Note: I’m speaking at Liquidity 2020 this Sunday night 10pm ET on “Reputation-based Governance systems in DeFi”. Free to attend. Get ticket here.

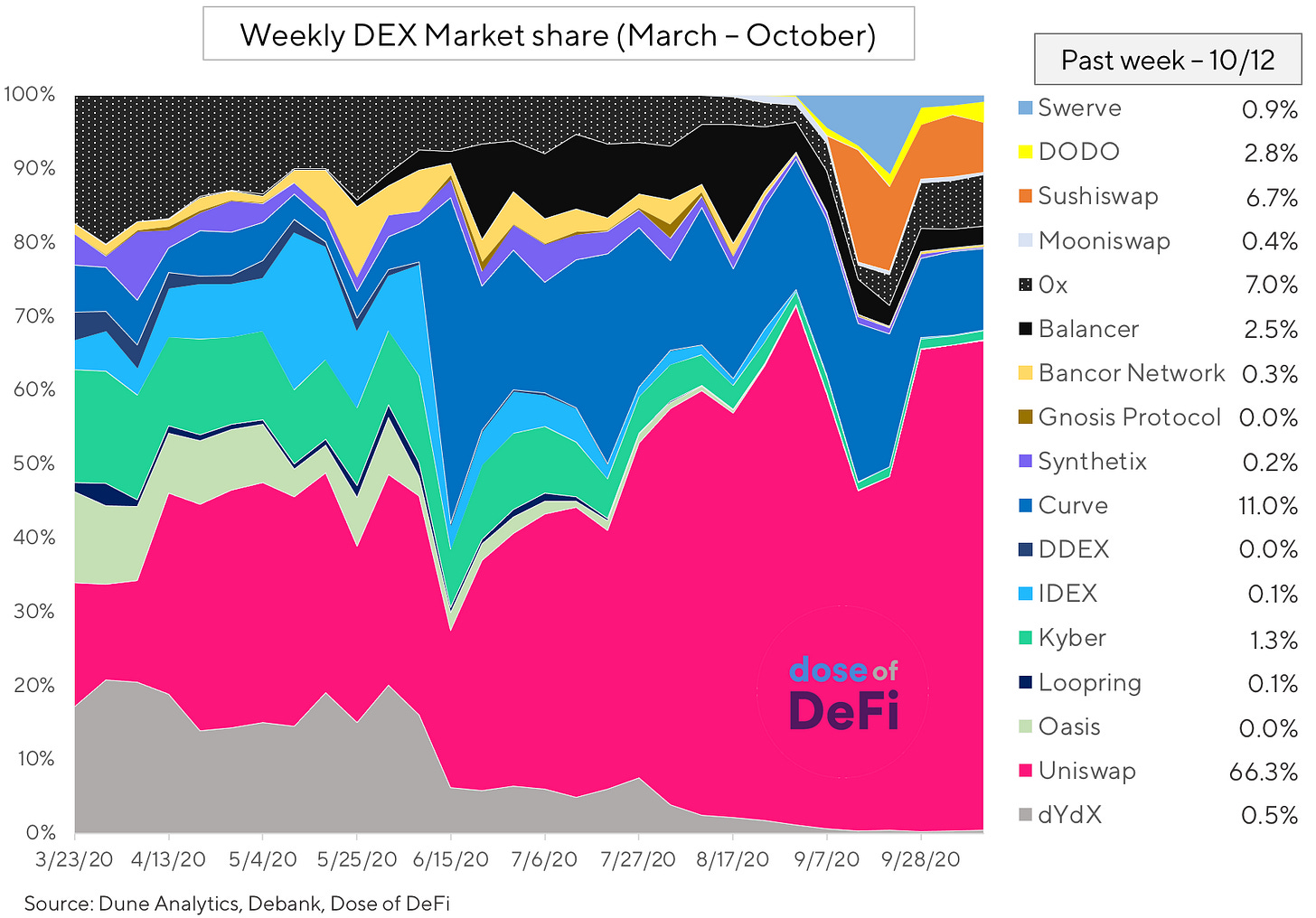

In September, Uniswap overtook Coinbase with a staggering $15.4bn in monthly volume - a 100x increase since April. Uniswap has risen to the top of a crowded DEX field and now commands a healthy 60%+ marketshare.

