No, of course, but what’d you expect from us? The clue is in the name! But even long-time DeFi advocates such as ourselves have had to acknowledge the massive 75% drawdowns in DeFi tokens from May-2021 highs. And then there's the speculative interest lately for all things NFTs, DAOs and games - which is overshadowing the old DeFi, seemingly forgotten.

Let’s look at both sides. The industry user base and overall market size has continued to grow on the back of the multichain expansion of the last year. And some promising projects came out of the DeFi 2.0 wave – as did a plethora of options protocols trying to find traction. But for the most part, these have failed to live up to sky-high expectations set by the success of DeFi Summer. And it’s surprisingly hard to point to a major DeFi innovation in 2021 that can compare to the likes of the Uniswap launch (November 2018), Synthetix (January 2019), MakerDAO multi-collateral Dai (November 2019), Curve (January 2020), COMP farming (June 2020), or YFI governance distribution (July 2020).

Is it just too early to evaluate success for the class of 2021, or have we seen the beginning of the end of breakthroughs in DeFi?

2021: A reflection

Covid-19 has distorted our conception of time; the last two years sometimes seem compressed together in our minds. And for crypto, 2021 was like that point in the night where you’re having a great time, but won’t remember it in the morning.

There was certainly a lot of hype and activity in 2021, but that was in large part due to the heightened interest of the market – not due to innovation.

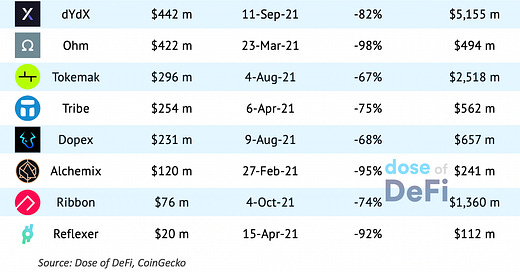

dYdX is actually from the first DeFi wave, but was late to the token party. Convex is clearly the most successful token launch of the year; its innovation came from winning the Curve wars, which Yearn started in the fall of 2020. Tokemak is another iteration on tokenized liquidity flows, and some even argue that we’re in a golden age of Ponzi-nomics.

Speaking of, OHM took the biggest tumble of the class of ‘21. OHM, along with Tribe, Reflexer and Frax (which launched in December 2020), all use Protocol-Controlled Value, which would be like if Maker could manage and earn yield off of the collateral that’s backing Dai. Alchemix is the classic DeFi 2.0 protocol because its very existence depends on other underlying protocols.

And then there are all of the options and derivatives projects, like Ribbon and Dopex. These have been touted as the next logical step in the DeFi journey, as the system climbs the financial ladder of complexity. Lots of money has been thrown at DeFi native options and derivatives protocols, but none has broken out and found product-market fit.

DeFi: The liquidity revolution

Just a year ago, we wrote about what made DeFi special. It’s that every user could become a liquidity provider:

In the traditional world, you buy and hold assets and hope the asset appreciates. Maybe you have some dollars in a yield-generating bank account, but for the most part, assets that you own are not “being put to work”.

In DeFi, this is totally different. Hodling an asset is just the first step. Any investor can be a liquidity provider by depositing these assets in a smart contract where they are “put to work” to earn additional returns.

It seems some of the recent focus on capital efficiency and sophistication of financial products has neglected the importance of tailoring products to a hodler’s mindset. Uniswap v3 is perhaps the best example of this. It’s capital efficiency at its finest, and by far the biggest DEX by volume every day. But it’s increasingly dominated by professional market makers – and there’s very little passive (or non-professional) liquidity.

This could be solved down the road with products built on top of Uniswap v3 that are geared more towards a passive liquidity provider. But at the moment, it just seems to be a new exchange for professional market makers.

The move away from passive liquidity is not true for all of DeFi. Curve and the tokenomics wave of Convex and Tokemak are arguably continuation of the passive liquidity preference, just on a protocol level. Options protocols, meanwhile, promise to unlock yield for individual token exposure - a great offer to a passive liquidity provider, but these haven’t really caught on – perhaps because of the complexity, or challenges in matching both sides of a market.

Market structure innovation

Sophisticated traders are incredibly important to creating these passive liquidity opportunities for DeFi users. Between 2018 and 2020, newly-built liquidation and arbitrage bots allowed a regular DeFi user to earn yield on Compound or Uniswap. These bots eventually began competing in priority gas auctions (PGAs) to get their arbitrage and liquidation transactions filled.

