In all likelihood, last week was peak exposure for Bitcoin, Ethereum, DeFi and crypto as a whole. Coinbase’s direct listing coming amidst all-time highs for cryptocurrencies and a host of other narratives from DOGE’s inexplicable rise to the explosion of digital art and NFTs.

The obvious parallel is Netscape’s IPO in 1995, which legitimized the growing web ecosystem and was public investors’ first taste of the booming internet market. Netscape was a harbinger of the explosive growth of the internet, but in the end, it did not become a core pillar of the internet (AOL acquired Netscape for $10bn in 1999).

The Coinbase listing will achieve similar things for blockchains and cryptocurrencies as the Netscape IPO, but will Coinbase follow the same path as Netscape or can it pivot to the new landscape that it is creating?

Framework’s Vance Spencer lays out what that could look like:

Liquidity Unleashed

So much of finance is sourcing liquidity for large transactions and capturing arbitrage opportunities. These also drive the DeFi world, but liquidity is not siloed in a single exchange, since the protocols are transparent and permissionless. DEX aggregators like 1inch are able to offer best pricing by accessing liquidity pools across Ethereum.

In the traditional or centralized world, best execution systems achieve this by splitting orders across multiple exchanges, but in DeFi this is different for two reasons:

In traditional finance, large investors invest in building proprietary best execution systems, but in DeFi, liquidity is permissionless at the protocol level, so all DeFi users have equal access different liquidity sources (note: this is changing with rising gas prices and the growth of MEV).

In DeFi, liquidity can be in more than one place. Okay, that’s not exactly true, but in traditional finance if you want to put your assets to work by lending or market making, you give them to a custodian/prime broker for that explicit purpose. In DeFi, you can deposit funds in a smart contract and then program that the funds should be used for different activities depending on market conditions. Or perhaps more accurately, others use the funds based on the defined parameters. (Check out more in last month’s post DeFi: The Liquidity Revolution)

Spencer posits that DeFi’s permissionless liquidity will spell the end of centralized orderbook exchanges like Coinbase, especially as new AMM designs like Uniswap’s V3 and Balancer v2 make AMM liquidity provisioning as capital efficient as orderbook exchanges.

This framing shows why the Great Orderbook vs. AMM Debate of the last year was so misguided. As blockchains scale and smart contract innovation continues, these lines blur and the real battle will be between global, permissionless financial networks and siloed, centralized exchanges. Coinbase has a strong position in the latter, but it’s hard to see that as an exponentially growing market (even without accounting for the future compressed margins).

Coinbase’s DeFi opportunity

There are a couple other areas where Coinbase’s business and DeFi converge:

USDC - Coinbase owns 50% of Centre, which operates USDC, along with Circle. In the centralized world, USDC is far behind Tether in terms of liquidity, but there is a strong argument that it could be the stablecoin in DeFi. There may be other opportunities, particularly a tokenized BTC to compete with WBTC.

Institutional investors - Coinbase went to great lengths in their S1 to emphasize their institutional business. Microstrategy, Tesla and many of the large BTC purchases have been executed through them. It’s not clear that large investors are ready for DeFi, but it’s a relationship game and Coinbase hopes to convert these investors into full-fledged member of the crypto economy.

Custodian - the self-custody revolution has not arrived Coinbase is one of the top 3 custodians in the space, along with Anchorage and Bitgo. This is an extremely low margin business, but since many cryptoassets require voting and other on-chain actions, custodians could become an important touchpoint for DeFi related services. Coinbase is going hard in ETH2.0 staking also, which it likely hopes to upsell users on other products.

Coinbase Wallet - Its non-custodial wallet doesn’t get much love, but it’s a good product with traction and the Wallet Connect QR code appears to be a must integration for all DeFi apps. Theoretically, Coinbase Wallet could be exactly like Coinbase.com (save bank transfers) except it’s enabling its users to access DeFi, instead of Coinbase.

Binance has a different playbook

The largest cryptocurrency exchange is facing similar headwinds as Coinbase, but of course they have a much more dire long-term threat in terms of regulation. Instead of doubling down on regulated activity like Coinbase, Binance is launched Binance Smart Chain, an EVM compatible chain aimed at replacing Binance.com’s centralized orderbook exchange and other centralized services.

So instead of being the regulated gateway to the open DeFi ecosystem, Binance is betting on creating a semi-permissioned and semi-centralized ecosystem that interacts with other blockchains. So far it has been successful, precisely because it’s easier for it to coordinate product launches and drive users. This works in the short-term, but will decentralized chains emerge with a more robust ecosystem eventually?

Coinbase certainly hopes so. Still, Binance - seeing the growth and potential of DeFi - is actively trying to prevent its own disruption. Coinbase seems to be aware of the same forces but need to be more pro-active in carving out their space in the DeFi future.

Tweet of the Week: Sunday’s carnage explained

An absolute killer thread from Willy Woo on the mini market crash over the weekend. The FUD police are out and about but it’s hard to escape the fact that BTC, ETH and DeFi tokens are super volatile assets and the crypto space has Archegos-level of leverage, so price swings can quickly become violent. BTC and ETH have traded sideways and a up the last two months but the 10% down days don’t seem to be going away.

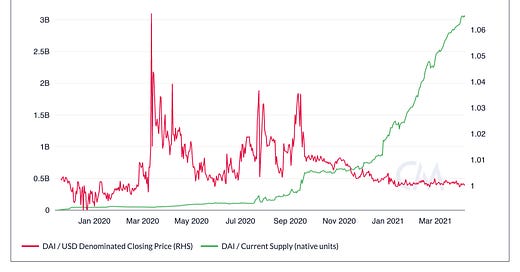

Chart of the Week: Dai grows and stabilizes

MakerDAO has appeared to leave its peg problems in 2020 with Dai staying close to its peg for the last five months, even as Dai’s circulating supply increases 500% to more than $3.6bn. Of course, much of this can be attributed to the Peg Stability Module, which allows market makers to always mint 1 Dai with 1 USDC. Lots more charts and info in Coin Metric’s State of the Network from last week.

Odds and Ends

DeFi Saver launches transaction recipe creator Link

Gauntlet: Aave Market Risk Assessment Link

Flashbots Transparency Report Link

Bancor unveils limit orders, using KeeperDAO and 0x Link

MEV resources guide Link

Yearn.finance completes $1.1m buyback of YFI Link

New lending protocol Liquity reaches $1bn TVL in 10 days Link

Thoughts and Prognostications

MEV wat do [Phil Daian/IC3 Cornell]

A history of frontrunning Synthetix [Kain Warwick/Synthetix]

RAI Narrative Strategy Guide [Ameen Soleimani/Reflexer Labs]

Understanding AMMs - price impact [Hasu/Paradigm]

DeFi’s Risk-Tranching Protocols [Guillaume Girard/Messari]

Uniswap: ELI5 [Nick Chong/ParaFi]

Ethereum’s consensus bug explained [Adam Cochran/Cinneamhain]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. Trying to work on productive discourse online and with friends, family and co-workers.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.