Composability is often cited as the secret sauce of DeFi. Financial “money legos” enable products and services to interlock permissionlessly, which expands the innovation vector outside of a siloed company.

Pooltogether, a no-loss DeFi lottery, built a fun savings product that pools deposits and gives the interest accrued on the pool to a lucky winner every week. Pooltogether didn’t need to build much; it relied heavily on Compound and Dai - and didn’t need their permission.

Composability is DeFi gospel. Entrepreneurs don’t need to build things that already exist, but only use existing products to make something new. So far, tokens and smart contract calls are the best examples of DeFi composability, but the last few months shows the composability of the DeFi user.

Just as new entrepreneurs can build on top of Aave, Synthetix or Uniswap, they can also build for the Aave, Synthetix or Uniswap user.

Community Piggyback

We’ll get to sushi later, but one of the best examples of a new project piggybacking off an existing project’s community is YAM. YAMs launched with no pre-mine and distributed new YAM tokens to anyone that staked tokens in their contracts, but not just any token. YAM selected 8 tokens that qualified for the deposit-for-YAMs game.

One might think it’s best to accept any asset to grow your TVL, but targeting specific tokens makes the initial launch rewards very appealing to those communities and token holders.

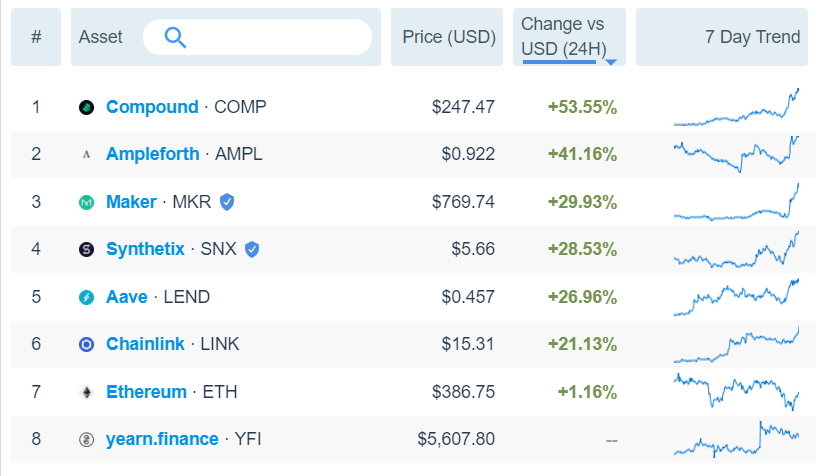

For the uninitiated without YAMs or one of the 8 tokens needed to stake, acquiring these tokens becomes part of the game itself. So soon after YAMs launched, any token that could be deposited to earn YAMs skyrocketed, as you can see from this Messari screener:

Compound was arguably the first to do this, albeit accidentally when ZRX and BAT mooned because they were the most optimal crops to farm COMP. YAM, meanwhile, was not going after tokens, but the communities behind them.

YAM was essentially Compound governance with Synthetix staking and Ampleforth’s rebasing, so it makes sense to target those token holders.

Of course, it’s a symbiotic relationship (at least at first). New entrants in the game need to purchase tokens to play, which makes the token holders of the targeted assets happy as the price increases to the new demand.

Token designs need to defend against exponential demand, as Maker learned, when Dai demand spiked as it became the crop of choice on Compound. It still trades at a premium to its $1.00 peg.

Targeting liquidity providers, rather than token holders

While YAM went after token holders, increasingly projects are targeting liquidity providers to play degen distribution games. Deposited tokens sit idly, while deposited LP tokens continue to earn interest. Synthetix, of course, has had incentives for liquidity providers for more than a year, but those only target their own products.

$BASED was the first (I think) to target existing LPs as distribution mechanism for a new token. Players could stake Curve $sUSDv2 LP tokens for initial $BASED distribution. Clearly, BASED designers knew their target audience.

The sUSD pool is full of SNX spartans, who some might call the degen-est token community, but 80% of SNX is already staked in Synthetix, so BASED instead targeted a popular LP token of the community to bootstrap a userbase. It had the same (good?) fortune as Maker & Dai as sUSD traded up to $1.10 after $BASED rewards started.

