Check out the recording of my talk, “Reputation-based Governance: A Look into DXdao” from Liquidity 2020, which ends tomorrow.

Although Crypto Twitter often seems like the dog from the movie Up, it does enable a diverse set of arguments to surface, and the space is small enough where conversations are not yet siloed, leading to a robust public debate on the topic du jour.

Automated Market Makers (AMMs) were that topic last week, in large part due to the runaway success of Uniswap. Some challenge the very foundation of the efficiency of AMMs, while AMM true believers and focused on how to dethrone Uniswap. I’ve consolidated these into 3 trends/debates below.

AMMs are inefficient and can’t scale

Most of the CT discussion was kickstarted by this thread from FTX CEO Sam Bankman-Friedman, which concluded with, “The past is orderbooks. So, I think, is the future”. His criticisms of AMMs are largely two fold:

Yield farming artificially inflates AMM TVL, volume and usability

Impermanent loss is an intractable problem

Regarding #1, UNI rewards have helped in recent weeks, but Uniswap volume and TVL were growing exponentially before the launch of UNI. New projects listed on Uniswap because it was the quickest and cheapest way to create a liquid market for a new token.

Impermanent loss remains either an unsolved math problem or is in dire need of a rebrand. Paradigm’s Dan Robinson did the best job of dispelling the myth that LPs are getting taken advantage of by arb bots. “Volatility harvesting”, as he puts it, can be a profitable trading strategy.

Former HFTer turned DeFi zealout, Tarun Chitra provides the middle ground in this discussion. Although he agrees with many AMM critics, he concedes that “the demand for passive investing vehicles runs much deeper than those who want rational asset prices are willing to believe”.

Most of the recent AMM criticisms are from traders. They fail to recognize that “AMM Liquidity Provider” is a brand new retail financial product. Much like the perennially underrated index funds, AMMs are more of a consumer product innovation (in simplicity) than a financial breakthrough (of complexity).

Some other great links on this topic:

Graphic from 0x’s Will Warren on how Market Makers could exploit AMMs

Andrew Kang - LPs can be profitable w/o incentives. “Single formula does not mean single strategy”

Cyrus Younessi – Uniswap AMM strategy acts as a Schelling Point for all LPs

Qiao Wang at Liquidity 2020 - What DeFi projects don’t understand about Market Making (But should?)

Alex Wearn at Liquidity 2020 – IDEX: Liquidity Wars: Order Book vs AMM

Can impermanent loss be eliminated?

For those that have turned into true believers, next is the quest for the holy grail of AMM strategy: eliminate impermanent loss (IL).

Mooniswap and DODO are AMMs that use oracles to adjust the price curve to reduce impermanent loss. This cuts into arb profits, but arbitrageurs are key to overall AMM efficiency. Moreover, the oracle price updates will get front-run, as Synthetix learned.

There were two related announcements this week for a single-sided AMM with an elastic token supply. Bancor announced a major v2.1 upgrade, while Andre Cronje teased a “liquidity based inflationary token that can offset IL via liquid governance”.

The Bancor update is already on mainnet and will be the first test of insurance for impermanent loss. The appeal for the LP is to be able to provide liquidity in a single asset, rather than token pairs.

Given the success of AMMs in 2020, it’s surprising that we don’t know more about their efficiency. Much of the discussion is theoretical. More time (and data) will change that. Paradigm’s Charlie Noyes posits three “Open Problems” for AMMs:

What is the expected return of a Uniswap LP?

What is the optimal fee to maximize LP wealth?

Can a Uniswap LP’s optimal growth rate exceed a buy-and-hold portfolio’s?

All this without getting into Balancer and Curve, who have already found product-market-fit in the LP market. Order books may not be going away but AMMs are just getting started.

AMMs – how to diversify into more assets?

