DeFi growth in perspective, AMMs by investor size

A year after Black Thursday plus retail and institutional investors prefer different AMMs

Happy Belated Pi Day! And the Ides of March (if that’s your thing…). No post this week, but back next week.

DXdao is still looking for a senior Marketing and a senior HR person. If you know a candidate, get in touch!

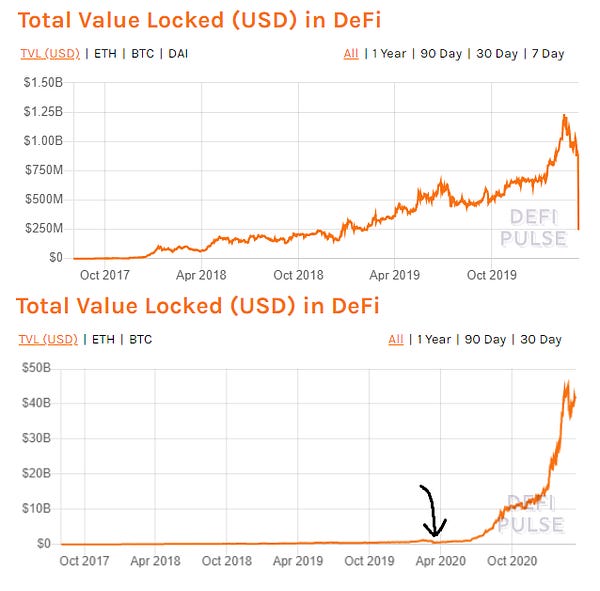

Tweet of the Week: DeFi growth in perspective

Everyone’s favorite cat compares the DeFi growth chart now vs a year ago, when DeFi TVL plummeted by more than 50% on Black Thursday. The market crash threatened the backbone of DeFi, Dai, and forced Maker to accept USDC as collateral and conduct an MKR auction to recapitalize the system. A year later and the crisis is a barely decipherable blip on a hockey-stick growth chart.

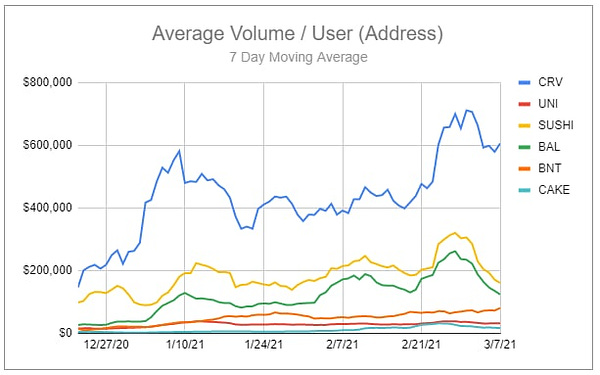

Chart of the Week: Volume per User across AMMs

One chart in a long thread from Andrew Køng with an optimistic take on the user, volume and growth numbers from Pancake Swap. Binance can certainly drive retail volume and new BSC users are likely new DeFi users, but as The Block’s Larry Cermack points out, if the LPs are Binance-affiliated, wash trading has very little cost with low fees on BSC.

Regardless, the chart above points out the very different user profile different AMMs. Curve has the largest trade size - it has absolutely devoured the OTC stablecoin market, but there is a clear distinction between AMMs that appeal to retail investors (Uniswap & Pancake) and those that appeal to institutional and/or arb bots (Sushi & Balancer). This may help explain the divergence between Sushiswap and Uniswap; Sushiswap now has more TVL, but Uniswap has 4x the volume and 25x the users. Still, there are always bullish takes on Sushi out there.

Odds and Ends

Aztec launches rollup for private ETH transfers Link

Dynamic Set Dollar unveils roadmap to DSD v2 Link

Argent announces Layer 2 plans Link

0x reveals governance parameters for soon-to-be launched 0x DAO Link

New DeFi lender Alchemix raises $4.9m from token offering Link

DODO pool exploit postmortem Link

Thoughts and Prognostications

Layer-2 for Beginners [Ali Atiia/Gourmet Crypto]

How to survive a crypto cycle [Fred Ehrsam/Paradigm]

How to structure a protocol’s treasury [Shreyas Hariharan]

DeFi transaction public visibility is a competitive advantage [Ken Deeter/Electric Capital]

A beginner’s guide to DAO’s [Linda Xie/Scalar Capital]

Proof of Stake is coming sooner than we think [James Beck/Consensys]

The evolution of the Constant Function market Maker [Roberto Talamas/Messari]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. Daylight savings time is a game changer; all down-hill from here.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao. All content is for informational purposes and is not intended as investment advice.