Tokenomics is back (thanks to CRV)

And this season, things have changed. Inflationary incentives and locked tokens have worked for Curve; can others replicate?

All blockchains need tokens, as do all DeFi protocols (although not always at first). Tokens serve two key functions for any given blockchain/protocol:

Help a network run, be it as a fee token or as a network’s governance rights

Represent the liquid financial value of a network (there is no altruism in blockchains).

At textbook-level, tokenomics is a manifestation of both functions. It’s shorthand for the technical architecture and economic incentives that form a network or protocol. A network or protocol exists to provide some function or service, be it a censorship-resistant transfer of value like Bitcoin, or a lending protocol like MakerDAO (censorship resistance, lending etc.). Tokens enable this activity and should also benefit financially from use of a network or protocol.

Unlike blockchains, many DeFi protocols launch without a token, but eventually, one is needed to decentralize governance or bootstrap use (much like blockchains). DeFi Summer showed that tokens could incentivize DeFi activity through liquidity mining, though it quickly became clear that indiscriminate token rewards were not sustainable.

Two key tokenomics trends emerged over the last few months, first deployed by Curve:

Locking up a token for an extended period of time in return for certain financial or governance rights

Heavy reliance on token inflation, rewards issuance, and future expectations.

Curve previously pioneered a unique technical architecture for stable swaps with low-slippage, but CRV’s tokenomic design features enhanced Curve’s network appeal. High inflationary rewards and a gravitational urge to lock CRV have helped bootstrap the network and boost the value of CRV. This is a self-fulfilling prophecy; Curve has liquidity in the protocol and demand for CRV, which then makes its liquidity rewards more attractive and helps maintain its stability black hole (more on that later).

Several projects have already migrated to a CRV tokenomics model, while others have signaled intentions to do so. Will DeFi blue chips follow and how will they fare? Much of the answer will depend on whether their motivations are the same as Curve’s. And whether they’re able to accept the drawbacks.

A study of tokenomics

Theoretically, a token’s value comes from the economic value generated from a basic function or service. This is why early Bitcoin valuation models focused on fees and transaction volumes. Of course in reality, Bitcoin is not worth $37k just because of the fees generated by the Bitcoin blockchain. Instead, Bitcoin is an example of tokenomics that depends on a collective belief that it is valuable. We might also call this feature of Bitcoin a money premium, defined as when value is derived from something other than the underlying economic activity.

Tokenomics expert was a popular job title during the 2017 crypto ICO boom. These so-called experts proclaimed that applying their tokenomic designs would instill a money premium on a token.

In the ensuing crash, the term tokenomics receded, but it crept back into DeFi mindshare in 2019. One of the early Dose of DeFi articles in September 2019 looked at how Bancor was copying Synthetix and using token inflation to incentivize liquidity providers (LPs). LP token rewards were groundbreaking at the time – as exemplified by the launch of the COMP token and Sushi’s vampire attack. But they were considered wildly unsustainable given the resulting constant sell-pressure on tokens.

