By any means necessary

Central banks enter a crisis with a limited set of tools at their disposal, but as it persists, they are forced to improvise to provide more support. Prior to 2008, the Fed's primary monetary policy lever was the Fed funds rate, but Bernanke and co. pulled on that lever early and set rates to 0.

Only as the crisis continued did the Fed look for other ways to support credit markets and bring out the bazooka with Quantitative Easing. This year, Powell exhausted the Bernanke playbook within the first weeks of the Covid-19 crisis and is now exploring more direct buying of corporate bonds, not to mention providing a backstop for a bunch of loans extended by Treasury.

MakerDAO is encountering its first major liquidity crisis, stemming from the event of Black Thursday on March 12, with Dai trading at a 1-5% premium.

In the immediate days after, the Maker community decided to onboard USDC as collateral, which helped bring the Dai price down, but more importantly, injected additional liquidity for the MKR flop auction to recapitalize the Maker system after the losses from 0 Dai bid collateral auctions on Black Thursday.

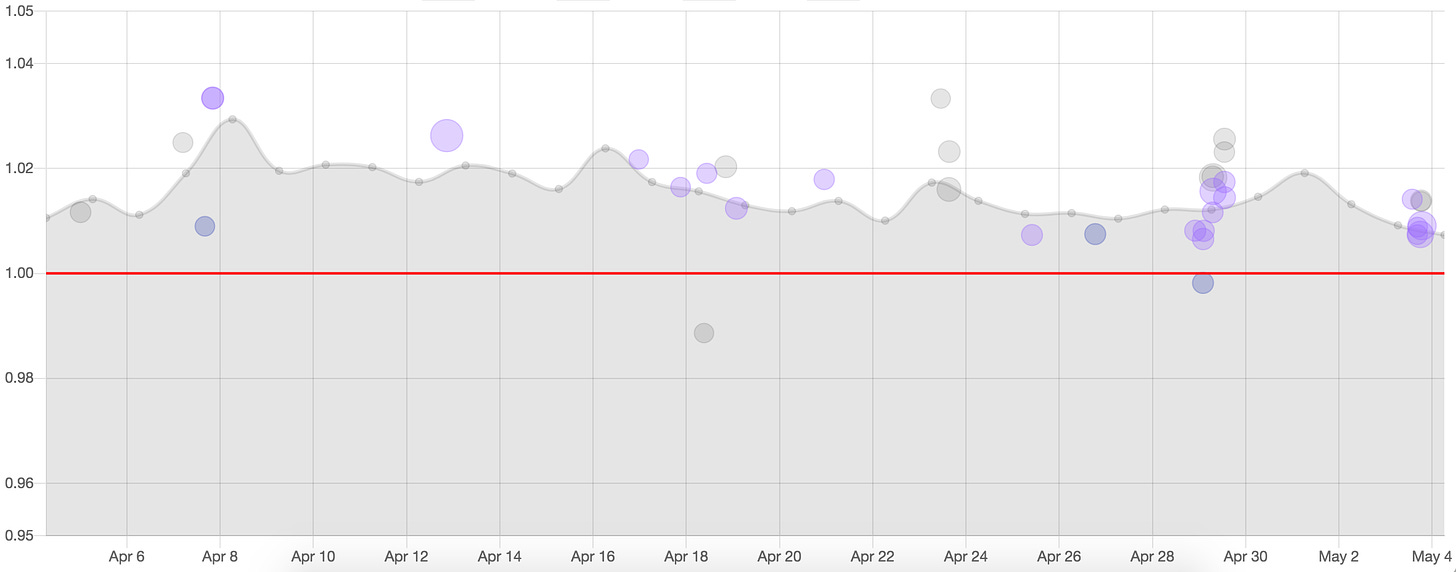

But still Dai traded at a premium for all of April:

Chart from daipeg.com, using the invaluable data from dai.stablecoin.science.

Over the last few weeks, one could argue that Dai has been stable, trading at $1.015, but parity with the US Dollar is more important to Maker’s expansion plans for Dai than stability. The community – also known as large MKR holders – wanted more action. And last week, MakerDAO moved forward with two new tools to help restore the peg:

Add WBTC as collateral

Lower the USDC stability fee from 6% to 0%

The addition of USDC as collateral was supposed to be a panacea because it “closed” arbitrage cycles and gave access to real dollars.

Hasu wrote about the problem of arbitraging Dai in January 2019:

When market demand pushes the price of DAI to $1.02, you can again take $1.00 USD, buy $1.00 ETH (or any other asset that can be used as collateral) and lock it in a CDP. The problem, however, is that for each $1.00 ETH locked up, Maker will give you less than $1 of Dai. That is due to the requirement for over-collateralization. The current collateralization ratio is 150%, so $1.00 ETH in a CDP can generate up to 0.66 Dai (this ratio could change, but it’s never going to be close to 100%).

Now you can certainly sell the 0.66 Dai at the same 2% premium, but you still have the original ETH locked up. The fundamental difference between “arbing” Tether and “arbing” Dai is that with Dai you also need to look for a profitable way to exit the collateralized debt position at a later date. And it’s only going to be profitable if you manage to buy back the Dai for less than you sold it for.

