2020 was surely a year for the ages. For DeFi, it was something of a coming out party.

At the start of the year, DeFi entrepreneurs, developers and investors were just beginning to connect the money legos, but by the end of the year, DeFi is arguably the biggest driver of crypto growth with every new chain and project clinging to the DeFi meme. In between, there were hacks, forks, market crashes and a good ole-fashioned bull market.

Let’s dive into the 8 trends that defined DeFi in 2020

Bitcoin undergirds DeFi’s growth

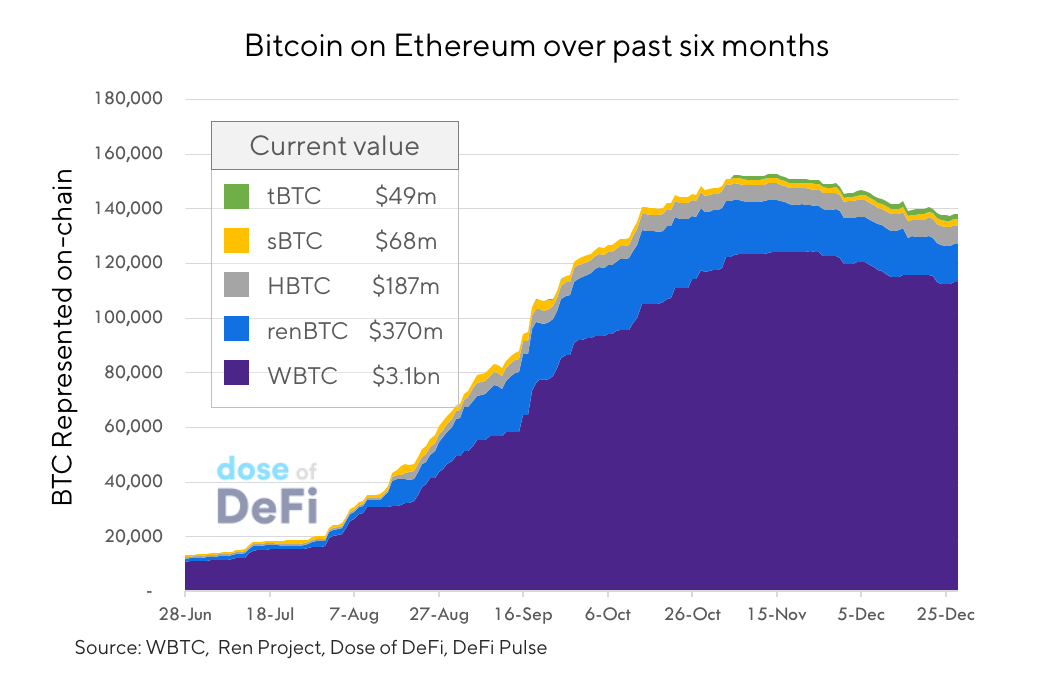

Bitcoin has had a 2020 to remember sans DeFi, but a small, but sizable chunk of BTC’s total supply (0.6%) is now tokenized on Ethereum through a custodian (WBTC, HBTC), a semi-centralized bridge (renBTC) or a decentralized bridge protocol (tBTC), plus the pure synthetic sBTC (h/t, DeFi Pulse’s BTC at Work).

Bitcoin was an important source of collateral for lending platforms and backs almost 7% of Dai. Investors tokenized their BTC in order to access the high yield in DeFi. Eight of the top 10 holders of WBTC & renBTC are AMM liquidity pools or lending platforms; the ETH/WBTC pair has been a favorite of AMM LPs and a key draw of Uniswap and Sushiswap’s liquidity mining campaigns.

Tokenized BTC growth has slowed as Bitcoin’s price has skyrocketed over the last two months. BTC will continue to play second fiddle to ETH in DeFi, but Bitcoin may be the asset that proves the liquidity black hole theory sucking assets onto Ethereum.

Explore more:

Bitcoin and Tether on DeFi [Dose – January 10]

Bitcoin in DeFi and COMP launch [Dose – June 15]

Hacks, exploits and economic attacks

The nascency of DeFi protocols and the $$$ value they secure create a honey pot for anyone with solidity skills. The bZx exploit, which occurred during ETH Denver in February, was the first major DeFi hack and demonstrated the frightening capability of flash loans and the fragility of oracle-based protocols.

Unforeseen protocol losses in DeFi products were a staple throughout 2020, with the latest exploit of Cover protocol on Monday. Audits are now demanded, but most recent economic attacks have occurred on audited smart contracts.

It’s hard to imagine this going away in 2021. Broader risk assessment tools and insurance are needed

Explore more:

bZx Hack Full Disclosure [Peckshield – Feb. 17]

LendFme drained of $25m in reentrancy attack [Jason Choi – Apr 19]

Harvest Flashloan Economic Attack Post-Mortem [Harvest – Oct. 29]

So you want to use a price oracle [samczsun – Nov. 9]

