Retail savings accounts were the smart money’s bet as to what could lead to a 10x growth in DeFi activity. Of course, that prophecy has failed to come true.

Building mass market products is hard and expensive, and DeFi interest rates have returned to earth and are only marginally higher than the traditional world. “New” users to DeFi have not come yet.

Instead, the most promising DeFi strategies in 2020 are targeting large, existing crypto traders and investors. The past week has seen four major developments that could further open up the DeFi institutional space, namely

Growth of WBTC in Maker

The rise of Layer 2 DEXs

dYdX’s BTC-USDC perpetual swap

UMA’s ETHBTC priceless synthetic token.

WBTC now backs 8% of all Dai

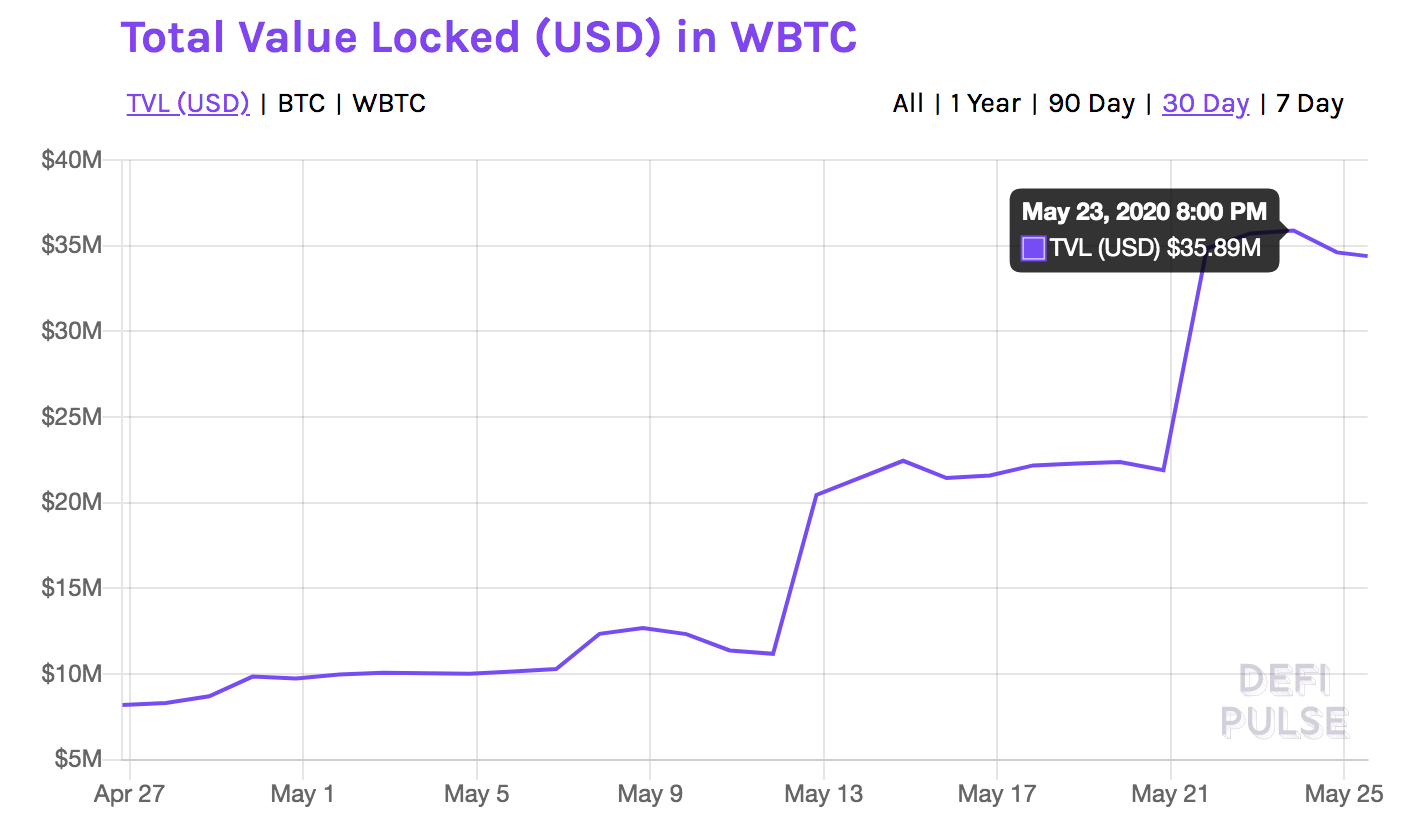

In just two weeks, the total amount of BTC locked in WBTC has tripled to 3,800 BTC or $35m. CoinList’s addition of WBTC certainly helped, but the real catalyst for the growth was the addition of WBTC as collateral in MakerDAO – over 68% of all WBTC is now locked in Maker.

The size of the BTC market dwarfs DeFi and the growth of WBTC seems to be from a few large, longtime BTC holders. The 1000 WBTC mint on May 11 was likely from crypto lender, Nexo Finance, which then proceeded to lock WBTC and mint Dai. Why? Alex Svanevik explains:

Currently Nexo charges (at least) 5.9% APR in interests on a loan from their platform. But the fee to borrow DAI against WBTC on Maker is only 1%. In other words, they could pocket a marginal spread of at least 4.9% by lending out the DAI. Alternatively, they could sell the DAI and then lend out USD for it instead — trusting that the DAI peg will hold.

