It’s hard to believe that “yield farming” has only been part of the DeFi lexicon for less than two months. Liquidity-based incentives have been around far longer, but only with the launch of BAL and COMP, earned through the usage of Balancer and Compound respectively, has the “yield farming” meme proliferated.

Yield aggregator Yearn.finance launched the YFI token 10 days ago to a rabid user base that was already familiar with rotating their crops to optimize yield. Since its launch, YFI has dominated the DeFi market and attention due to its mysterious origins, its “ponzinomics”, the lack of a pre-mine to founders and investors, and the promise of the Yearn platform to become a cornerstone of DeFi infrastructure.

Fighting bots and whales

Before YFI, DeFi was infatuated with MTA, a governance token for mStable, a platform for saving and swapping stablecoins. mStable allows anyone to mint mUSD by depositing any stablecoin and enables zero slippage for trading between stablecoins. MTA tokens earn fees for insuring mUSD.

MTA’s launch came after the initial-DEX-offerings (IDOs) of UMA and bZrx, which both seeded a pool on Uniswap 50/50 with its new token and ETH. While anyone could purchase these new tokens from the Uniswap pool, in practice, a handful of whales/bots swooped in and purchased a large amount as soon as they were listed, thereby driving up the price of the listed token and depleting the Uniswap pool’s supply of the launched token.

MTA originally planned to launch on Balancer with a similar model, but the problems with IDOs on Uniswap led them to use Mesa, a DEX built on Gnosis Protocol and governed by the DXdao. Mesa uses batch auctions of 5 minutes to find the optimal price for buyers and sellers. Users submit bids and Mesa (or GP’s solvers) find the clearing price.

There were some hiccups, but mStable sold 2.6m MTA on Mesa at $1.81 – MTA is currently trading at ~$4.55. After the launch, however, several seed investors looked to realize some of their gains, which concerned many who had just purchased MTA. In response, mStable announced a 3 month lock-up for seed investors.

mStable used the sale proceeds to launch three Balancer pools (mUSD/USDC, mUSD/WETH and mUSD/MTA). Investors can farm MTA by providing liquidity to any of these pools.

COMP and BAL launch

Compound and Balancer launched tokens last month, but neither had an “initial DEX offering” even though their tokens are now traded freely. Instead, COMP and BAL was distributed to platform users – COMP to those earning/accruing interest on Compound and BAL to those earning trading fees by providing liquidity on Balancer.

To recap:

UMA – Initial Uniswap listing on April 22, targeted liquidity mining initiative thereafter

COMP – liquidity mining for protocol usage launched on June 15

BAL – liquidity mining for protocol usage launched on June 23, retroactively to June 1

bZrx – Initial Uniswap listing on July 13, liquidity mining for protocol usage and fee rebates thereafter

MTA – Initial DEX offering on Mesa on July 18, liquidity mining on three mUSD Balancer pools thereafter

YFI – liquidity mining for protocol usage launched on July 17/18 (out of nowhere)

Takeaways:

The ease of secondary-market liquidity in a Uniswap/AMM-enabled world - No longer do projects need to pay high listing fees or market makers to give tokens initial liquidity. As long as the token is out there, it will be traded on Uniswap/Balancer.

Protocol usage is the easiest way to launch a token. Compound, Balancer and Yearn.finance all released tokens entirely through protocol usage, preventing the frenzied gas wars to get into a token launch. MTA’s sale on Mesa appears to be a better option than Uniswap/Balancer to protect against front-running.

Fundraising is not a priority – in 2017, token launches were defined by how much they raised, but none of the DeFi token launches so far have raised money for development. Instead, the launch goal is token distribution.

YFI distribution

Yearn.Finance founder Andre “I test in prod” Cronje launched the YFI token with zero pre-mine, meaning there were no YFI tokens allocated for investors or the founding team. All YFI was farmed and YFI token holders were immediately given governance over the platform.

One of the first governance decisions of the new community was to stop YFI farming and cap the number of YFI tokens at 30k, which means that all YFI tokens would be distributed after just a week of farming. Inflation rewards and yield farming are user acquisition strategies, but Yearn.finance reached almost $350m TVL in a week, how much more growth needs to be subsidized?

More important than the subsidy for Yearn.finance products, YFI yield farming subsidized the creation of a governance community. Many of the most eager DeFi farmers participated early, instantly creating a small army of token holders financial invested in the long-term success of the platform and willing to shill the project endlessly on Twitter.