Decentralized exchanges (DEXs) are no longer a fun experiment. Ethereum DEXs were responsible for $1.2bn of fees in the past 30 days, according to Token Terminal. New entrants are clamoring for a slice of the market; most offering higher throughput or more capital efficiency for liquidity providers.

The last 6 months offer insight into how the market will develop. Some observations below.

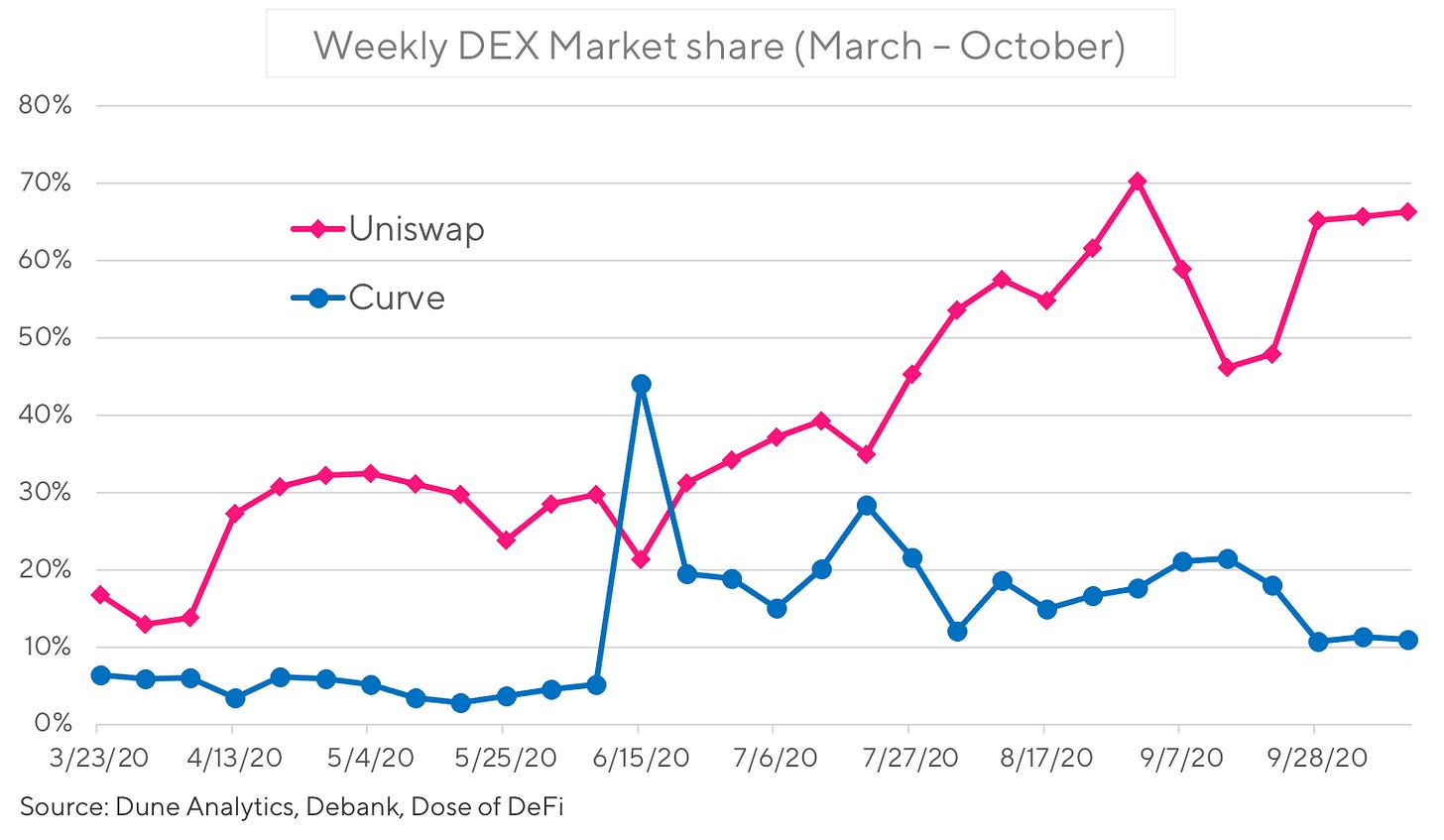

Uniswap and Curve emerge as industry leaders

Obviously, the biggest story is the runaway success of Uniswap. The launch of UNI helped, but Uniswap’s volume and liquidity were already growing. Curve, meanwhile, is the only other DEX that increased market share over the last 6 months. It already offers a product that beats most centralized options and competes favorably with Uniswap because it utilizes an algorithm specialized for stable assets.