With the addition of USDC as collateral in Mid-March, arbitrageurs no longer need to purchase ETH to get Dai to sell, but it remains capital inefficient as the 120% collateralization rate prevents you from minting as much Dai as you deposit USDC.

That means you are forced to take on Dai debt and must wait until the peg returns to parity to pay it back to realize profits. When USDC was first added, it came with a 20% stability fee and then MKR holders lowered it to 6% before slashing rates to 0 with the latest executive vote over the weekend.

With 0% interest rates, Maker has slashed the financing costs of arbing real USD into their system. Traders just need to hold Dai debt, cross their fingers and wait for the peg to return.

The other big move was the addition of WBTC as collateral, which launched on May 4 with a 1% stability fee and a 150% collateralization ratio. I discussed the implications of WBTC as collateral last week, and although the inclusion has felt inevitable, there was strong pushback to the acceptance of a “centralized custodian” in the Maker ecosystem.

Bitcoin has always been apart of Maker’s growth roadmap, especially given the huge market for Bitcoin-backed loans, but the choice of WBTC as the BTC synthetic of choice is because Dai’s drifting peg forced Maker to act now and WBTC is the only option with close to enough liquidity.

89% ETH

There has not been a flood of WBTC into Maker. As of writing, $76,000 Dai has been minted using WBTC, compared to $433k from BAT, $11.8m from USDC and the remaining $99m from ETH collateral (all from daistats.com). You can now safely call it “Multi-Collateral” Dai.

The question is how much the pushback from the community will matter, and whether other Ethereum-based BTC loans can overcome Maker/WBTC’s head start. The measures have helped (a little); as of writing, Dai is trading at $1.007 on dYdX and Coinbase Pro.

UMA and Bootstrapping Liquidity

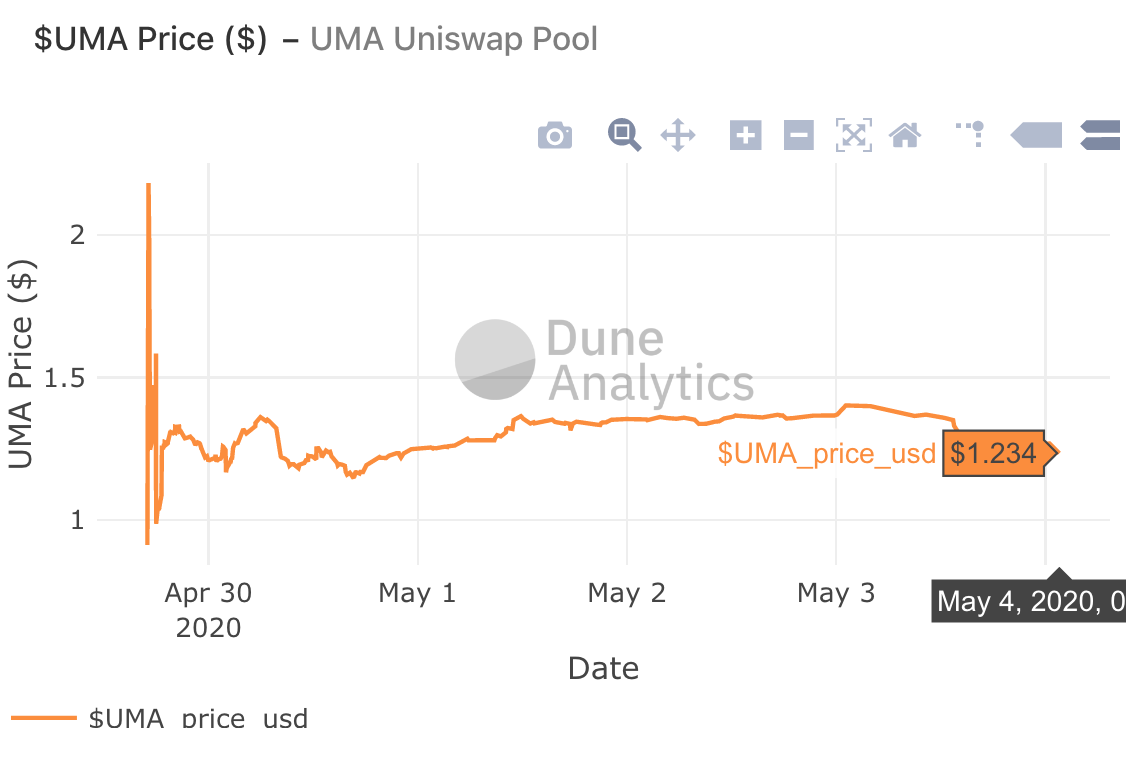

UMA’s initial Uniswap listing gave flashbacks to 2017 ICO craze. With all the lending and trading development in DeFi, lest we forget how innovative new capital formation tools – like the ICO – can be.

The sale did not yield immediate widespread distribution; only 291 addresses hold UMA tokens. In terms of price, the listing was a success. The token was listed at $0.26 but the first buys sent the price to over $2.00 before settling in the $1.25 range now, or 5x their listing price.