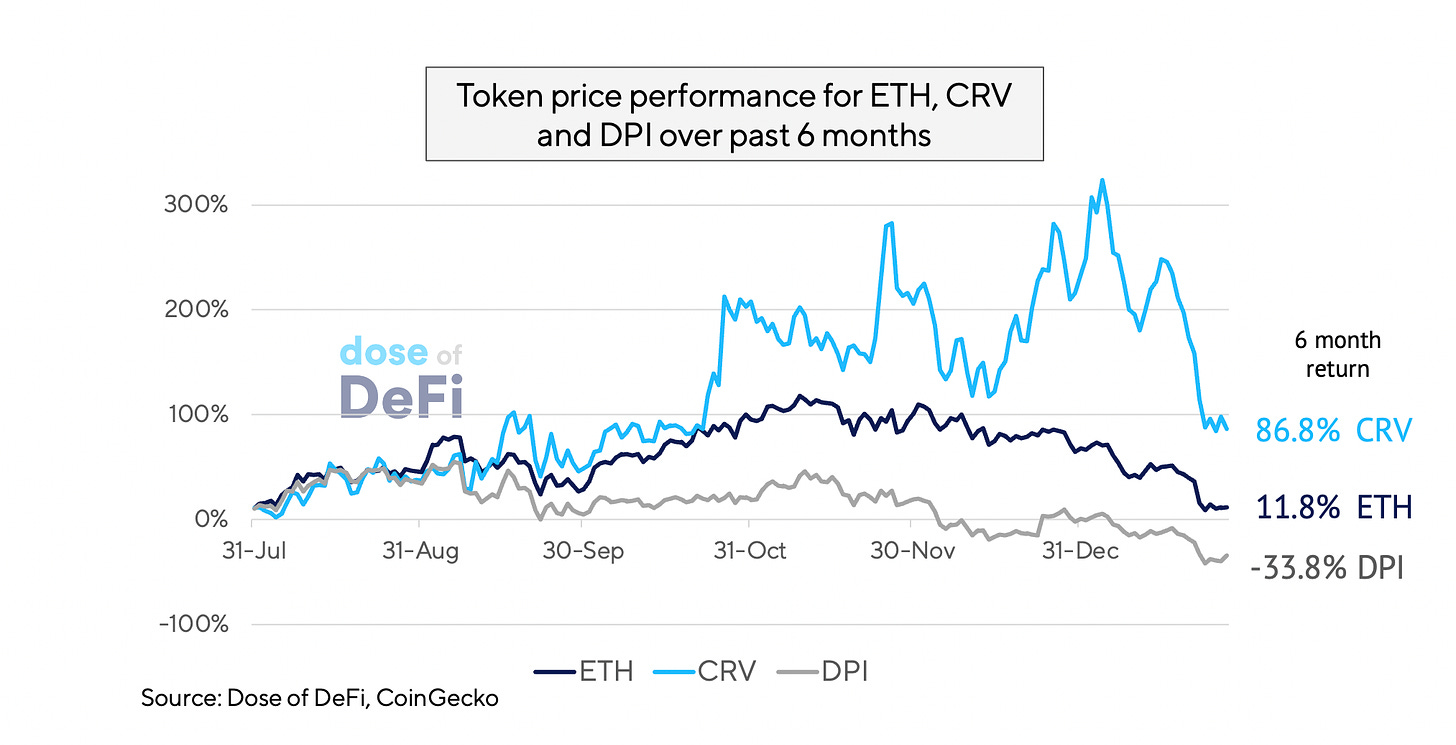

CRV has bucked this trend and surged in price in 2021 despite having some of the highest new token emissions.

The key reason that CRV has outperformed the rest of DeFi in 2021 is because 25% of the circulating supply is locked up as veCRV and therefore unable to be sold (tokens can be locked up for up to four years.)

This supply constraint counters the high inflation rate. While plenty of CRV is being printed, most of this additional supply is being locked up as veCRV. Why are token holders sacrificing their ability to sell?

Two reasons:

Locked tokens receive the Curve protocol fee

veCRV holders can vote to allocate rewards to different pools via gauges.

While fees are nice, it’s the ability to direct the CRV money printer that is in particular driving token locking. And therefore, it’s generally not individual users locking tokens, but protocols buying and locking CRV so they can direct rewards to their new token.

The CRV wars have been covered in detail elsewhere so we won’t go into it here. But there’s one vital takeaway: Curve liquidity exists to enforce stability for new tokens, not generate fees (or even volume).

This brings us to a new realization: Curve is actually a service provider for projects that want to bootstrap their token liquidity and CRV is a utility token they need to achieve that. Curve is providing a stability black hole to projects looking to onboard larger investors.

Locking-up catching on?