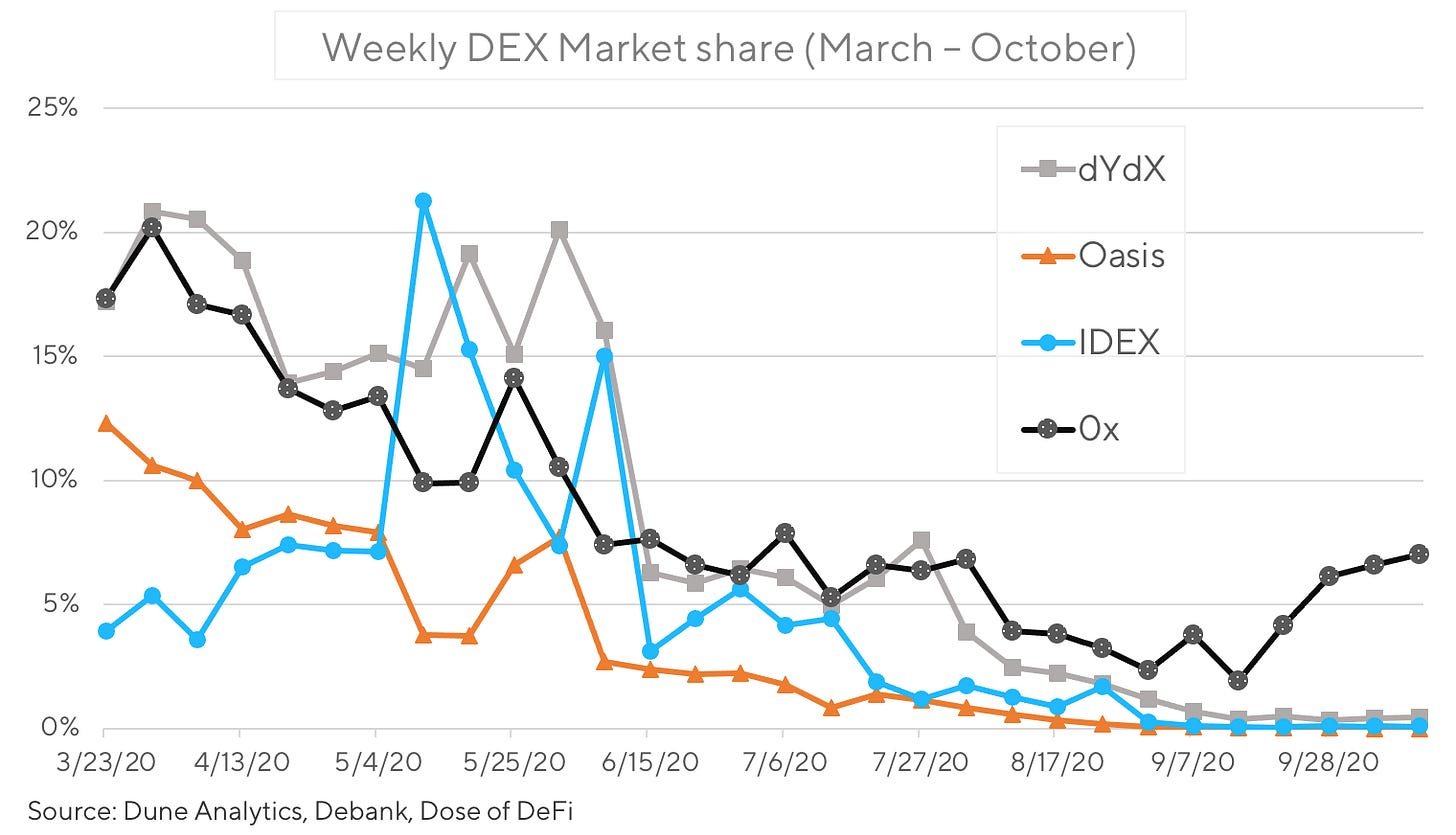

The decline of order-book DEXs

Traditional order-book DEXs worked as a proof of concept on Ethereum 1.0, but it’s not clear they are competitive. dYdX, Maker’s Oasis, IDEX and 0x all saw significant market declines as traders preferred the ease of AMMs. L2 Scaling solutions should address speed, tx cost and privacy concerns. dYdX launched a BTC-USDC perpetual contract with 10x leverage, but it hasn’t caught on and users seem to prefer an unbundled margin trading experience. It has partnered with Starkware on Layer 2, while IDEX plans to roll out IDEX 2.0 next week.

0x struggled for most of the summer but has rebounded over the last month, posting a 7% market share over the last week, thanks to the success of its aggregator Matcha and Tokenlon, a relayer integrated with imToken. It’s not clear what’s in store for Oasis.

