More often than not, “high yield” is preceded by “unsustainable”, because by their very nature, high yields imply an investment risk that the high returns are supposed to compensate for.

In the case of DeFi’s farming craze, yields came from subsidies to lure new deposits, and yields were high because subsidies (or rewards) were front-loaded for early users and because the value of rewards increased from speculators buying the farmed tokens.

As the DeFi summer ends, there seems to be no fall harvest to follow. Enthusiasm has declined and yields have compressed. What’s next?

YFI is the poster child for the yield farming movement. Of course, it launched with no pre-mine, so all YFI in existence was farmed from the yearn.finance protocol. More importantly though, yearn is yield-optimization protocol for assets deposited in yearn’s ‘vaults’, which are managed by YFI holders.

Initially, the vaults just rebalanced stablecoins across lending protocols with the highest returns, but after the launch of COMP, deposited assets were able to earn more than just a simple yield. Soon, yearn’s vaults employed new strategies that harvested farmed assets and sold them to offer and passed this back in the form of a higher APY.

Yearn’s crop of choice was CRV, which launched in mid-August and was an easy source of yield for any crypto dollar deposit. The CRV launch was hotly anticipated but the launch also came with significant CRV inflation, leading to a sky-high valuation that has steadily declined as more and more farmed CRV hits the market.

A high CRV price = high yields for yearn’s vaults = high YFI price, but this did not last.

(Excellent thread on YFI by Spartan Group’sJason Choi)

It’s no surprise that CRV has tanked with constant sell pressure from yearn, meaning Dogetoshi’s prayers went unanswered:

Yearn proponents would argue that these specific strategies have lost their shelf-life. YFI does not stand for Yield Farming Index, but then, what is the innovation?

Programmatic, on-chain liquidity pools

Originally, Andre built yearn “for himself” to optimize between lending protocols, but he quickly realized that gas costs would eat up small differences in yield. A larger pool of capital would reduce transaction costs. In short, capital efficiency scales with size.

At its core, YFI is a protocol for directing on-chain capital pools. Anyone can deposit an asset into a vault, which executes a transparent on-chain investment strategy.

This is a genuine innovation. Set Protocol is arguably the first project to offer automated investment strategies, but Yearn’s strategies have been more complex, focused on a single asset and allow for easy redemptions (with a fee).

CRV mining rewards will dwindle, but that shouldn’t materially affect YFI’s ability to attract capital and redirect it on-chain to money-making opportunities. YFI holders just need to build and create the most profitable strategies – and keep pumping the marketing machine.

Stickier Assets

YFI vaults benefit from shared gas costs but since the strategies are on-chain, it is highly forkable. YFI’s moat – outside of Andrew - comes from its ability to attract capital in large amounts; depositors benefit from increasing returns to larger pools of capital.

Presumably, it would be easier if a protocol had funds of its own to invest, rather than relying on external investors.

Yam Finance is hoping to do precisely this. The food coin was known for its rapid rise and fall, which was attributed to the innovative launch strategy and the governance module’s failure, but Yam’s real innovation comes from its on-chain treasury.

Yam is a rebasing currency (like Ampleforth) and on a positive rebase, meaning the price of Yam is above its target, 10% of the excess YAM is used to purchase yUSD and then deposited in the Yam treasury.

Yam’s treasury has already grown to just under $3m in the two weeks since Yam v3 replanting and the first rebase. At the moment, this is meant to provide a floor to the price of Yam, beause Yam governance could vote to liquidate the treasury and return to Yam holders.

Yam intends to be very active with the treasury. Yam founder Trent Elmore laid out in a forum post:

Yield-bearing strategies. Currently the treasury employs a yield bearing strategy by utilizing yUSD. This allows for sustainable growth with limited downside, as it’s based in stablecoins. In the future, we could employ additional yield bearing strategies, utilizing aggregators or base protocols.

Strategic Investments. While stablecoin yield generation is great for sustainability and downside protection, in the event of a DeFi boom it is likely going to underperform many protocol’s native assets. Allocating a portion of the treasury to a DeFi index (potentially the new DeFi Pulse Tokenset Index) could be an effective way to ensure the treasury grows with DeFi.

Financial Protocols. This has always been the most exciting direction for the Yam treasury to me. Building financial protocols that Yam can help enable and seed liquidity to is probably the most impactful direction it can take, but also the most difficult and resource intensive.

Mutual funds might be a more accurate way to describe Yearn vaults, whereas Yam’s approach is more akin to a hedge fund – give us money and we’ll decide something to do with it.

Yam has just begun a more active treasury management. There is currently a proposal to buy $250k worth of DeFi Pulse Index Tokenset and a forum discussion on deploying the treasury to farm UNI.

Note: DXdao is working on something similar for its on-chain treasury. If you have any ideas, get in touch.

