DeFi Regulatory barrage, plus USDC growth outpaces USDT

Plus Odds & Ends and Thoughts & Prognostications

Happy London hard fork and EIP-1559 (and belated 6th birthday to Ethereum)!

I also wanted to welcome recent new subscribers to Dose of DeFi. The newsletter comes out every Thursday with commentary on a tweet & chart of the week along with a weekly link roundup, and then once a month, there is a deep dive into a trending topic. Last month was on MEV and the one before on stablecoins and CBDCs.

The archive has previous editions going all the way back to Summer 2019. “Maker Crashes, Dai Liquidity Crunch, USDC to the rescue?” and “Bitcoin in DeFi and COMP launch” are good ones to checkout.

You can also read Dose of DeFi in Chinese or Russian. Thanks for reading.

— Chris

Tweet of the Week: Regulatory pressure intensifies

It’s hard to know where to begin with the increased attention on the cryptocurrency space from government regulators, but Sen. Elizabeth Warren’s “shadowy super coders” seems like the best meme to capture it.

At the start of the summer, it was all about the digital dollar, with the Fed promising to release a report this summer even though Fed Chair Jerome Powell remains “legitimately undecided”. Countries around the world were contemplating CBDCs and the monetary implications of digital currencies.

But all of that seems like small potatoes compared to the onslaught of the last two weeks, when Uniswap Labs updated their front end to ban certain synthetic tokens fearing regulatory pressure. Then the cryptocurrency industry got singled out in the huge bipartisan infrastructure that is rolling through the US senate right now. The bill aims to raise $30bn in new taxes on crypto companies, but the bill’s language would mandate tax-reporting requirements for miners, wallets and node operators - not just the broker-dealers like Coinbase it meant to target.

And then on Monday, a confident SEC Chair Gensler gave a speech addressing cryptocurrencies, stablecoins and, yes, DeFi, which Bloomberg columnist Matt Levine called “very pro-regulation” but that the speech did not say “anything new or surprising or even really interesting”. All this...plus the Uniswap’s DeFi Defense Fund brought to you by a16z and the Ivy League and the budding Builder-First Legal Activism DAO from Yearn and the LeXpunK Army.

Clearly, momentum is moving towards regulatory action. The bright spot in this regulatory barrage has been the legitimization of crypto in Washington D.C., specifically around the Wyden-Toomey-Lummis Amendment that would clarify the definition of a broker-dealer in the cryptocurrency tax portion of the infrastructure bill. The crypto community has coalesced into a (potential) political force, although the amendment’s status is still up in the air.

All of these moving parts point toward what is unlikely of all in DC: legislation. The capital is marred in gridlock but the growing interest in cryptocurrency from across the political spectrum and the regulatory landscape make new legislation before the 2022 midterms a legitimate possibility.

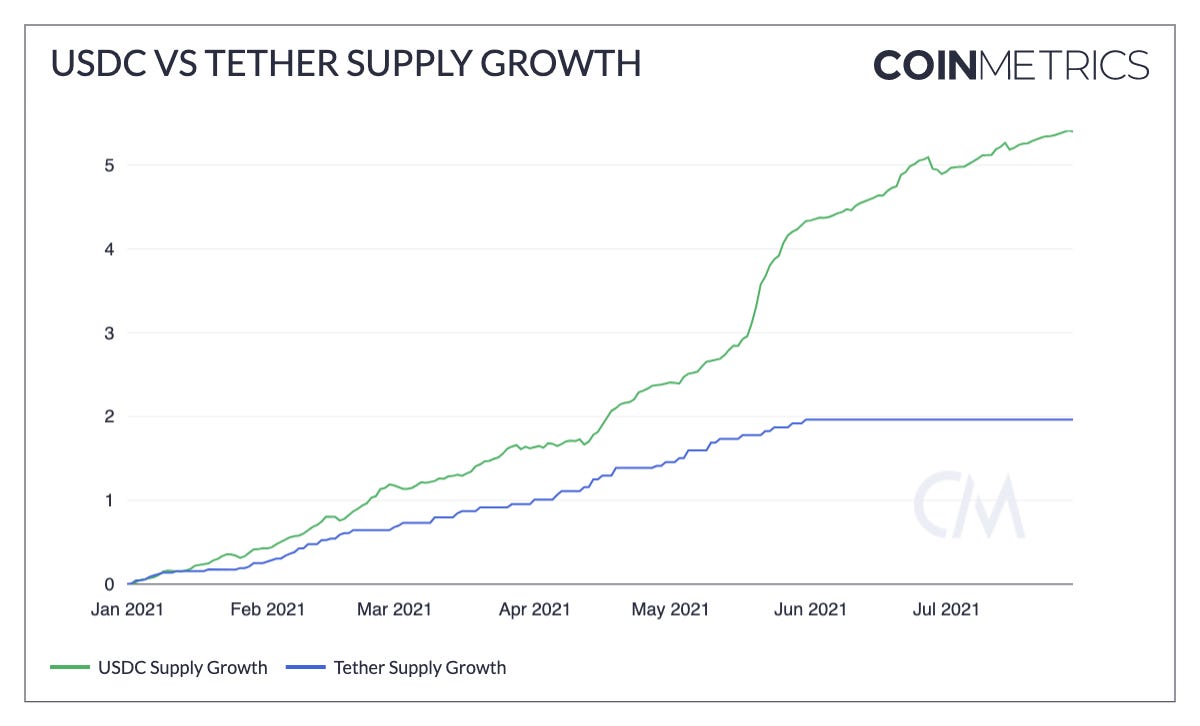

Chart of the Week: USDC surges ahead of USDT

Tether is still the largest stablecoin - $64bn in circulating supply to USDC’s $27.6bn - but as this chart from Coin Metric’s latest State of the Network shows, USDC’s growth has outpaced USDT for the entirety of 2021. The piece speculates on decreased activity from the China mining crackdown, but the lack of new issuance over the last two months is extremely fishy. Is Tether doing this to earn good faith with regulators or as a directive? USDC, meanwhile, continues to grow and will likely maintain its lead over BUSD as long as it lacks a mass retail on-ramp like Coinbase.

Odds and Ends

DXdao* Month in Review Link

Paxos proposes a new PAX PSM to MakerDAO Link

Compound lists MKR, AAVE, SUSHI and YFI Link

Curve approves new members for ‘Emergency DAO’ away from core team Link

dYdX announces governance token Link

Former Maker team raises $5.2m for fixed-rate protocol, led by Dragonfly Link

Barn Bridge’s BOND token fails Aave governance vote Link

Thoughts and Prognostications

RAI is a stablecoin (thanks to price arbitrageurs) [Ameen Soleimani/Reflexer Labs]

Dai on different networks [Alec/MakerDAO forum]

Q2 DeFi report [Consensys]

Data Wars: pricing data for DeFi [Patrick McNab/Bankless]

Treasury management in the age of DeFi [Joel John/Decentralised.co]

That’s it! Feedback appreciated. Just hit reply. Written in an oddly cool Brooklyn.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.