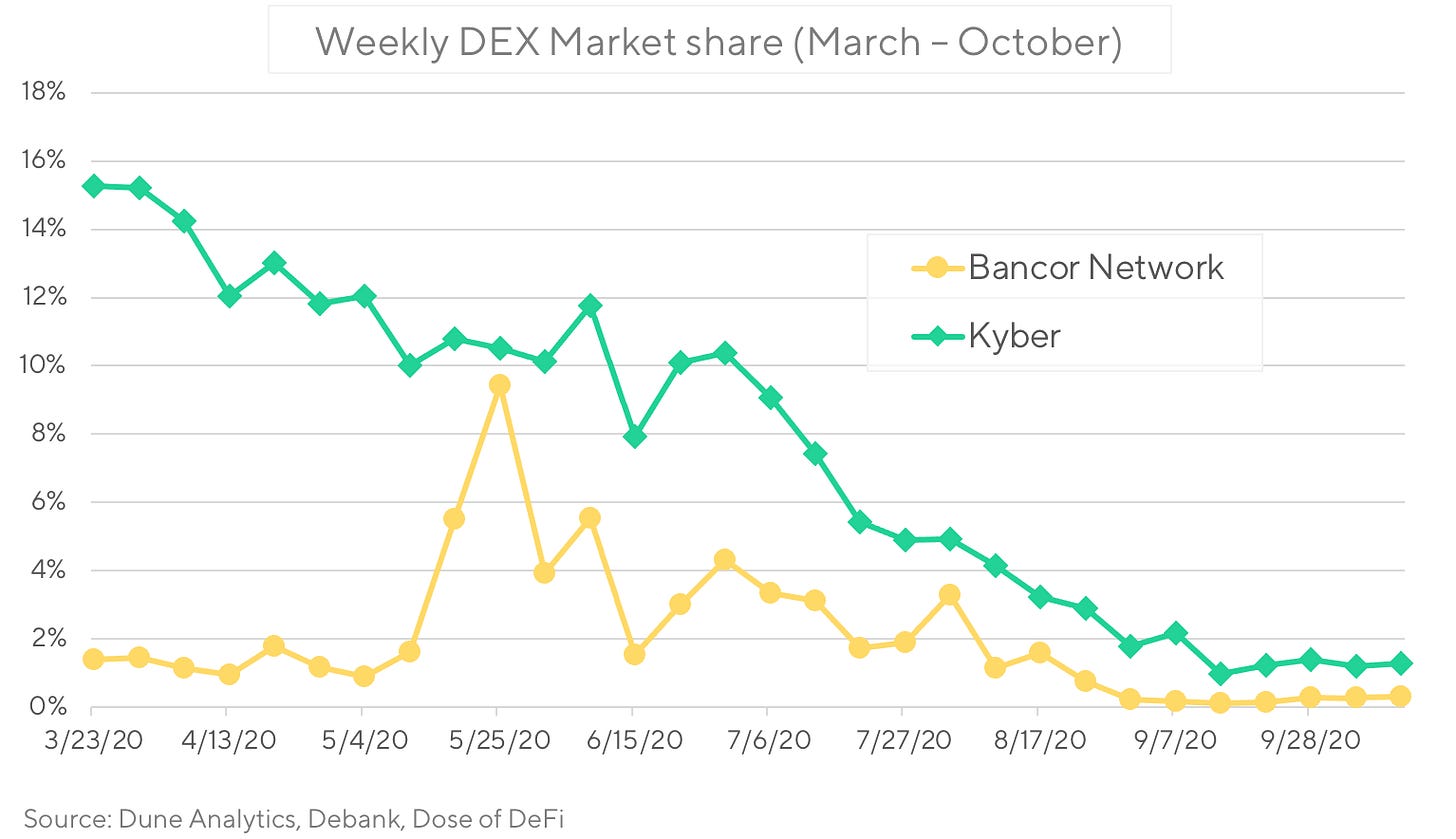

Kyber and Bancor fall because of high gas costs

Kyber and Bancor were precursors to Uniswap and pioneered the on-chain liquidity model. Their architectures are not fine-tuned for a 100 GWEI world and have lost out to Uniswap. Both projects are looking to turn things around. Kyber founder Loi Luu explained their approach in a blog post last week, focusing on lower gas costs and targeting professional market makers. Bancor, meanwhile, unveiled an ambitious overhaul today. Bancor v2.1 features “single-sided exposure & impermanent loss protection to AMM pools via elastic BNT supply.”

