Can USD-independent stable assets survive – and thrive?

A detailed study of the emerging OlympusDAO

Note: This week’s Dose of DeFi was written by Denis Suslov. Stablecoins are some of the most successful crypto projects, and the largest ones are now battling to out-regulate each other in an effort to appeal to institutional investors and financial authorities. Yet efforts to build stablecoins that maintain the decentralization and permissionless ethos of DeFi persist.

Here, Denis looks at a new type of stablecoin – perhaps more aptly called a ‘stable asset’ – and focuses on OHM as an example to answer an important question; can DeFi create assets that are independent from the traditional monetary system?

Stablecoins are emerging as core pillars of the DeFi system, with different flavors for different use cases. In our April analysis of stablecoins, we categorised them into three buckets: centralized fiat-backed (USDC, USDT, etc.), overcollateralized on-chain (Dai, UST, LUSD, etc.) and undercollateralized algorithmic (FEI, FRAX).

Undercollateralized algorithmic stablecoins emerged late last year in an attempt to create a hyper capital-efficient system built around on-chain incentives and game theory. There were some spectacular failures and death spirals in stablecoins with little to no collateral backing, but some – most notably FRAX and FEI – have stood the test of time (so far) and achieved stability around the $1.00 peg.

Their innovation is centered around something called Protocol Controlled Value (PCV), which we’ll get to in greater detail later. Two projects, RAI and OHM, are using this design to try and build the holy grail of crypto: an independent, stable store of value.

While dollar stablecoins are likely to be the lifeblood of DeFi, they are becoming more centralized and susceptible to regulatory capture and inflation concerns. Stable assets like RAI and OHM are therefore needed if DeFi hopes to maintain its credible neutrality. But is the continued existence of these assets possible, and does anyone really want a ‘stable asset’? The unfolding story of OHM could hold the answer - and hint to a critical yet unexpected role for stable assets in the future.

What problem is OlympusDAO trying to solve?

OlympusDAO, which manages OHM, is trying to create a decentralized store-of-value tool that won’t break. Specifically, there are three main issues that stable assets such as OHM could hope to solve:

Continued reliance on central banks: There’s irony in the fact that despite all the crypto efforts to move away from centralized entities, USD still plays a crucial role, with investors using stable coins as a store of value, and most assets priced in USD. This means a lot of monetary policy even in crypto is essentially outsourced to the Fed.

Insufficient refuge in crypto: In a world of volatility, a stable asset is a safe haven, especially in times of a bear market. USD-pegged assets have done well so far, yet they have disadvantages (see points 1 and 3), especially considering the increased regulatory attention.

Algorithmic stablecoins break: Pegs are much harder to defend, especially by undercollateralized protocols, as witnessed by Reserve Protocol, Titan, Empty Set Dollar, Basis, and other projects that failed to stick to the $1.00 mark (and even Dai, to some extent). A simplified example looks like this: an algorithmic stablecoin has a market capitalization of $100m. Imagine coin holders lose faith in the project and want to sell 25% of all coins. In this case, the protocol will have to come up with $25m to buy up the coins. Protocols don’t tend to have that kind of free liquidity, which means things can quickly unravel.

How do stable assets work?

Without an explicit peg, stable assets try to maintain stability by incentivizing arbitrageurs to maintain the market price near the redemption price. There have been some attempts to create an ‘independent peg’, such as the one surmounted in RAI by the Reflexer protocol. Reflexer uses adjustment speed and plays on market expectations to stay stable, while OlympusDAO approaches this problem in a different way.

There’s a period in US history that’s particularly helpful for understanding the mechanics of this protocol. US colonial governments were short of currency on the continent, even though there was plenty of wealth. As Hunter Gebron describes in his piece on the period:

"In Virginia, the Tobacco was stored in warehouses and paper slips that represented the tobacco’s value were used by colonialists to facilitate commerce with greater ease and portability." Later, "Colonial Land Banks were public institutions that granted paper money loans in exchange for collateral such as land, houses, townhomes, or farms. They existed in every colony between 1712 up through the French and Indian War (1754–1763) and into the Revolutionary War (1775–1783). They proved to be an invaluable mechanism for the creation of unique colonial money supply".

Extrapolating this idea on crypto, imagine that you have a stable asset that is simply backed by all the various existing crypto assets. These assets can be used to buy out the ‘paper slips/paper money’ when the price deviates. In the case of OlympusDAO, monetary policy is set by the DAO, while in the case of land banks, it was the banks’ directors. As Gebron put it, "In each colony, there was an administrative loan office with a board of directors or a group of trusted citizens chosen by the legislature."

As an aside, there’s one other difference: OHM is trying to be stable relative to the value of assets stored in the protocol, not a price peg.