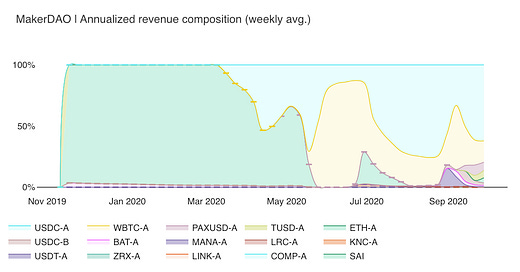

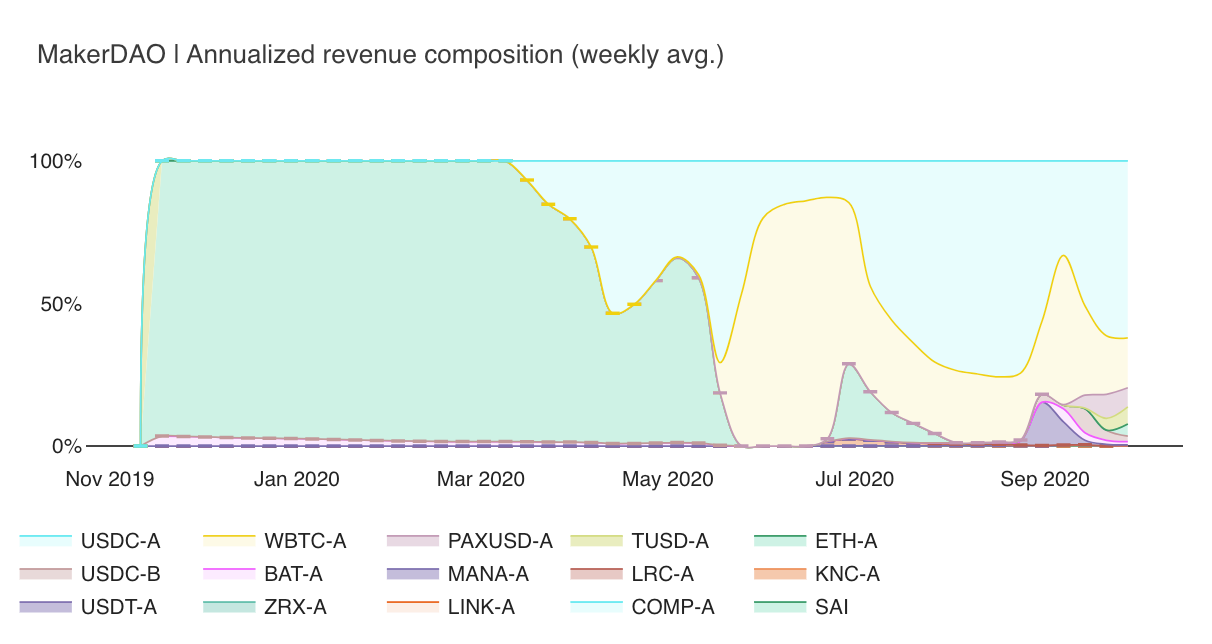

Chart of the Week: Maker’s Diversification

One chart from a long post from Token Terminal on MakerDAO. Of course, revenue dropped to 0 after Black Thursday, when Maker slashed stability fees to 0. Fees have started to inch back up, and Maker is diversifying its fee source. Most fees come from USDC vaults, which now backs more Dai than ETH ($356m vs $345m). The bright spot is WBTC, which was added to the platform in the spring. It has a higher stability fee (4%) compared to ETH and now backs $74m Dai. Although its TVL as grown to nearly $2bn, Dai has struggled to maintain its peg and many felt that Maker missed the opportunity of the DeFi summer. Messari has another piece on Maker’s climb to $2bn.

Tweet of the Week: MEV is coming

More great MEV content. I just love that meme. In all seriousness, Layer 2 scaling solutions have been a hot topic lately (and last week’s Dose). In a way, MEV is extracted to the external validators securing the Layer 2, but that presents its own problems of rent-extraction. The thread goes into all the ways miners can benefit. Most worryingly, it appears miners are not extracting MEV because they don’t know about it. Also check out Vitalik’s post, “A rollup-centric Ethereum roadmap”.

Odds and Ends

Metamask exceeds 1 million monthly active users Link

Galaxy Digital becomes a shareholder in ParaFi to co-invest in DeFi Link

DeFi Alliance - What Bitmex Means for DeFi (Wed 11am ET) Link

ZeroSwap: an AMM model Layer-2 Dex based on zk-Rollup Link

Top 93 markets on Uniswap surpassed Coinbase in 24 hr volume Link

DeFi tokens and ETH shrink their summer highs Link

Curve competitor Shell Protocol launches first stablecoin pool Link

Thoughts and Prognostications

There’s no such thing as a decentralized exchange [Peter Van Valkenburgh/The Block]

Liquidity Mining: A User-Centric Token Distribution Strategy [Dmitriy Berenzon/Bollinger Investment]

Crypto Market Structure 3.0 [Arjun Balaji/Paradigm]

Ten Theses on Decentralized Network Governance [Mario Laul/placeholder]

A comprehensive analysis on DEX liquidity aggregators’ performance [Fulvia/0x]

Audits != Go All In [Kerman Kohli/DeFi Weekly]

Ethereum’s DeFi Evolution: How DeFi Is Fueling Ethereum’s Growth [Nate Maddrey/Coin Metrics]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. Congrats to Sam.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao. All content is for informational purposes and is not intended as investment advice.