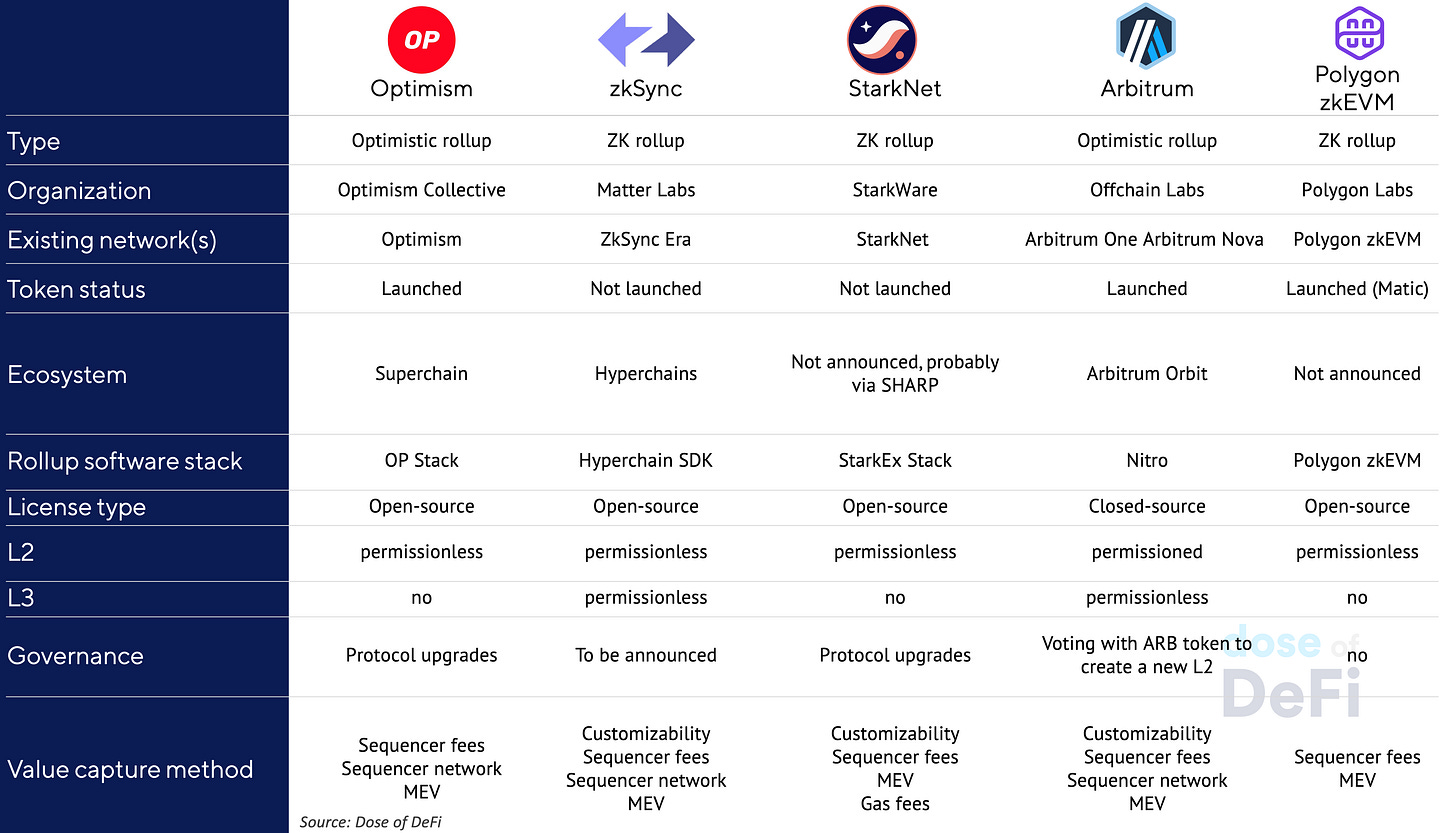

To recap, rollup technology offers enhanced speed and throughput by operating as an independent, high-performance blockchain that stores compressed archives of transactions on an L1 network. Optimistic rollup technology has been successfully deployed in the form of projects such as Arbitrum and Optimism, which have reliably served users for almost two years. Meanwhile, zero-knowledge (ZK) rollups like Starkware, zkSync and the Polygon zkEVM finally fully opened to the public over the last few months.