AMMs have begun to crack into CEX market share, but spot trading is only a fraction of overall trading volume. AMMs have proved viable for pricing fungible tokens because you can pool liquidity, but it’s not clear it works for assets that are hard to price, like options or any time-based derivative.

Opyn is an options platform that uses a Uniswap pool and handles liquidations separately, while Hegic just launched an options platform that writes puts/calls from a liquidity pool.

UMA, meanwhile, has tried to bootstrap liquidity for its yield dollar in a Balancer pool and provide an easy onramp for those that want to hedge future interest rates. While liquidity has flowed into the Balancer pools, it does not appear to be an efficient pricing mechanism.

Just today, Yield Protocol announced a beta launch on Ethereum mainnet. Rather than try and build liquidity on Uniswap or Balancer, Yield Protocol aims to introduce fixed-rate lending through an entirely new AMM that is optimized for maturing products.

Tweet of the Week: The value of Uniswap governance

This tweet from crypto lawyer Gabriel Shapiro was in response to the failure of the first Uniswap governance proposal to reach quorum. The proposal - led by ‘Univalent’ was to lower the quorum needed to pass votes, but it failed to reach quorum itself. Rekt has an excellent run down of the days leading up to the vote.

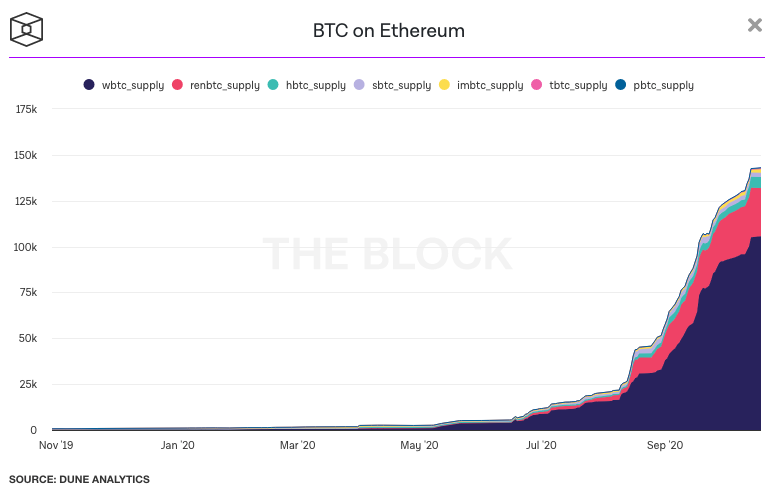

Chart of the week: BTC on Ethereum

Nothing new here to frequent readers. I think Bitcoin is still an untapped market for DeFi, but the growth is still something to marvel at. WBTC now has 0.5% of all BTC in its custody, primarily backing loans in MakerDAO or farming UNI. Completely unrelated, this chart is part of an awesome new data dashboard section on The Block. Check it out and let them know that all the cool kids use ‘DeFi’, not ‘Open Finance’.

Odds and Ends

Coindesk: DeFi audit firms swamped by ‘overwhelming demand’ Link

Forbes big write up on leading DeFi VC Paradigm Link

DXdao* is sponsoring gas fees on prediction market Omen Link

Nexus Mutual plans major upgrades to protocol Link

0x Developer and Governance update October 2020 Link

Perpetual Protocol plans to launch on xDai Link

Gauntlet Finance launches risk scores for DeFi Link

Trading View announces support for Uniswap markets Link

Thoughts and Prognostications

Token-based Governance is a fantasy; start focusing on assigning executive power [Elad Verbin/Lunar VC]

Do vesting rewards work for liquidity mining? [Anil Lulla/Delphi Digital]

Q3 Token Report: The rise of the ownership economy [Bankless]

Ethereum enhancers, not Ethereum killers [Matt Finestone/Loopring]

Q3 DeFi Review: DeFi reaches peak exuberance before coming back down to Earth [Messari]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. Super heavy Paradigm edition. AMM > CFMM, memes are not about accuracy

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.