The lack of a sale or pre-mine for YFI underscores point #3 above: token distribution is the most important thing for a token launch. Typically, this was done to the team, investors and then in a crowd sale or ICO to disseminate widely, but moving forward, projects should use token launches to pick their token holders, because they will ultimately determine a project’s governance and long-term success. On Friday, Andre released plans for Yearn.finance v2.

DeFi Bull Market

The past few months have been good for DeFi, judging by the new token launches, TVL reaching $3.6bn, DEX volume highs or just the increased attention of Crypto Twitter. Another sign is new entrants, such as new ETH buyers or centralized exchanges and non-Ethereum blockchains.

Before Ethereum Twitter explodes over “decentralization” concerns, the biggest news is what it says about the DeFi bull market. Namely:

DeFi – at least the meme – has moved outside of Ethereum.

Cheaper transaction costs and, to a lesser extent, speed of transactions will be a common feature of new DeFi entrants.

Interoperability with Ethereum is necessary for any project that claims to be “DeFi”

The fact that a centralized exchange is building a DeFi product on a different blockchain (Solana) is good news for Ethereum DeFi, because - at the minimum - it educates and expands the DeFi investor universe.

No matter how fast the transactions are, Ethereum has the on-chain assets needed for a DEX, meaning that a DeFi solution is only as good as its bridge to Ethereum. Here, Serum will join Loopring and other Layer 2 solutions on Ethereum, which already offer fast trading and a trustless bridge to Ethereum, in addition to NEAR, Cosmos, Polkadot and others that are building Ethereum bridges – and of course, ETH2.0.

Although Serum will launch “in ~a month”, the details of its interoperability plan are still lacking (Serum whitepaper); it looks like its solution will have similar trade-offs to other L2 scaling solutions but with the heft (and volume) of FTX.

Regardless, FTX and Solana have thrown down the gauntlet. Expect every centralized exchange and every Ethereum competitor to roll out major DeFi initiatives. I’m waiting for the first cross-chain farming opportunity, or is that just staking ETH in Phase 0 of ETH2.0?