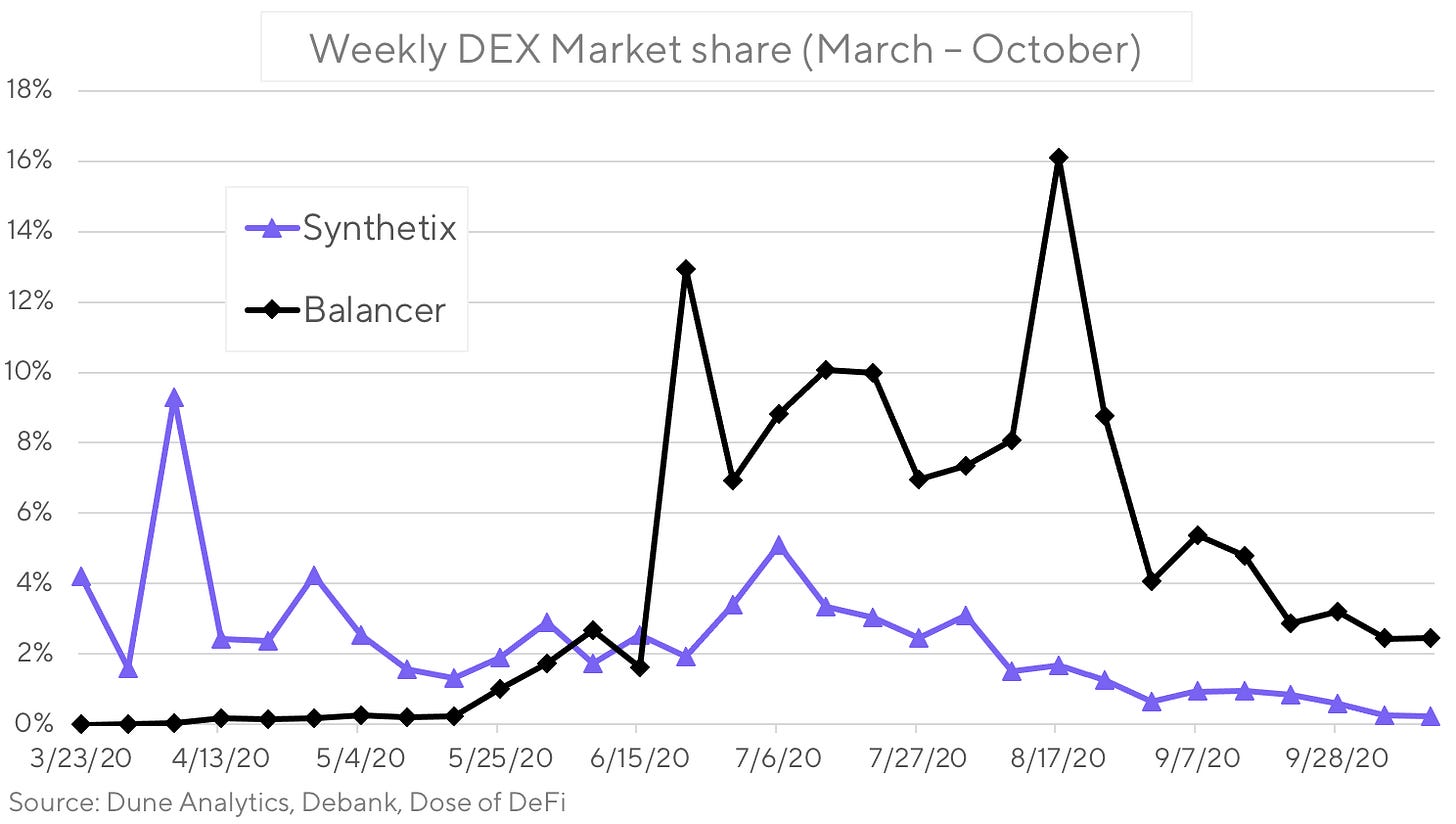

Balancer and Synthetix face identity crises

SNX, Synthetix’s token, has had a very good 6 months - up over 600%, but that has not been because of more volume on the Synthetix Exchange. Is Synthetix a decentralized exchange or a synthetic issuance platform? Balancer’s launch and liquidity mining campaign drove deposits and trade volume followed. Over the last 6 weeks, however, volume has plummeted. Balancer pools are more appealing to liquidity providers of volatile assets because of higher fees and flexible asset ratios, but it does not have consistent retail flow. It’s a secondary liquidity layer to Uniswap that arb bots can access when the price on Uniswap strays far enough to justify the higher trade fees. Both Balancer and Synthetix need to figure out how to attract more flow.