The appeal to Nexo and any other BTC holder is clear. BTC-backed loans are big business and Maker is expanding the DeFi lending addressable market. It doesn’t appear to be slowing down:

This 4 million Dai mint also appears to be Nexo Finance. Maker is now approaching its $10m debt ceiling for WBTC. Rune’s last point show’s the versatility of DeFi, but there will need to be more varied products and services.

Layer 2 DEXs offer a new growth area

Almost all of the major developments so far in the DeFi DEX space have revolved around liquidity pools. Kyber and Uniswap (along with Bancor) pioneered the automated market maker (AMM) space, while the other big development of the DEX space over the last year has been the rise of DEX aggregators, like 1inch, DEX.AG or 0x’s Liquidity API.

Rising gas prices and more sophisticated traders are pushing more investors to Layer 2 solutions, which are finally exiting the theoretical phase. IDEX and Synthetix have unveiled Layer 2 demos, while Loopring is live on Ethereum mainnet and benefiting from frustrations over high gas prices.

Layer 2 sacrifices composability for transaction speed, so while there may be growth in DEX volume, it may not have DeFi spillover effects like liquidity. In fact, they may resemble centralized exchanges:

The good news for DeFi is this would represent a new growth segment: sophisticated traders.

dYdX’s BTC-USDC perpetual

dYdX managed to grow over the last year even though it employed a traditional order book, because it focused on margin trading, a limited number of trade pairs and was conducive to professional traders, allowing free cancelled orders and covering the cost of gas.

Bitmex’s perpetual swap is the most popular product in crypto, so the launch of dYdX’s BTC-USDC perpetual is big news for DeFi. It saw more than $10m on a single day and has done almost $25m in volume since launch. It has also significantly increased its average trade size:

ht - Brock Elmore and Our Network

Two additional thoughts:

USDC – USDT (Tether) has seen market cap explode in 2020, but it is also integrating itself directly into financial products. Increasingly, BTC futures are being quoted and settled in USDT. A USDC option should be a welcome diversification by the market, and good news for USDC, which has grown slower in 2020 compared to other stablecoins.

Funding rate – Perpetual swaps have no expiry date, but need to keep rebalancing the overall position of the platform. So it will pay shorts if it is heavily long and vice versa. The funding rate (currently 0.022%) pays out every 8 hours, so if it’s positive shorts get paid that percentage of their position, while longs get compensated if its negative. This is a new product in DeFi and could attract additional flows for those wanting to get paid to be short or long Bitcoin. It also could spawn other money legos that plug into the dYdX perpetual.

UMA’s ETHBTC token

UMA released its first product last week: a synthetic token that tracks the ETH/BTC price. Unlike the perpetual contract, this does have an expiry of August 1.

As UMA’s name (Universal Market Access) indicates, synthetic tokens like ETHBTC will be retail oriented products, but they need large investors on both sides of the trade to collateralize the product (at least for now). UMA’s synthetic tokens need a long and a short; investors can enjoy a premium by collateralizing & minting new synthetic tokens and then selling them.

Like dYdX’s perpetual contract funding rate and WBTC-backed loans on Maker, UMA can grow by attracting and incentivizing investors with existing positions that can be more capital efficient in a DeFi-enabled world.

Chart of the Week: DEX market share

Well-done chart from the newly launched Formal Verification newsletter. Uniswap is the clear leader, but the space is still in flux. Curve’s growth demonstrates that innovative designs can work for specific assets. Kyber has had consistent volume but it does not appear to have done better than the industry March - May. Smaller traders may have been turned off by high gas prices.

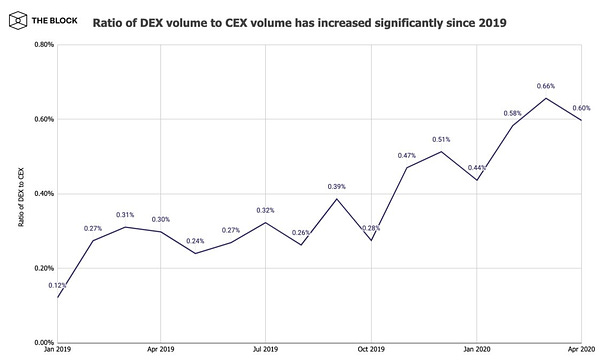

Tweet of the Week: DEX market share of CEX

It’s small, but growing. Not a lot more to add. It should be noted that volumes on centralized exchanges were nearing all-time highs in March/April, so the growth of DEXs during that period is especially strong.

Odds and Ends

All 118 projects of ETHGlobal’s HackMoney Showcase Link

Ponzis and marketing schemes are ETH’s biggest gas guzzlers Link

RenBTC quietly goes live on Ethereum mainnet Link

How Dai became a favorite in Latin America Link

tBTC: Details on May 18 pause Link Update on tBTC launch Link

Synthetix finishes trial for Ether as collateral Link

Maker raises USDC stability fee to 0.75% Link

Thoughts and Prognostications

The Extreme Effectiveness of Memes in Crypto [Degen Spartan/My Two Gwei]

Hegic Options shut down because of a fundamental design flaw [Andrew Kang]

Proof of Liquidity [Joel Monegro/placeholder]

Maker’s MIP Process Explained [Chris Powers/Govern This]

Why Kyber Network Tokens Tripled to $100M Despite Covid [Coindesk]

3 Things DeFi should learn from the Financial Crisis [Nemil Dalal/Bankless]

That’s it! Feedback appreciated. Just hit reply. Happy Memorial Day! Written in Brooklyn (again). Don’t forget to subscribe to Govern This. Time for euchre?

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.