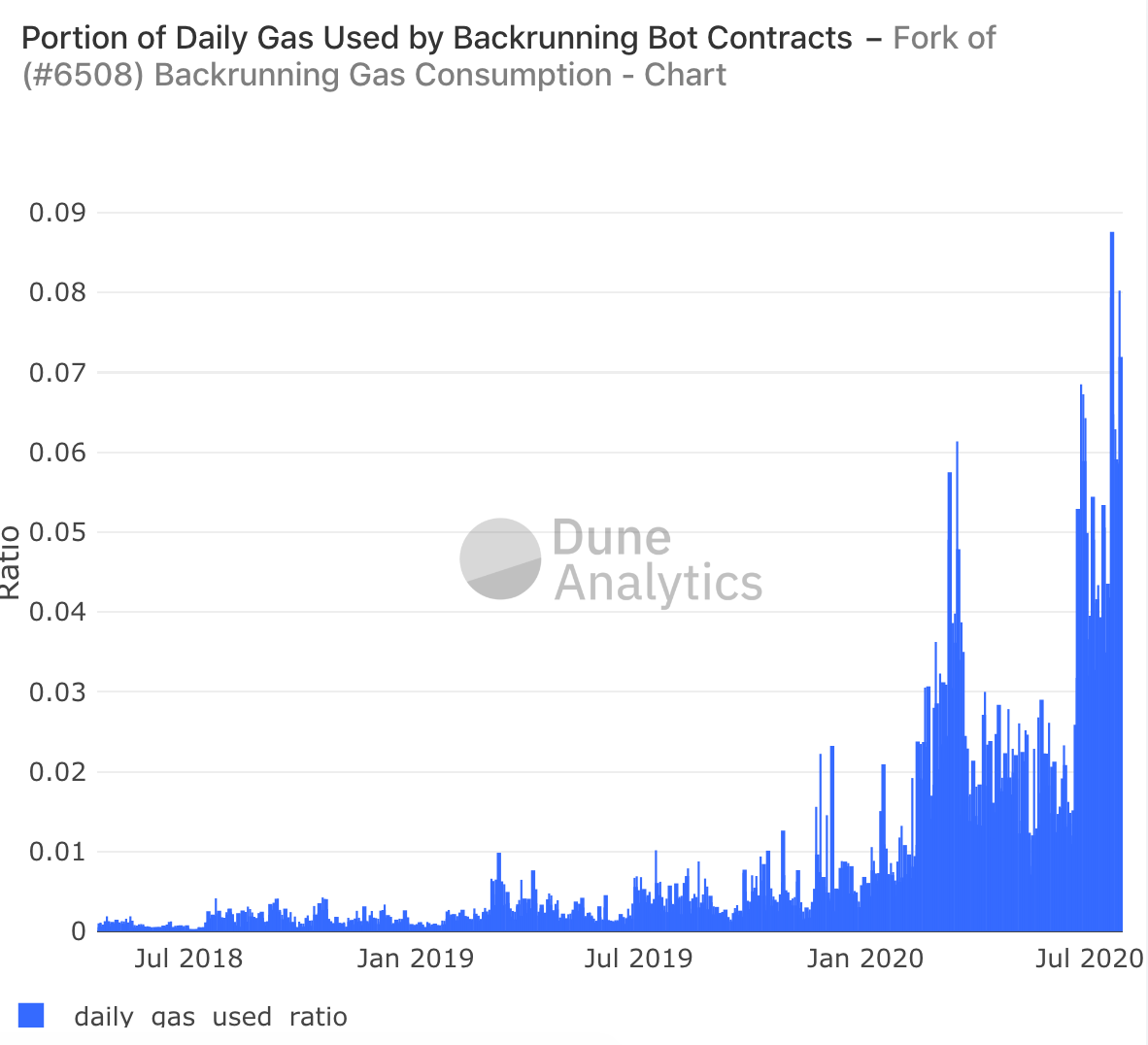

Chart of the Week: Trading Bots Guzzling Gas

H/T @trent e

This Dune dashboard created by Philippe Castonguay shows the percentage of gas being used by frontrunning bots, or traders that search for transactions yet to be mined and submit tx in the same block that capitalize on that information. Ethereum gas prices have been stubbornly high for months and 100 gwei gas now seems like normalcy during Asian evenings/American mornings. Bots will be willing to pay high gas prices as long as their significant arbitrage value to be had.

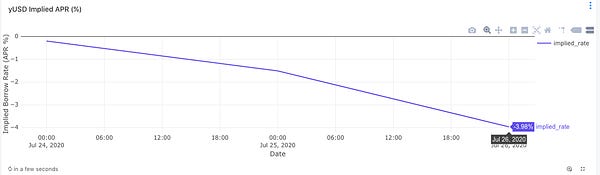

Tweet of the Week: UMA’s fixed-rate loans

A tweet that makes you squint and think. Last week, UMA launched a “yield dollar”, a synthetic dollar that (usually) trades at a discount until expiry, where it can unlock $1.00 of the collateral asset used to mint the yield dollar. Yield dollars aim to introduce fixed-rate lending and compete with the algorithmic ETH-backed loans on Maker or Compound. Teo’s tweet shows that the first yield dollar , yUSD-SEP20 set for expiry on September 1, is trading at a negative interest rate for the borrower, or at a premium to the amount you could unlock in collateral on September 1 (I think). Synthetic tokens can track real world assets or fill a hole in the on-chain financing market. Building liquidity for fixed-rate loans is tough (just ask Dharma), but UMA just released its own liquidity mining campaign on Monday.

Odds and Ends

Synthetic Foundation decommissioned Link

Blockchain transaction visualizer compares Bitcoin & Ethereum Link

Rai, a decentralized synthetic asset, launches on Kovan Link

Augur v2 launch and REP migration Link

KeeperDAO Launches Pooled Liquidations & Arbitrage for DeFi Link

Maker becomes first DeFi protocol to hit $1 billion in total value locked Link

Thoughts and Prognostications

Musings on UMA: DeFi Infrastructure [Trent Elmore]

Zkopru (zk optimistic rollup) for private transactions [ETH Research]

Bankless Q2 Token Report [Bankless]

Evidence of Mempool Manipulation on Black Thursday: Hammerbots, Mempool Compression, and Spontaneous Stuck Transactions [Block Native]

The Tetherization of wBTC [Jack Purdy/Messari]

What can we do with a DAO now [Philippe Honigman]

That’s it! Feedback appreciated. Just hit reply. Written in Difficult, TN, where the sunsets make the humidity worth it. Wear a mask. Apologies for last week’s hiatus; I’ve been on the road and too much to keep up with in DeFi.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.