Now, we call this game MEV (miner extractable value), which seems to be both an existential problem for blockchains and also the bleeding edge for electronic trading. Much of the Wall Street story of the last 30 years was about the constant advancement of electronic trading; even retail-oriented products like Robinhood or Roboadvisors are descendents of innovations that started in the 1970s trading shares electronically. The pinnacle of the electronic trading revolution is the HFT firms, which consider themselves more coders than financiers. And now, all major HFT firms are eyeing DeFi as a growth market. The last shoe to drop was Citadel. Its CEO Ken Griffin was a major crypto skeptic, but even he waved the white flag late last year, with Sequoia and Paradigm’s $1.2bn dollar investment into Citadel.

So for all of the MEV activity in 2021 – from crypto natives like Flashbots to the entrance of TradFi HFT firms like Jump or HRT – we may only now be seeing the beginnings of a new market structure that has yet to determine how to pass along enhancements in capital efficiency to passive liquidity users. The equivalent took decades in the electronic trading revolution (until e-Trade), and decades more until the phenomena of Gamestop and Reddit emerged.

Reasons to be hopeful

Like all new market structures, a lot of development will be needed before the everyday-user phase can begin. Smart contracts existed for several years before anyone knew what to do with them, even though everyone knew they would change the way we coordinate. And during that time, infrastructure was quietly being built: for example, with developer tools like Infura and Hardhat, but also, the working through of ideas on what might work on a blockchain. This of course also meant time spent on lots of ideas that in the end didn’t work (2017 - never forget!).

We’re optimists, so here’s a positive spin on the great DeFi lull:

DeFi systems have done well even if tokens have not. Yes, there have been exploits, but the base layer protocols have performed remarkably well (read: they didn’t break) and there’s now broad acceptance in TradFi for blockchain-based financial systems.

Consolidation is a natural industry process, and is yet to come. There are tons of random DEXs and multiple chains, but that’s normal for a new industry in flux. First comes an explosion of new ventures and then once the dust settles, there’s consolidation. DeFi still needs to go through that process, and there’s a lot of froth to wash out.

The multichain world may unlock another wave of DeFi innovation. Bridges are necessary infrastructure for the moment, but there could be new market structures forming, or capital efficiency gains to be drawn from a DeFi network expansion. The success and excitement around Cosmos is the best testament to this.

Inflection points

And, all of this promise, is before you consider the billions and billions of dollars that have been raised but not yet made their way into the crypto world. Two inflection points are coming in 2022 that will spur more DeFi growth.

First, the merge, expected this summer*. The move to PoS will open a new vector for DeFi products that will stem from Ethereum's PoS yield. Lido’s success with its stETH token exemplifies this.

Second, US regulatory clarity. We’ve been on the bullish side of US political crypto prospects for a long time, and The Biden Administration’s Executive Order last month brought clarity that may drive more assets on-chain and a larger market for DeFi.

There’s no doubt: we’re clearly in a lull after all the low-hanging fruit was picked in the first DeFi wave. And while these protocols may remain giant incumbents for years to come like their Web2.0 ancestors, DeFi’s long-term expansion remains a certainty. What we’re seeing is part of the build-out of a new market structure for the broader financial world – one that is global, transparent, and digitally native.

* Don’t @ us!

Odds and Ends

Aave v3 launches on 6 networks Link

Do Kwon: By my hand, $DAI will die Link

Almost all bridge volume comes from bridge front-ends (not aggregators) Link

Notional Finance: Weekly interest rate roundup Link

Could LDO incentives be used to flip ETH liquidity on Uniswap to stETH Link

Thoughts and Prognostications

Ethereum Merge: Run the majority client at your own peril! [Dankrad Feist]

On Aggregation Theory And Web3 [Joel John/Decentralised.co]

The Golden bullrun [knower]

People are the new platforms [David Phelps/Three quarks]

MEV reflection: Review of last year’s bot on bot attacks [bertcmiller/Flashbots]

That’s it! Feedback appreciated. Just hit reply. Written in Brooklyn. Spring is here! Now it’s time to shave.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to DXdao and benefit financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.

You definitely need to look into ICHI