Sushi Time

Ok, now to finally talk about SushiSwap, an un-launched Uniswap fork that started its token distribution campaign last week with YAM-like staking interface but for targeted Uniswap LP tokens instead of the underlying token. SushiSwap is targeting two overlapping groups:

Token communities - SNX, LINK, UMA, COMP, YFI amongst others

Uniswap Liquidity Providers (LPs)

After sushi began distribution, the targeted tokens increased in price. Some (UMA) went up by A LOT, but the price action was likely diminished because the targeted tokens are still on the market in the Uniswap pools, as opposed to locked up in staking contracts.

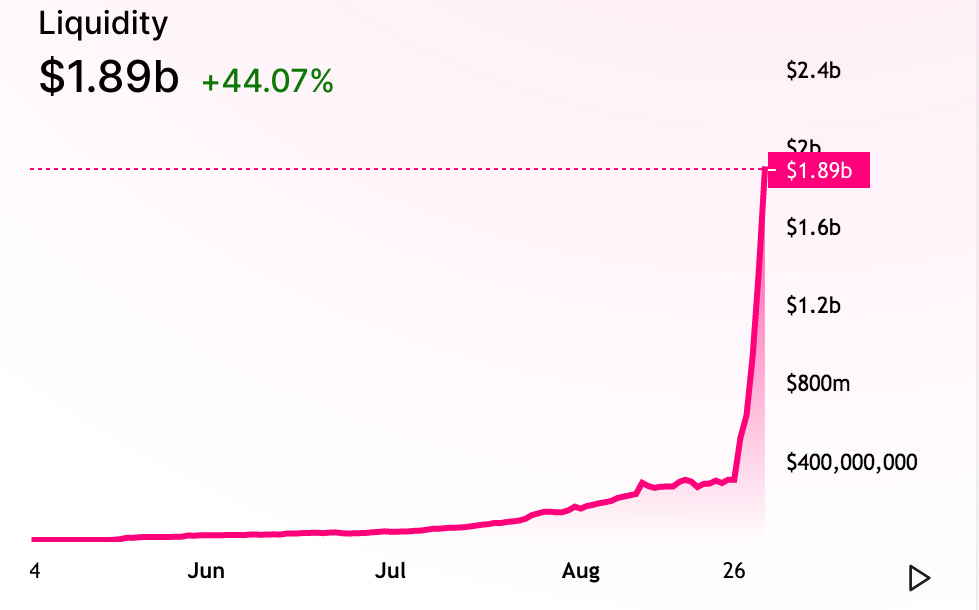

Just as YAM increased demand for the tokens needed to play its distribution game, Sushi increased demand for Uniswap LP tokens, driving deposits into specific Uniswap pools, leading to an explosion of Uniswap’s liquidity.

The underlying liquidity is in Uniswap, but custody of upwards of 80% of the LP tokens are in the SushiSwap staking contract. SushiSwap hopes to migrate the liquidity over to SushiSwap once it launches. Presumably, some of the staked LP tokens will leave once rewards die down and the migration process may have unintended consequences on asset prices if LP tokens need to be liquidated before migrating.

LPs ≠ traders

Sushi has been all over Crypto Twitter with endless hot takes on the implications of popular, yet forkable protocols. The speed at which SushiSwap’s TVL has grown shows how fickle liquidity can be, but liquidity is a trailing indicator.