That these rollups have proven viable means attention can now turn to the practicalities of launching and maintaining hundreds (thousands?) of rollups. And with this, finally achieving blockchain scalability. To win the next phase, existing rollup projects need to have a technical architecture that limits deployment costs and allows for some composability within the rollup ecosystem. This would allow easy movement from rollup to rollup without directly interacting with Ethereum. These projects – which we will go into further detail on below – must also include sustainable value capture methods to lure users and developers.

If these multi-varied rollup ecosystems succeed in scaling Ethereum, it means that Cosmos (and Solana, or even Polkadot) could be “swallowed by Eth flavored variants of Cosmos originated ideas like roll apps and Eigenlayer,” in the words of Cosmos OG Zaki Manian. And if the rollup ecosystems become core blockchain infrastructure, they will have to deal with the thorny problems of decentralization and MEV.

Arbitrum

Arbitrum launched Ethereum’s first optimistic rollup in September 2021 (Arbitrum One), followed by a cheaper but less secure optimistic rollup (Abritrum Nova) in July 2022.

In March this year, it announced Arbitrum Orbit, a vision for chains built on top of Arbitrum One or Arbitrum Nova. It refers to these as “L3 chains” and hopes to attract developers looking for customizability. Anyone can fork and “modify the Arbitrum source code as they see fit.” These L3 rollups will pay ETH to the Arbitrum sequencers for transaction fees.

There is another way for Arbitrum to capture value. While creating a new L3 is permissionless, launching an L2 similar to One/Nova is permissioned. To create a new L2 chain, approval from the Arbitrum DAO is required. This can be achieved through the governance proposal mechanism. Such a proposal necessitates holding 5 million tokens in a wallet to be submitted. Projects interested in launching Arbitrum stack-based L2s will drive the demand for ARB tokens. Interestingly, this process is somewhat similar to Polkadot's approach, where chains must deposit DOT tokens to secure a ‘slot’ and share Polkadot's security.

Optimism

Optimism launched its Optimistic Rollup soon after Arbitrum in December 2021. Earlier this year, Optimism revealed the OP Stack and the Superchain, its vision to “merge Optimism Mainnet and other chains into a single unified network of OP chains”. The Superchain shares the same network of sequencers, and eliminates the need for a separate bridge for each chain.

Any project could launch an OP rollup on the Superchain; it operates on an open-source MIT license. It is possible to change Optimism Stack’s code according to a project’s needs, however this would require establishing its own security measures, as it wouldn't be compatible with Superchain.

The first member of Superchain is Coinbase's Base; Conduit will join the network later. Opclave and Restaking.wtf are further platforms that will use this specific model. Opclave is an enhancement to the OP Stack that enables users to create and utilize non-custodial wallets, using touch/face ID authentication on Apple devices, without the need for seed phrases. On the other hand, Restaking.wtf provides the capability to use any ERC20 token to simultaneously validate multiple on-chain trust networks. This platform will play a vital role in decentralizing Optimism's sequencer.

In the future, Optimism will use a network of sequencers where to become a sequencer, one must deposit OP tokens, driving the demand for it. Overall, Optimism’s "OP-chains" are really similar to “appchains” on Cosmos because they allow for the development of diverse decentralized applications on dedicated chains. Cosmos-SDK is equivalent to Optimism Stack.

The zero-knowledge options

Optimistic rollups came to market first, but ZK rollups are considered technically superior because they use validity proofs as opposed to fraud proofs, which drastically lowers the time to L1 finality (sidenote: the difference between ZK rollups and optimistic rollups is a great ChatGPT prompt). The three most promising ZK projects with outlined launch plans are zkSync, Starkware, and Polygon’s zkEVM.

zkSync will have an ecosystem of Hyperchains that are all connected to the Basechain. The Basechain is not different from any other Hyperchain, but directly settles its blocks on the L1 Ethereum and functions as the default computational layer for general-purpose smart contracts, plus acts as a settlement layer for all other Hyperchains (L3 and beyond). Hyperchains can be developed and deployed by anyone in a permissionless manner. However, to ensure trust and seamless interoperability, each Hyperchain must be powered by the exact same zkEVM engine as the primary zkSync L2 instance.

