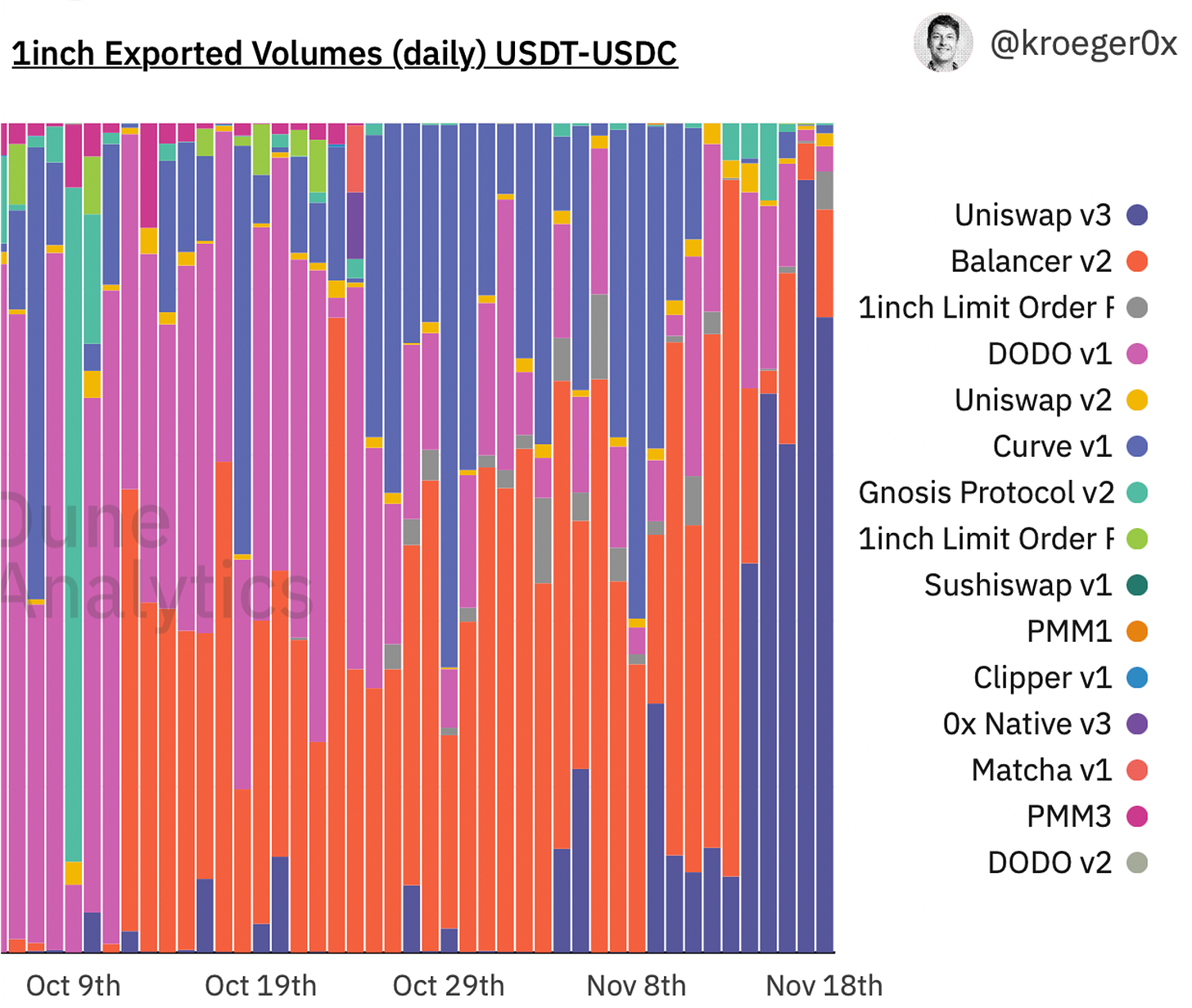

Chart of the Week: Uniswap’s 0.01% fee grabs stablecoin marketshare

Dune chart crafted by Alex Kroeger (aka DeFiCorgi) to track the DEX marketshare of the trade volume for the biggest stablecoin pair (USDT-USDC), using 1inch’s flow as a proxy. The huge jump in marketshare for Uni v3 is due to do Uniswap governance voting in a 0.01% fee tier last week to specifically target stablecoins. A surprisingly strong result from Uniswap governance, which has struggled to reach quorum in the past.

MakerDAO, meanwhile, is trying to be the primary venue for stablecoin trades with DAI, offering 0% fees on swaps between USDC-DAI and USDP-DAI.

Ironically, DeFi is following CeFi’s lead; Coinbase lowered its stablecoin trading fees in June to 0% for maker volumes and 0.01% for take volumes. The rapid growth of stablecoins and the number of well-heeled players has made them the first market segment to see fees compress. It won’t be the last.

Tweet of the Week: What is DeFi 2.0?

Parsec founder with an interesting definition of what DeFi 2.0 is: any dapp or protocol who’s token outpaces its base chain currency. DeFi blue chips from the good ole’ days have lagged behind ETH price since the Spring with most of the CT’s mindshare and investor speculation going to a swath of new projects that build on top of the existing DeFi primitives. Bankless hosted a podcast last week with folks from the major DeFi 2.0 darlings (Tokemak, OlympusDAO, Rari, Tracer & Alchemix), which provides great context on the innovation (and added risk) in this next generation of DeFi protocols.

OlympusDAO may be the trendiest DeFi 2.0 project. Combined, the plethora of OlympusDAO forks almost have as large of a market cap as the original. To dive deeper, check out Dose of DeFi’s August article on OlympusDAO and OHM from Denis.

Odds & Ends

Augur plans to decentralize, using governance system built by DXdao* Link

Delphi Digital: 5 charts showing competitive dynamics in DeFi Link

Themis is a new fair ordering consensus protocol Link

The latest on crypto in the infrastructure bill that was signed into law Link

Maple Finance launches permissioned on-chain loan to Alameda Link

Maker Wormhole aims to make Dai easily transferrable across L2s Link

Fei and Rari teams propose token merger Link

Thoughts & prognostications

Dumb Money: How to Get Rich in Ethereum Without Understanding It [Ben Munster/Decrypt]

Reflections on Congressional committee hearing to ‘Demystify Crypto’ [Kevin Werbach/UPenn]

Best hackathon projects in Lisbon [Jo Sun/GBV]

The delicate balance of getting a big crypto airdrop right [Tim Copeland/The Block]

How to manipulate Uniswap v3’s TWAP oracles [Michael Bentley/Euler]

zkRollups: Matter Labs and Starkware Comparison [Alex Beckett/Bankless]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, which has been dripping with Autumn vibes the last week. Off next week for Thanksgiving.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to DXdao* and benefit financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.