There was also some controversy on access to the listing. Yes, Uniswap is an open platform, but the initial seed round token price was only available to sophisticated traders with lots of capital. Gnosis’s Martin Köppelmann had the best Twitter thread explainer of the dynamics of using an automated market maker (AMM) for a token auction and Reuben Bramanathan had another good one with key takeaways.

The Uniswap listing was cheaper than using an orderbook exchange and a market maker, but it still requires a good chunk of ETH – UMA needed to put more than $500k into the pool to list 2% of its tokens.

Some suggested that a listing could be done more efficiently on Balancer, pointing to a post last month by its co-founder Mike McDonald about “Bootstrapping Liquidity Pools”. Whereas in Uniswap, pools must be 50/50 in the listing token and ETH (or another token in Uniswap v2), Balancer pools can have any preset allocation of two or more tokens that it automatically rebalances to.

A team could set an initial price with a weight of 20% ETH 80% new token, which would be more capital efficient, and then set the rates of the Balancer pool to change over time, in order to slowly build liquidity. McDonald says that projects can define the token weights with an exponential curve that adjusts the weights down after launch, which “drops the value of the token in the pool [and] discourages an eventual price spike due to early speculation.”

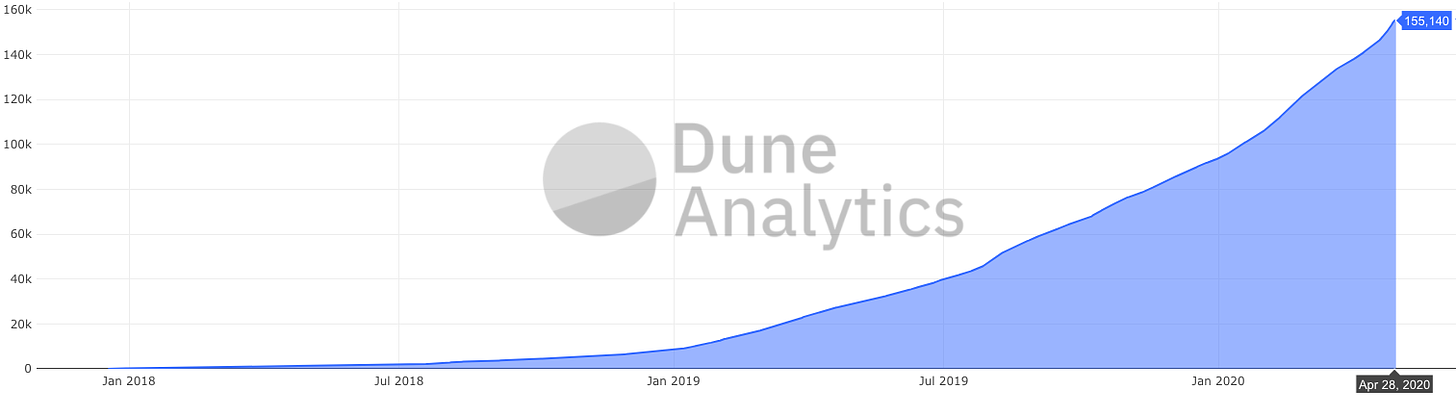

Chart of the week: DeFi users

Another Dune chart, this one is part of a post from 1confirmation’s Richard Chen into how many DeFi users there are - 150,000 according to the analysis. The post is a reminder that TVL is heavily skewed towards lending platforms. Outside of Dai holders, Uniswap and Kyber have the highest number of users, boasting more than 50k each. And while there has been strong growth over the last year, the market is still tiny. All charts will update on the Dune Analytics page.

Tweet of the Week:

Keeping it spicy. Despite previously giving a Shermanesque statement that Compound would never launch its own stablecoin, Compound Founder Robert Leshner opens the door just a little bit to the idea, as long as the community leads it. It’s not that surprising with stablecoins passing $10bn in circulation last month and DeFi’s most celebrated stablecoin off the peg with a tough PR week.

Odds and Ends

Bancor announces v2, integration with Chain link, Q2 launch Link

DeFiZap and DeFiSnap combine to form Zapper Link

SAFG aims to be new framework for investing in DeFi protocols Link

Instadapp launches DeFi Smart Accounts Link

Liquity is a new borrowing pool with 110% collateralization ratio Link

Buidling with Opyn options Link

DeFi Italy team launches Synthetix portfolio tracker Link

Layer 2 DEX Loopring April update Link

Thoughts and Prognostications

Examining the World of Crypto Dollar Yields [The Integral/dYdX]

Kyber Activity Surges as DEX Plans Switch to Staking [Coindesk]

COVID19 and the Decentralization of Money [Albert Wenger/USV]

Bitcoin and Tether on DeFi [Dose of DeFi/January 8]

Insights and analysis from the 10,000 largest Ethereum wallets [Adam Cochran/MetaCartel Ventures]

Binary Options Primer [Synthetix]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn (again), where the past two days have been top 10 weather days of the year. Don’t forget to subscribe to Govern This.

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.