As DeFi users started shifting away from the Ethereum mainnet to lower-cost chains, the infrastructure need for bridges escalated. While some had already launched at this point, most were still in the research phase. Since then, bridges have multiplied in number, size and scale – and we can now draw conclusions on the market share winners and strategic successes. These industry leaders form the center battlefield for the multichain world that we wrote about last fall – and will be reflecting on later this year. For now, Denis takes a closer look behind the scenes.

- Chris

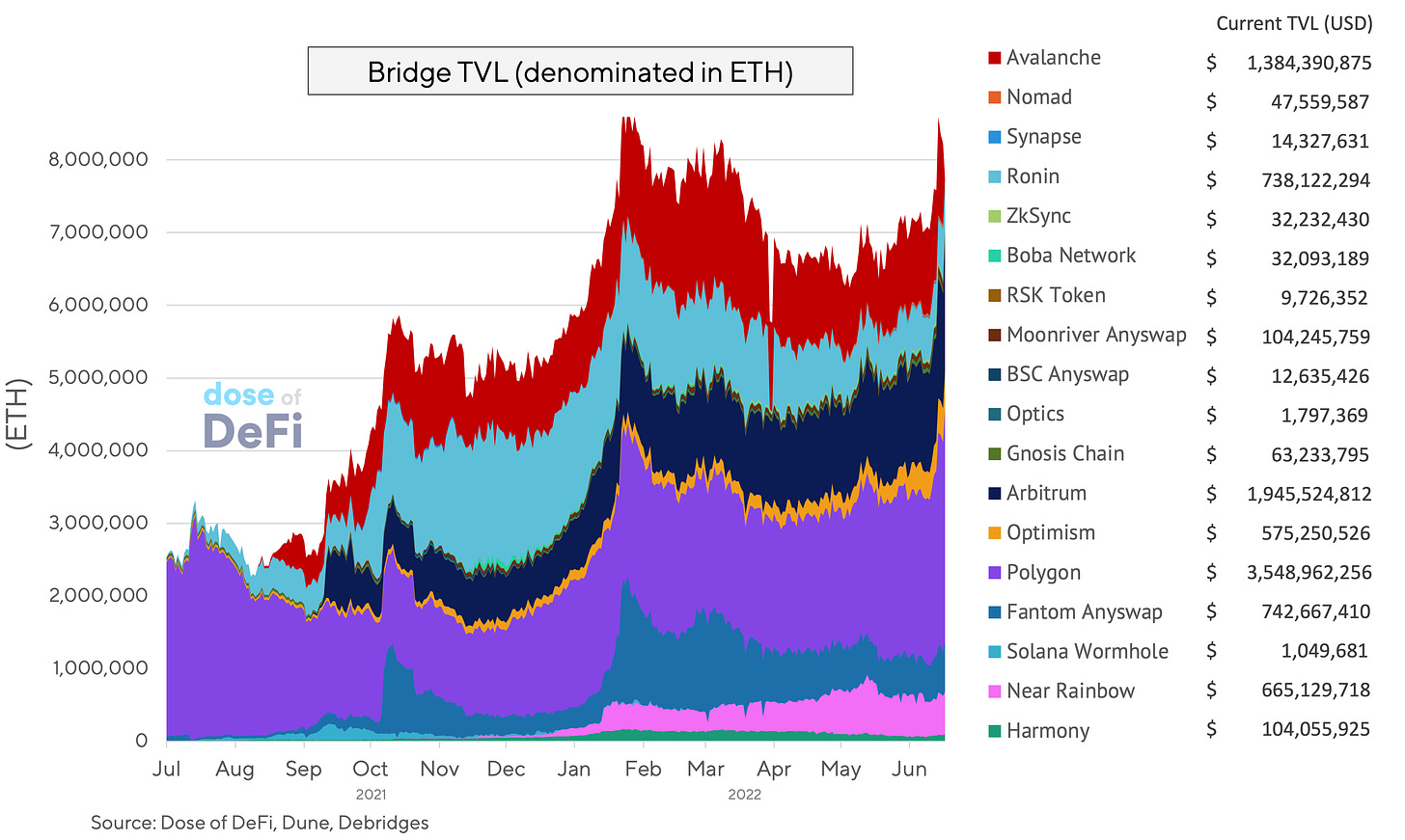

The bridge industry has matured quickly. Following the proliferation of bridges over the last nine months, they now collectively represent roughly 10% of TVL in smart contracts (based on data from the Dune Analytics dashboard by Eliasimos and DefiLlama). To put this rapid growth into context, Polygon Bridge’s USD4 billion TVL is now second only to the TVLs of DeFi giants Curve and Maker.

Taking a step back, bridges were first conceptualized following the emergence of the second blockchain, which prompted discussions on how to connect them. WBTC was the first successful bridge, linking together the two most important blockchains, albeit through a centralized entity. Then things stepped up a gear in late 2021, with the start of an intense era of new bridge production. This article by Dmitriy Berenzon from 1kx gives a detailed overview of this turn of events.