StarkNet built by StarkWare is another ZK solution. It launched an alpha on Mainnet in November 2021, but was not made publicly accessible until March. As per its latest announcement, its code will also be open-sourced, but not for launching forks of StarkNet, but just for the sake of transparency and having more eyes to review the code. Starkware has not unveiled technical plans or tools to make it easier to launch a Starknet or make them interoperable. Unlike Optimism and Arbitrum, StarkNet’s token will be used for paying transaction fees (instead of ETH) and also for staking in the network’s consensus mechanism, and as a governance token (formal governance structure has not yet been decided).

Polygon is also working on a zkEVM solution, Polygon zkEVM. Interestingly, it will settle directly to Ethereum, not to the existing Polygon PoS chain. One could say that the Polygon team used to scale Ethereum with a sidechain and is now also scaling it with a zkEVM. However, it seems like they are not building an ecosystem of Hyperchains; they probably don’t see a market opportunity for a multi-rollup ecosystem and want projects to launch as smart-contracts in an ‘old-school’ way.

Looking ahead

Irrespective of the technology, projects will need to have a sustainable system in order to fully scale and attain the network effect of a large ecosystem. In all the complexity of open/closed-source licenses, permissioned and permissionless L2 and L3s, we identify three primary value capture methods among rollup projects that will foster a sustainable ecosystem.

First, for cases where it’s possible to copy the software code, free support and guarantees are only given if the code is exactly replicated. However, when customizing the code to fit the project’s specific requirements, the rollup developer either waives the guarantees (OP Stack-based ‘Hacks’), or requires the project to pay for the code in some form.

Second, rollups pass the transaction fees paid by users to the sequencers. These sequencers perform vital tasks and bear operational costs such as maintenance and cloud provider fees. It’s reasonable to capture value within this system module. This has been implemented in different ways, at L2 level like in the Optimism Superchain, or at L3 level like in zkSync Hyperchain or the Arbitrum Orbit case.

The third method of value capture involves governance tokens of the projects. It is highly likely that the majority of rollups will move towards decentralization, requiring their tokens to be staked in order to join the shared sequencer network. Some rollups have already announced such plans, and we expect others to follow suit.

Looming over everything is MEV. So far, rollups have operated with a single sequencer who (graciously) declines to extract MEV. Arbitrum and Optimism have diametric views on MEV. Arbitrum still maintains that it can be eliminated or greatly reduced through fair ordering, while Optimism argues for auctioning off MEV and returning to token holders.

Increasingly, shared sequencers are seen as the solution to both decentralization and MEV concerns. A fair-ordering system, like what Arbtirum favors, requires an honest majority assumption and that only works within a decentralized network. Alternatively, if MEV is to be democratized and distributed, as Optimism favors, a shared sequencer unlocks more MEV potential for a transaction because it can be executed atomically across rollups.

Odds and Ends

Matcha releases Matcha Auto with greater protection against failed trades Link

3% of US adults used cryptocurrencies for non-speculation; unbanked 5% Link

Dai backed by USDC decreases to 25% from 40% a month ago Link

Tornado Cash governance attack explained Link

A list of resources to understand Maker’s endgame Link

CFTC chair says DeFi will be regulated even if they are 'just code' Link

Compound v3 launches on Arbitrum Link

dYdX v4 deep dive Link

Bancor DAO hit with class-action suit over impermanent loss claims Link

Thoughts and Prognostications

Don't overload Ethereum's consensus [Vitalik]

Automated market making and arbitrage profits in the presence of fees [Ciamac Moallemi, Jason Milionis, Tim Roughgarden/Columbia]

Oracle-free protocols could reshape DeFi and protect against hacks [Dan Elitzer/Nascent]

Liquid venture investing in crypto [Arthur0x/DeFiance Capital]

Tracking the soaring demand for ETH staking [Kyle Waters & Tanay Ved/Coin Metrics]

Exploring historical and current yields on-chain [Kyle Teander/Messari]

tldr of tornado governance hack [0xngmi/DeFi Llama]

That’s it! Feedback appreciated. Just hit reply. Written in Nashville in the midst of potty training. Happy Memorial Day!

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. All content is for informational purposes and is not intended as investment advice.