PCV is an important concept here. The name is telling, and it means that the project has the right to control its own treasury/assets. In comparison, many existing stablecoins that are overcollateralized on-chain do not have the ability to manage the assets stored in the underlying protocol. For example ETH, USDC and other assets in MakerDAO belong to users. And when users have the right to remove their deposit in full at any time, this presents the risk of a bank run. OlympusDAO and Float use the PCV model, first implemented by Fei.

As we mentioned in April, “Fei is an automated central bank and the PCV is the balance sheet it uses to enact monetary policy.” OlympusDAO works in a very similar manner. Also, because the assets are blockchain-based, you can track the flows of a project in real time, which creates transparency that was impossible with the land banks, and remains so with the central banks of today.

Why the high APY?

Right now, the OlympusDAO protocol is in its expansion phase (one the founder calls a "drawn-out genesis period"), trying to attract as much asset volume as possible, and getting OHM tokens in as many hands as possible. This means rapid printing of tokens, extending them in exchange for incoming assets to those who staked the token on the protocol’s official page. Combining this with its high current price, the result is a very high-staking annual percentage yield (APY). However, the price will go down gradually, and the goodwill of many token holders that didn't expect it or stake (and therefore didn't enjoy the new tokens), might deteriorate.

In an efficient market, the price of OHM should reflect the value of assets in the treasury, which currently is estimated to be between $34m (conservative) and $96m (more reflective of current assets’ market value). The two estimates imply a $29 and a $83 token price, respectively, but OHM is currently trading at approximately $300 (and even reached $600 earlier this month). This means investors are ready to pay far more for each token than the PCV backing it, likely reflecting the positive expectations about the project. Only time will tell if such expectations were realistic, or overblown.

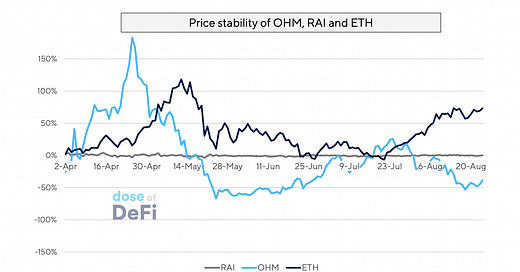

So how has the protocol managed to keep the price of the token stable so far? The below chart shows OHM’s price fluctuations against ETH and RAI:

OHM’s obvious volatility is perhaps acceptable given its high-growth-introduction stage, but investors are very unlikely to accept such uncertainty if they want to use it for store of value going forward.

Is there demand for stable assets yet?

RAI and OHM have both been in operation for almost a year, which is a long time in this industry. And is certainly a longer lifespan than some of the earlier algorithmic stablecoins (think Empty Set Dollar, Reserve, Basis and other similar projects). Perhaps PCV helped to stabilize market expectations thus far, with the dynamics of these protocols themselves as a consequence.

Yet regardless of how innovative or efficient the mechanisms underpinning a new currency are, it has to be used by someone to be valuable. Let’s consider stable assets against the three key functions of money:

A medium of exchange - possible, but in reality very unlikely, as the market prefers to have as small a number of currencies acting as mediums of exchange as possible

A unit of account - RAI: possible, OHM: impossible, because it’s still too volatile

A store of value - possible for both

For stable assets like OHM, a role as a store of value – and one that is independent but more stable than BTC – is perhaps the most alluring aspect. BTC and ETH are great forms of collateral for the crypto economy, but would be more capital-efficient collateral with less price volatility.

So far, Reflexer has struggled to increase the use of its token outside of its initial holder base. RAI is available on Coinbase but almost all trading volume is on Uniswap.

Most of OHM is currently locked in staking (72%), the hands of DAO (18%) or in AMM liquidity pools (8.3%). Such a high locked percentage means that few investors are using OHM as a stable asset or a form of money.

OHM’s bootstrapping phase distinguishes it from RAI, which has already achieved stability, but needs help scaling. Like RAI, OHM will need to find use cases through partnerships, but OHM is different from RAI in that it can be backed by a wider variety of assets and not just ETH.

So while the demand for stable assets is not yet in itself 'stable', if the community latches on to the potential of these assets for store value, they could well cement themselves in digital portfolios for the long haul. What’s needed for OHM to scale, like so many other things in DeFi, is more assets on-chain.

Odds and Ends

OpenSea analytics dashboard Link

Chain Broker: most active DeFi investors Link

Ribbon launches v2 with more decentralized vaults Link

Permissionless lending protocol Euler raises $8m, led by Paradigm Link

USDC to move all reserves into cash and short-duration treasuries Link

Thoughts and Prognostications

Uniswap Research Report: Discord, Governance, Community [Other Internet]

Exploring a simplified pricing framework to make sense of this clown world that we all live in [DegenSpartan/eGirl Capital]

Sushi and super apps [Kyle Samani/Multicoin]

Examining Uniswap v3 LP solutions [Michael Cohen/xtokenmarket]

That’s it! Feedback appreciated. Just hit reply. Written across Shanghai, Brooklyn and Madrid.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. All content is for informational purposes and is not intended as investment advice.