Fast forward nine months, and we’ve now reached a point where the average DeFi investor is using bridges regularly. At face value, this is great news for the swaves of recently-launched bridge projects. However, with the reality of the current market decline and its impact on volumes, these projects are now scrambling for market share among a dwindling set of users.

Amid this scramble, the choice of approach in both bridging and validating methods will be key to determining the bridging competitive landscape in a few years time.

What’s your asset?

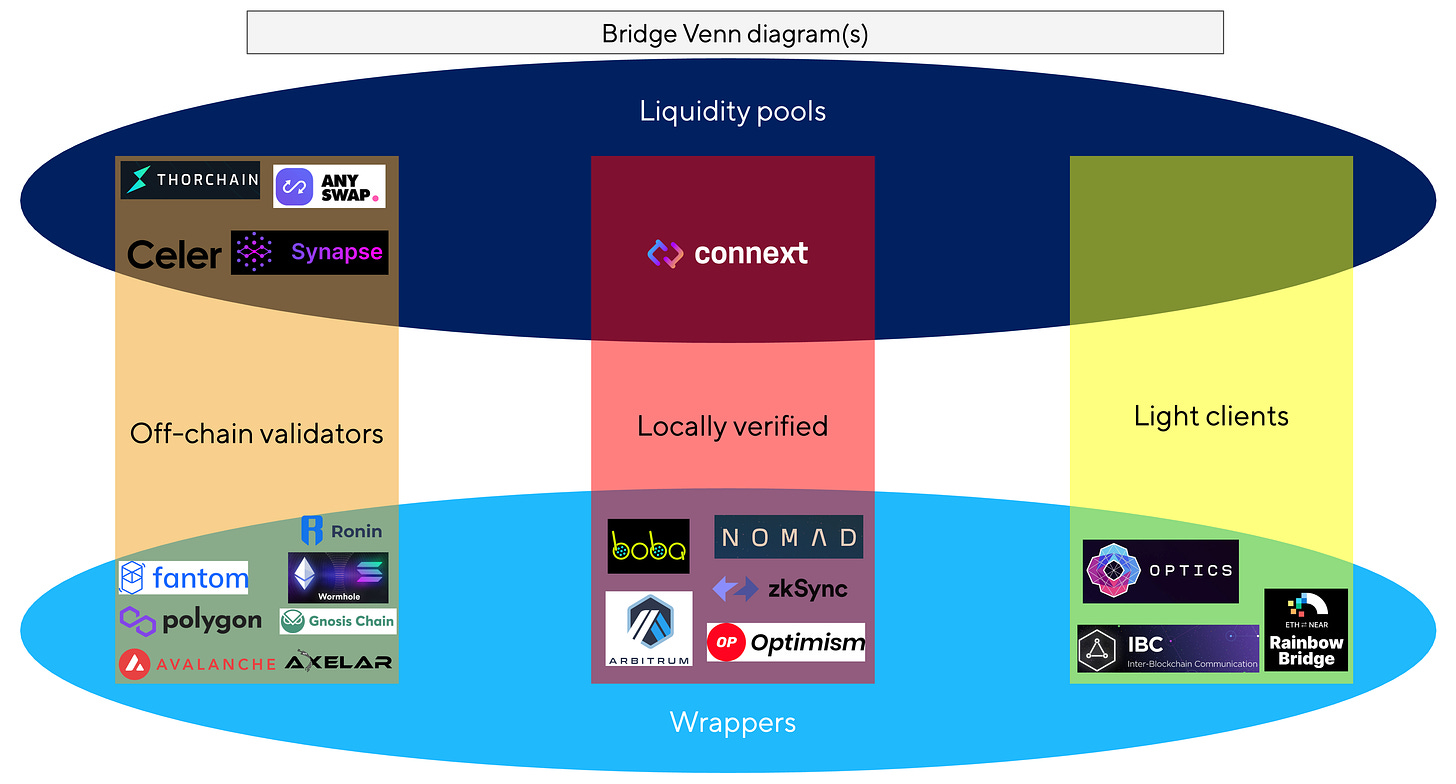

As a basic definition, a bridge facilitates the migration of assets from chain A to chain B. Within this concept, there are generally only two types of assets that a user receives after migration: an asset “IOU” or a natively-issued asset. From the perspective of bridge designers, this equates to one of two methods: token wrapping or creating liquidity.

Token-wrapping bridges (combined TVL: USD11.2 billion)

Alternative Layer 1s and their DeFi projects initially saw bridging as a way to bring assets to their ecosystems. Yet creators of these assets weren’t necessarily interested themselves (Avalanche won’t issue an AVAX on a competitor chain, for example). So in such cases, a “wrapper” bridge is used by the Layer 1.

With wrapper bridges, an asset is locked on chain A and a “wrapped” version is minted on chain B. While it may be easier to think in terms of transfers, the asset doesn’t actually move. It’s thus important to instead call it “wrapping” because it's essentially an “IOU” from the bridge, and doesn’t have an intrinsic value on the new chain.

Competition between wrapper bridges creates multiple non-fungible versions of tokens, which is confusing for users and leads to liquidity fragmentation. For example, multiple versions of USD live on Solana; Saber swap lists 70 versions of the token.