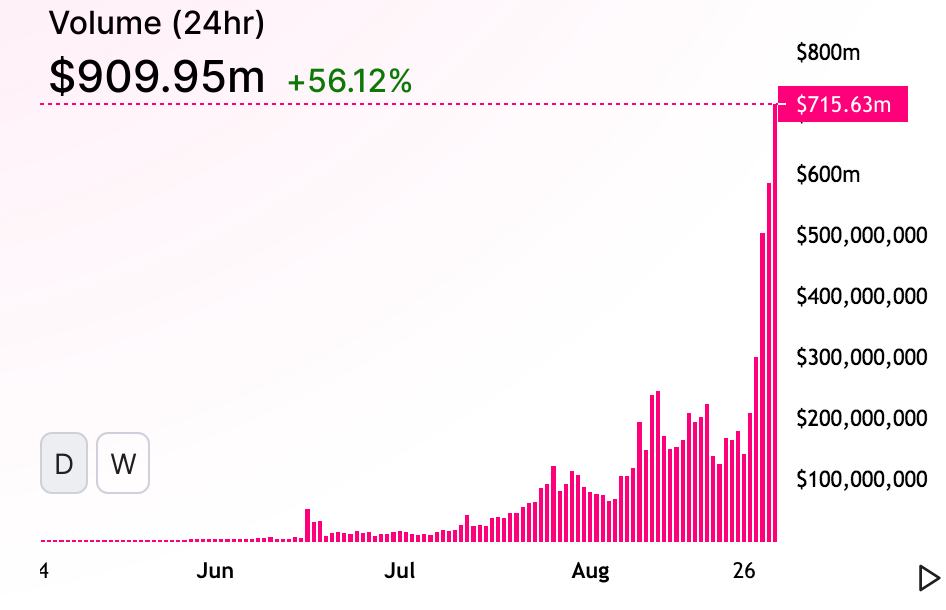

LPs follows fees, which follow trade volume and in that regard, Uniswap is still king:

That is such mind-bogglingly high volume compared to a month ago, especially with these gas prices. Most focus on the LP side of Uniswap, but - as I’ve said before - Uniswap does not get enough credit for the dead simple interface that makes it the easiest place to trade any token.

You can try to peel away LP’s with token incentives but the only way to make it stick is if a project can attract trade volume and the fees that come with it. Forking the Uniswap Protocol could attract agnostic liquidity, but it’s not clear that forking Uniswap.exchange will be as helpful. It’s the center of the DeFi (crypto?) trading universe right now, and like Binance in 2017, it’s often the first place to trade the hottest new token.

Uniswap.exchange is open source too and traders (especially aggregators) are looking for the best price, so projects could siphon market share from Uniswap, but more focus should be on appealing to traders, rather than just liquidity providers.

Note: I’m working on something related to this and will have more to share soon!

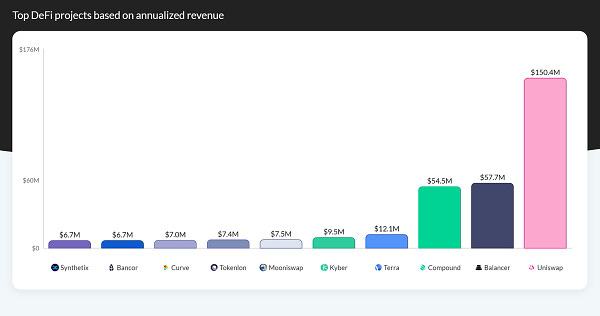

Tweet of the Week: Balancer’s slow rise

One tweet in a great thread about Balancer, who has grown considerably while everyone tries to fork Uniswap. Balancer has had one of the more successful liquidity mining campaigns, and while the adjustable portfolio weights are often seen as its killer feature, the ability to set custom fees is just as appealing to LPs. Some pools with volatile assets have high fees to compensate for impermanent loss, while UMA has launched an incentivized pool for its yUSDOct20 token with a fee of just 0.01%.