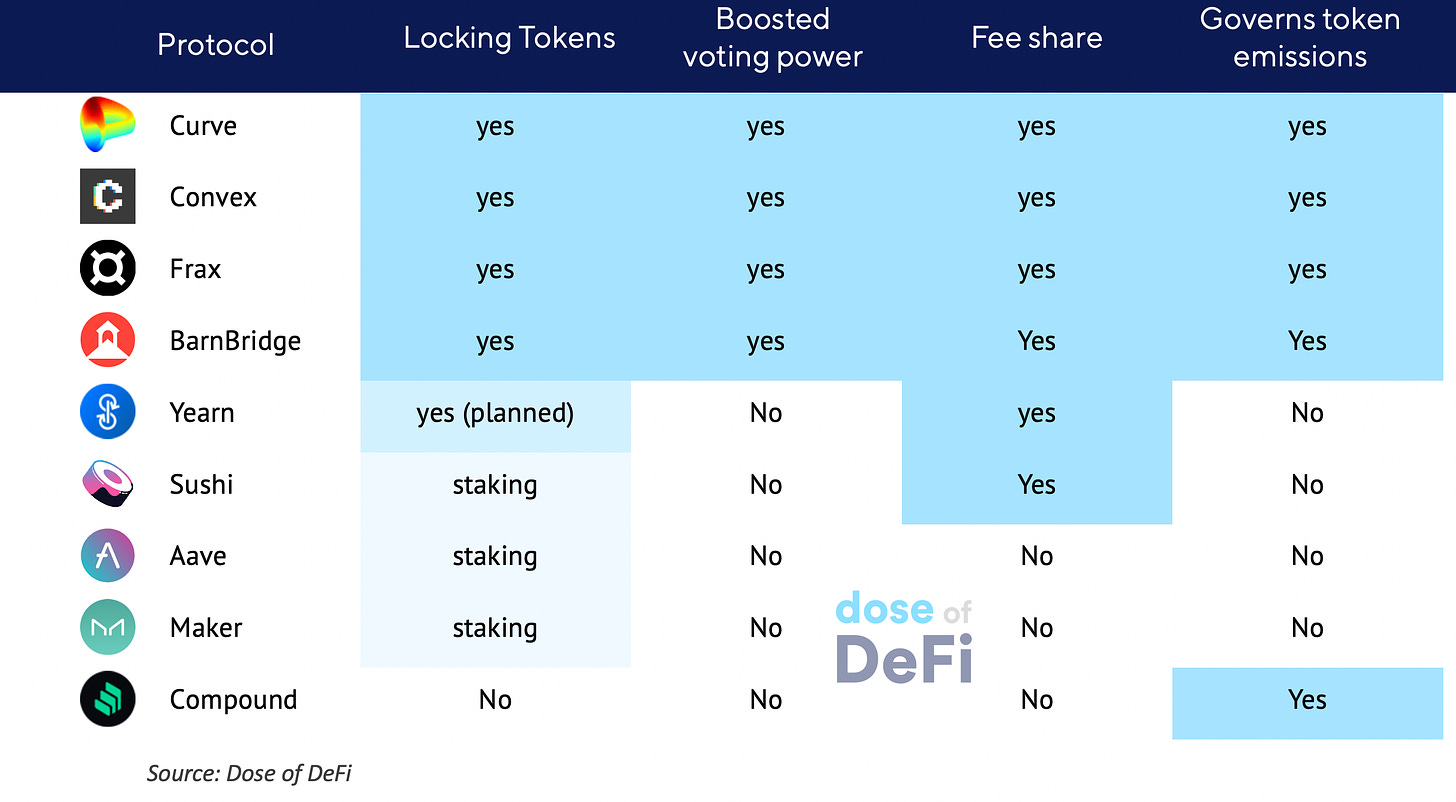

It’s hard to imagine something more desirable in DeFi than token liquidity provided by Curve. But could the tokenomics model – governance of high inflation rewards and token locking – work for others? Here are our predictions:

We expect governance of high-inflation rewards to be part of the tokenomics strategy for liquidity aggregators that help projects bootstrap liquidity, but not for many others. Almost every project needs high-inflation rewards when it launches, but not when it matures.

Token locking for greater token weight, meanwhile, will become much more widely used in tokenomics and governance designs. The reason it’s not been widely used yet is because DeFi was previously too young to have given investors the confidence needed to lock their tokens for years. This has changed. Investors expect the existence of cash-generating protocols. Locking up a token for years in August 2020? No, thank you. But in 2022? That seems reasonable.

The big unanswered question is what incentive is there to lock-up a token, if there aren’t high inflationary rewards? A claim on fees is a good start, but projects will need to get creative. A proposal from Parafi Capital in the MakerDAO forum about creating gbMKR, a locked version of Maker, suggests that those that lock MKR for an extended period could borrow Dai at 0% (among other attractive perks).

CRV wars may limit Curve’s market potential

With such innovations, it might seem like all of DeFi has been built solely in service of bootstrapping liquidity for a new token. But that’s like saying the only point of traditional finance is to launch IPOs. It is an important and lucrative component, but hardly the driving force for market structure.

The CRV wars are being waged by yield aggregators and new stablecoins. Yield aggregators make sense because they can translate the CRV rewards to a higher APY to beat competing aggregators, while the key priority for a new stablecoin project is peg management. Curve’s stable-swap pools allow for deep liquidity to absorb shocks, and a stable-stable pool with CRV rewards is attractive to liquidity providers.

Yield aggregators and new stablecoins are growing aspects of DeFi, but will they be the most important liquidity sources long term? How can the CRV wars help Curve be the most liquid DEX for ETH-USDC or other common pairs?

With a focus on providing stability-as-a-service, Curve’s may miss out on more traditional markets. And more worryingly, the CRV emissions determined by governance do not prioritize volume or fees, which is pretty important for an exchange.

Textbook meets reality

In the end, the economic value of a blockchain network or DeFi protocol should translate into a token’s value regardless of the tokenomics. But as the economic value increasingly depends on the ability to bootstrap a network, the tokenomics and incentive system becomes almost as important as the core service or function.

It’s also worth taking pause to reevaluate what ‘core service’ even means in the future of DeFi. For Curve at least, the tokenomics aspect has in fact become the core function in itself’

And as DeFi grows and barriers to entry rise, bootstrapping liquidity is only going to become more important. Is it possible to launch a DeFi protocol without token rewards? Yes, but not a decentralized one.

Odds & Ends

Compound prioritized EVM chains over Gateway Link

Fantom surpasses BSC to become 3rd largest chain by DeFi TVL Link

Ethereum Foundation: stop calling it ETH2 Link

A look at collateral auctions over last week at MakerDAO Link

CFO of Wonderland outed as co-founder of QuadrigaCX Link

Thoughts & Prognostications

Urgent Considerations of Impact on Blockchain/DeFi of the SEC's Proposed Regulation ATS Amendment [Gabriel Shapiro/Lex_Node]

Layer 2: Bridges, tokens and fungibility [Sam MacPherson/MakerDAO]

Some thoughts on [Redacted] [knower]

Theoretical advances in AMM understanding [0xfbifemboy]

Soulbound [Vitalik]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn, where we’re preparing for a winter storm. Getting excited for Denver!

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to DXdao and benefit financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.