Liquidity pool bridges (combined TVL: USD0.6 billion)

Some tokens are in fact native to multiple bridges. For example, the team behind USDC issued its token on a number of chains themselves. Liquidity pool bridges are used to connect these tokens by gathering symmetric pools on both origin and destination chains.

This is a rather capital-intensive approach to bridging, and relies heavily on bridge token incentives to compensate the opportunity cost to liquidity providers. It’s not clear whether transaction fees will be sufficient in the long term to cover the cost of liquidity. But it’s a safe bridging experience for users, because they receive a token that was minted by the team itself. Plus, liquidity pool bridges are usually faster than token wrappers. Synapse and Celer are examples of bridges using this method.

Who’s validating?

Across the spectrum of existing bridges, three validator methods have arisen, with different approaches to the validation of the asset transactions between chains. Our thoughts on these – including their pros and cons – are as follows:

Off-chain validators (combined TVL: USD10 billion)

In such bridges, third-party validators observe the origin blockchain for a signal that an asset is locked. They then transfer this message to the destination blockchain (call a smart contract on it). To avoid one validator centralizing control, either a multisignature wallet or some kind of consensus mechanism is used.

This approach can be risky because it involves trust in third parties that control assets on the origin chain. All three of the largest hacks from the Rekt list happened on bridges that use validators (Ronin, PolyNetwork, Wormhole), with a cumulative amount equal to that of the subsequent 17 hacks combined.

However, the pros are that such bridges can onboard new chains relatively easily, and can carry any kind of messages (not just token transfers).

Locally-verified bridges (combined TVL: USD0.7 billion)

Instead of relying on third-party validators, these bridges use underlying blockchains’ (“local”) validators to verify transactions. In addition, there’s a time window to submit a “fraud proof” by any third party that notices a fraudulent/incorrect transaction. The latter feature is similar to making optimistic transfers to Layer 2s like Arbitrum and Optimism. Nomad is an example of a locally-verified bridge, and as its documentation explains, “this tradeoff allows Nomad to save 90% on gas fees compared to pessimistic relays, while still maintaining a high degree of security…”. Connext uses Nomad for its liquidity network. The disadvantage is that these bridges have limited support for generalized message passing.

Light clients (combined TVL: USD1.2 billion)

The third method is the creation of smart contracts on one chain that work as light-client validators of another (technical explanation for Rainbow, Optics Bridge, IBC). The main advantage here is that there’s no need to trust third parties; it’s enough just to trust the code. Also, because the security of the origin chain is borrowed, an attack to undermine such a bridge has to be a (very expensive) consensus-level one.

Light clients are expensive in general (they write a lot of data to blockchain), aren’t scalable (a new smart contract has to be written for each new chain added), and are sometimes slower than other validator methods.

Risks and future market structure

With bridges now an integral part of regular DeFi activity, the stakes (and risks) are higher. First,

there’s a real possibility that one bridge will become dominant. And with this, the whole ecosystem might become dependent on it. As an hypothetical example, consider the fact that approximately 20% of BSC and Fantom’s TVL was migrated from outside (mostly ETH from Ethereum). If this was via one bridge and the bridge was then hacked, 20% of the assets would disappear, with significant negative impact on the respective ecosystems.

Furthermore, a collapse could reverberate across the ecosystem because the bridged tokens are used in AMMs, lending protocols and beyond.

Finally, for bridges to build sustained user trust, they have to offer some kind of “service-level agreement” guarantee that they’ll still be running in at least two or three years time (and this isn’t something that can be assumed in this world).

In addition to these risks, it goes without saying that security is vital. And with much of the latter determined by who is doing the validating, we expect the following to unravel by way of market structure over the next two years. A few prognostications:

Light client bridges will become the substrate of bridging infrastructure. They will play a key role in defining canonical assets and will be used for “institutional-size” transactions.

To counteract cost, poor scalability and low speed, liquidity pool bridges will be used for frequent, low-volume “retail” transactions.

From a technology perspective, liquidity pool bridges will be implemented as validator or locally-verified bridges, depending on whether scalability or speed is required.

These market dynamics have only begun to play out and will surely also be influenced by how the multichain world as a whole evolves.

Odds and Ends

dYdX to launch Cosmos appchain Link

Uncollateralized on-chain lender, Maple Finance, faces cash shortage Link

Liquity submits proposal to Curve governance for CRV emissions to LUSD Link

PwC's 4th Annual Global Crypto Hedge Fund Report Link

Thoughts and Prognostications

This time isn’t different [Trevor Chow]

Review of Ethereum’s rollup-centric roadmap for scaling [Ally Zach/Messari]

What will Ethereum miners do after the merge? [Sami Kassab/Messari]

That’s it! Feedback appreciated. Just hit reply. Written during my last week in Brooklyn! Look out for Dose summer schedule. Excited to see many of you tonight.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao* and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.

Hi! a very insightful post, thank you! would you like to discuss some partnership/collab opportunities? if yes, where can I reach you out?