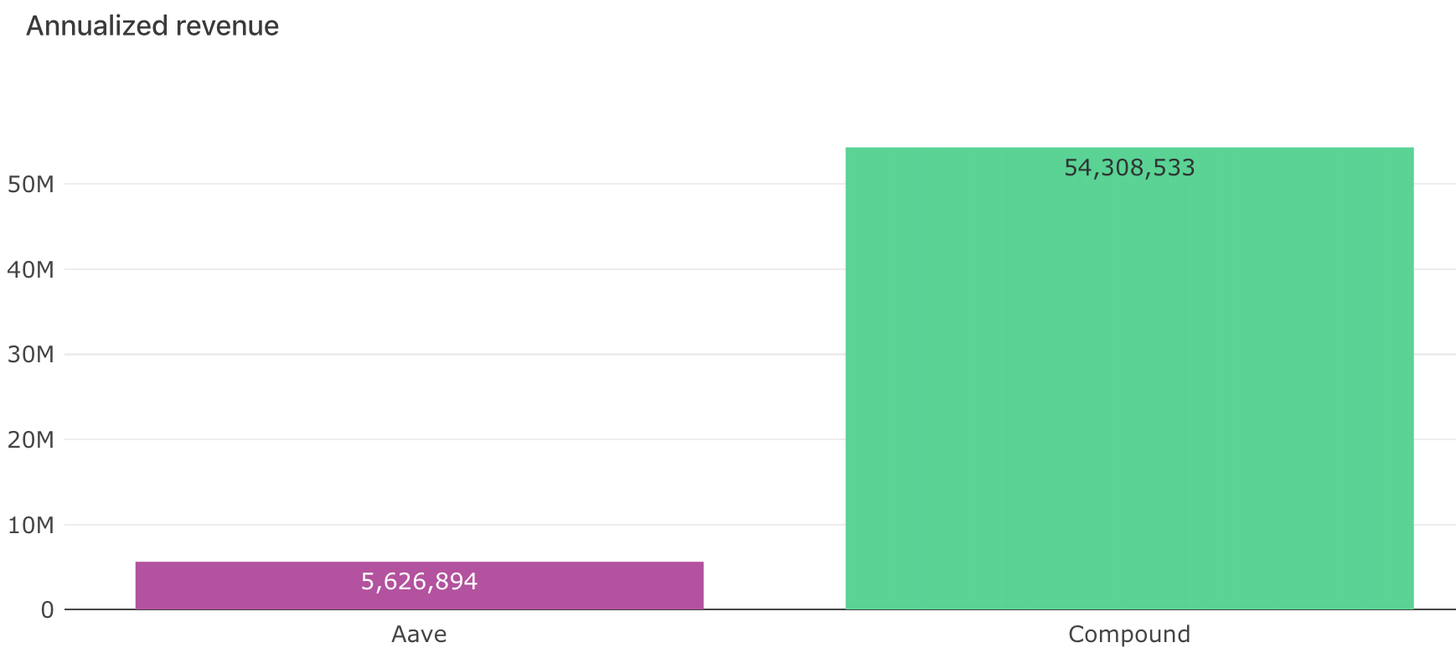

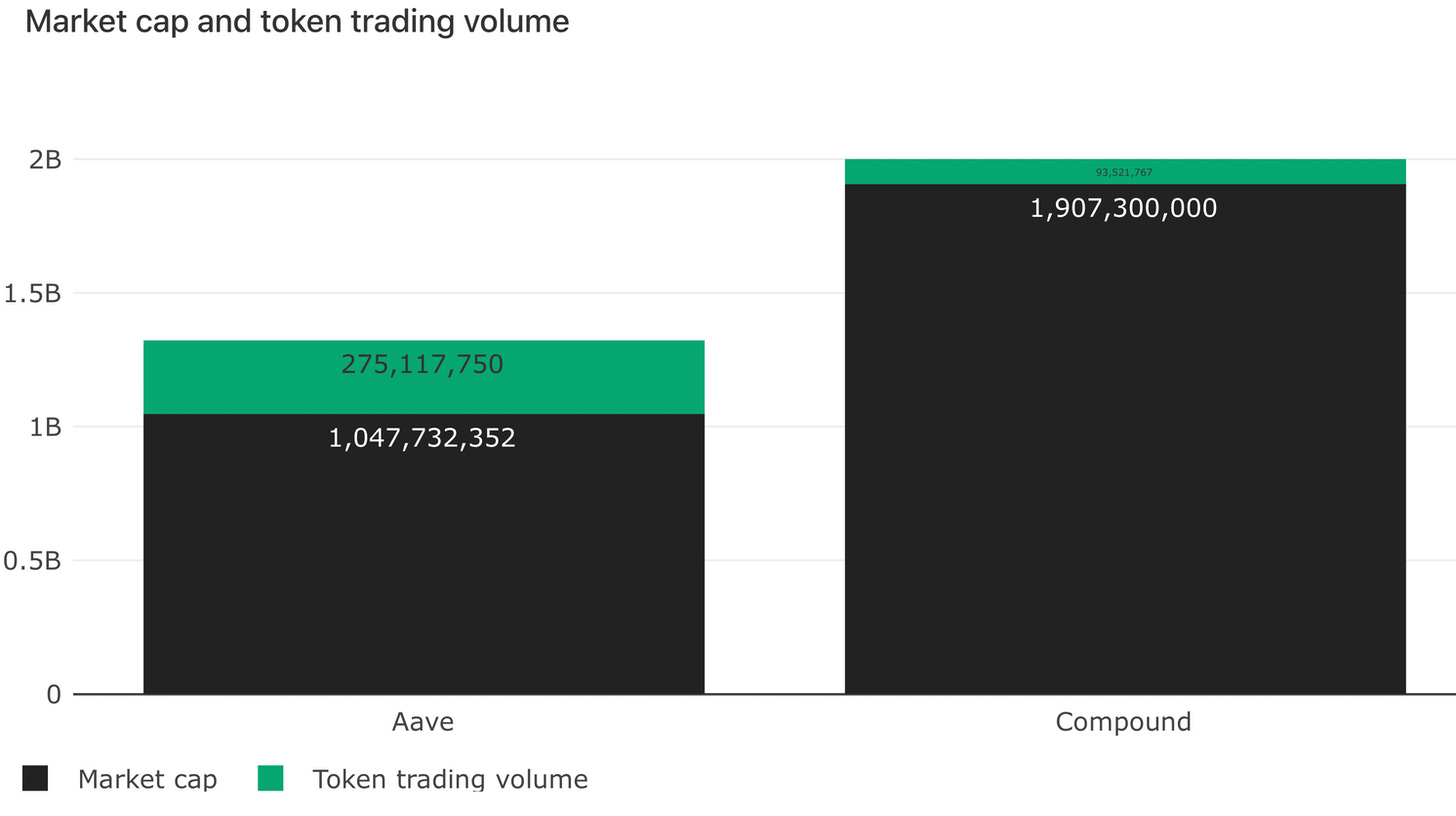

Charts of the Week: Aave and Compound

A couple of simplistic charts from Token Terminal’s Biweekly Newsletter. Revenue comparisons are hard, because like many startups, some projects are waiting to charge revenue until they grow further. The second graph highlights the difference in LEND and COMP dynamics, resulting from two different distribution strategies, a 2017 ICO (LEND) and a 2020 yield farming expedition (COMP).

Odds and Ends

SEC’s Hester Peirce comments on DeFi Link

ARC hopes to be the “MakerDAO for everything” Link

New AMM DODO announces seed round led by Framework Link

PowerPool aims to aggregate DeFi governance tokens Link

Centre announces USDC 2.0 with gasless sends Link

Uniswap introduces decentralized token lists Link

Synthetix unveils Pollux release with new features Link

The road to YAM v3 Link

Thoughts and Prognostications

Ethereum is a Dark Forest [Dan Robinson/Paradigm]

Why xDAI (STAKE) Deserves to Win the Reddit Scalability Hackathon [Ameen Soleimani]

Analysis of Crypto Governance Systems [Aaron Bartsch/MakerDAO forum]

How DeFi reinvented the Fair Launch – or did it? [Hasu/Deribit]

P0: We Need Stake Based Decentralized Scrum [Monet Supply]

Why Decentralized Trading has 10x’ed in a Few Months [Laura Shin/Haseeb Qureshi/Dan Robinson/UnChained Podcast]

A Quantitative Analysis of the Ethereum Fee Market: How Storing Gas Can Result in More Predictable Prices [Matthias Nadler/University of Basel]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, as summer takes its last breath. FYI, I don’t know of a good substitute for piggybacking. Special edition next week for Labor Day. Literally going to eat sushi right now ¯\_(ツ)_/¯

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. All content is for informational purposes and is not intended as investment advice.