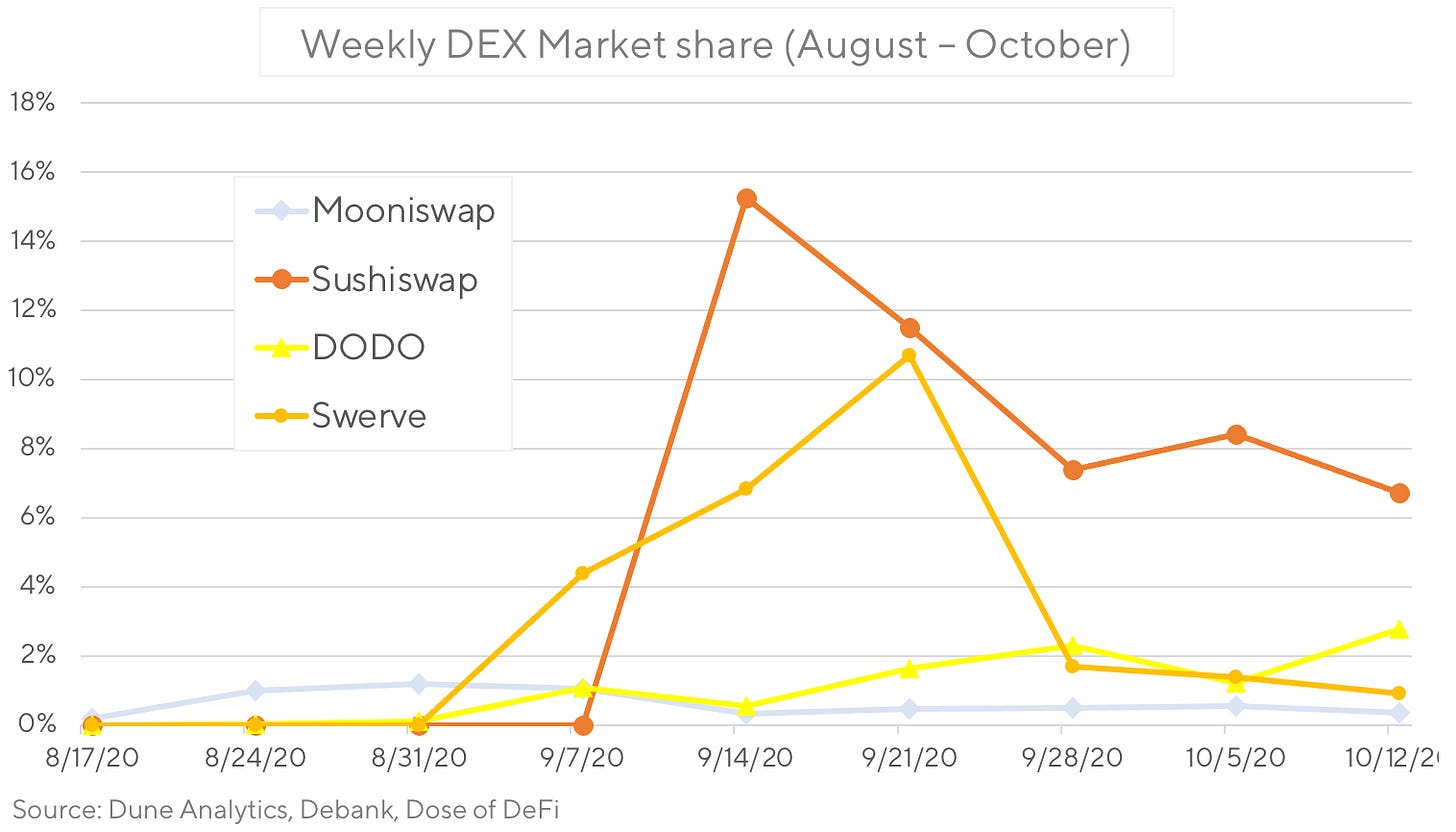

New entrants to the DEX game

Sushiswap and Swerve are forks of Uniswap and Curve that launched with a token to reward liquidity providers. Initially, this was translated into strong trade volume, but volume numbers have come back down to earth, particularly for Swerve. The token incentives are clearly a sugar high, but it’s not a bad way into a market.

DODO is DeFi’s latest darling, lining up a slew of heavy hitters in their token offering. It claims to be a '“proactive market maker” and promises to minimize impermanent loss by using an oracle to adjust the pricing curve. DODO was able to quickly realize significant volume with $325m+ traded over the last month.

Sources for Charts: Dune Analytics DEX Metrics, DeBank, Dose of DeFi

Tweet of the Week: EVM - The Security Standard?

Former Bitcoin Core developer Jeff Garzik on how the heavy usage of the Ethereum Virtual Machine (EVM) gives EVM-compatible chains a security advantage over newer, but potentially faster, Layer 1 or Layer 2 chains. Solidity and the EVM have oft been described as “developer unfriendly” and new blockchains highlight WASM, C/C++ or Rust compatibility as a core feature to expand the developer market and capability of blockchain dapps. Garzik argues, “Investors routinely underestimate the value of iterative evolution - trial-and-error over time - sunk into software, tooling, auditing software libraries & the 1,000 other elements of a software ecosystem.” Most interestingly, we can begin to see this play out now as xDai has emerged as a scaling solution, in large part because it is EVM compatible.

Odds and Ends

DXdao* month in review Link

Curve vulnerability report Link

The rise and fall of Blue Kirby Link

Bank for International Settlements research on CBDCs Link

Aave raises $25m from Blockchain Capital, Blockchain.com, others Link

DeFi Pulse and Set Labs launch $INDEX to govern financial indices Link

Thoughts and Prognostications

Liquidity Mining rewards are currently wasteful and suboptimal [Andrew Kang/Mechanism Capital]

A deep dive into YFI v2 Vault strategies [Chris.eth/Consensys]

The Optimistic Rollup Dilemma [Avihu Levy & Uri Kolodny/Starkware]

On Tax Risk in DeFi [Hasu/Derebit Insights]

How Transaction Ordering Can Save Humanity [David Hoffman/Bankless]

It’s Time to Launch the ETH2.0 Beacon Chain [Ben Edgington/Consensys]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. Lots of charts, but no chart of the week.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.