Sushi's strategic sale to VCs, DeFi volumes decline

Plus DXdao celebrates 2 years of on-chain governance!

Happy 2 year anniversary to DXdao governance!

DXdao launched in the summer of 2019 after a staking period that distributed voting power to 399 Ethereum addresses; it is a 100% on-chain organization.

DXdao was the first DAO to control its own website as well as the first one to launch its own fundraiser. It governs three DeFi products (Omen, Swapr, Mesa) with more on the way, paying more than 15 contributors on-chain every month.

Check out the 2 year anniversary article to read more about its history and future.

Tweet of the Week: Sushi’s strategic investors

The Sushiswap community is debating a potential sale of up to $60m of Sushi tokens from the treasury to 21 VCs as strategic investors. This follows Index, Alchemix, Lido and other DeFi projects that engaged in “treasury diversification” aka, selling your tokens to raise dollars and bring in outside stakeholders. This is a normal process in the startup world, but this debate is happening in public forums, so thorny details like the 30% discount that’s being offered to the strategic investors (with 18 month lockup), are out in the open.

Sushi was one of the first projects with no VC money before launch and therefore no VCs in their token distribution. The 21 strategic investors, which include most of the prominent DeFi funds, argue that the institutional support they bring from capital to hiring justify the discount.

We’ll see. I agree with Messari’s Mason Nystrom:

It's a testament to the power of crypto networks that world-renowned VCs like @lightspeedvp now have to approach the community for a fundraising round.

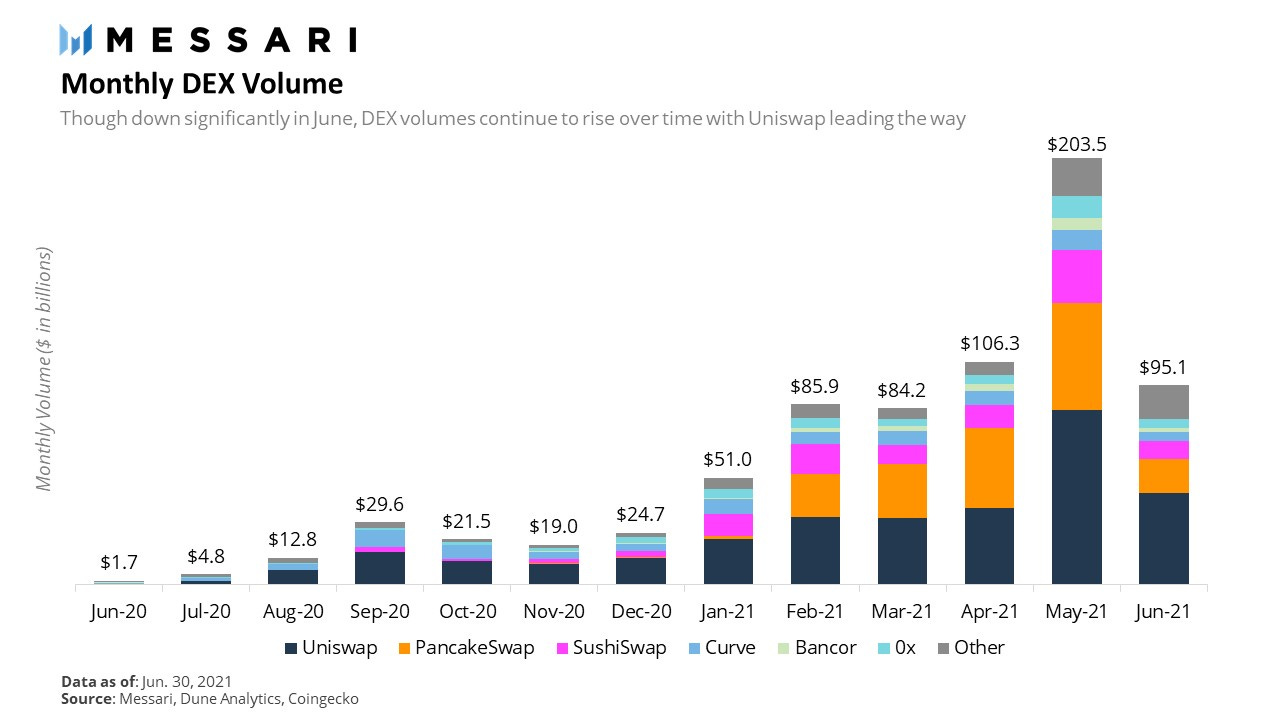

Chart of the Week: Q2 highs and lows

A lot of stories in this chart of DEX volumes over the last year. The explosion of volume and liquidity during DeFi summer last year, Sushiswap and the launch of UNI are only a blip on this chart from Messari’s excellent Q1’21 DeFi Review (Messari Pro required). Volumes and yields continue to decline into July, shifting DeFi away from hyper growth mode. After months of fundraises and protocol upgrades, there is less organic energy and growth in DeFi; most DeFi product opportunities will flow downstream of secular infrastructure trends (Layer 2, EIP-1559 and MEV).

Odds and Ends

Dune dashboard to track # of users per DeFi project Link

MakerDAO 5% short of executive vote threshold 10 days after submission Link

Hop Protocol launches cross-chain bridge with USDC as first asset Link

Clipper, a retail-oriented DEX raises $21m led by Polychain Link

Uniswap launches alpha version on Optimism Link

Shapeshift is decentralizing Link

Thoughts and Prognostications

We live in a mempool: backrunning the MEV crisis [Tom Schmidt/Dragonfly]

China’s Crypto Projects Plot Their Next Move: Stay or Flee [Shuyao/Da Bing]

Miners are misunderstood by devs and rest of Ethereum community [Tina Zhen]

Uniswap grapples with treasury oversight [Nate/Tally Newsletter]

Ethereum’s political philosophy explained [Paul Ennis/Coindesk]

U.S. Founding Fathers had right decentralizations governance instincts [Jon Wu]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn in a nice hot summer.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.