AMMs are DeFi’s Zero-to-One innovation

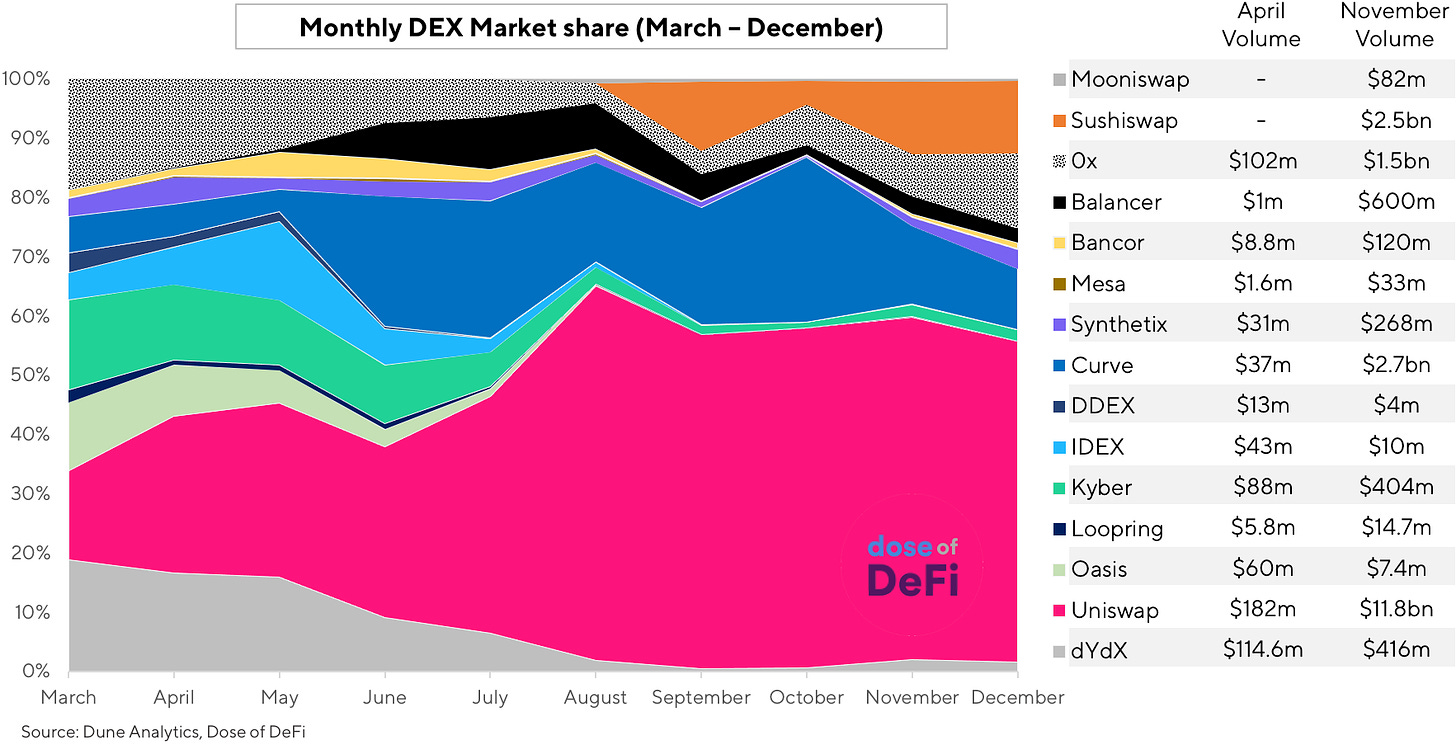

At the beginning of 2020, Ethereum orderbook DEXs were still competitive and there wasn’t even an agreed-upon term to describe on-chain liquidity pools that used a constant pricing function to market make at any price (automated market makers or “AMM”).

Uniswap is the major success story here (and maybe in all of DeFi), because it was the first to see how the simplicity of AMMs could make it an easy-to-use product for liquidity providers, but more importantly, traders. The bare bones swap interface of Uniswap is now ubiquitous across all DeFi products and even some CEXs. Meanwhile, the success of Balancer and Curve preview a robust AMM market with many designs and strategies.

Most importantly, the cost of liquidity provisioning – once reserved for large centralized market makers – is dramatically lowered and may prove to be DeFi’s killer app. Capital efficiency enhancements and Layer 2 are next for the AMM space.

Explore more:

Constant Function Market Makers: DeFi’s “Zero to One” Innovation [Dmitriy Berenzon/Bollinger – April 23]

Curve's Moat, DEX volume growth [Dose of DeFi – June 29]

Improved Price Oracles: Constant Function Market Makers [Guillermo Angeris & Tarun Chitra – June 2020]

AMMs take center stage [Dose of DeFi – Oct 19]

Black Thursday pushes Dai to the brink

March 2020 may go down as one of the craziest months in financial history. The global collapse of confidence led to panic selling across every major asset, with Bitcoin and Ethereum dropping nearly 40% on a single day, March 12, also known in the DeFi space as “Black Thursday”.

The rapid drawdown in ETH price led to a catastrophic failure in the MakerDAO system. From the Dose after Black Thursday:

There are three issues facing the MakerDAO system

It is undercollateralized by $5.4m

A liquidity crunch has caused Dai to lose its peg on the upside

Several Vault owners got hosed

Maker conducted a successful auction of MKR for Dai in the days after to plug the shortfall, but Dai persistently traded above its $1.00 peg for months, even after Maker governance added USDC as a collateral. USDC now backs nearly 40% of all Dai.

The most consequential result was the abdication of Dai as the Stablecoin King of DeFi. Prior to Black Thursday, Dai had an almost religious following amongst Ethereans, but now, Dai has lost its luster due to the addition of centralized assets plus the practical difficulty of dealing with a wavering peg. USDC took advantage of Dai’s struggles and is now the most liquid stablecoin in DeFi.

Still, Dai has more than 10x’d its circulating supply in 2020, so it’s hardly going away and may have a rebound if interest rates rise enough to turn on the DSR. 🤞 for MKR holders

Explore more:

March 12: The Day Crypto Market Structure Broke [Kyle Samani/Multicoin]

Maker’s Quest to Defend the Peg [Dose – May 4]

Yield farming merges user acquisition with token distribution

A surprisingly accurate metaphor and the potential for agricultural references made yield farming the 2020 Meme Newcomer of The Year.

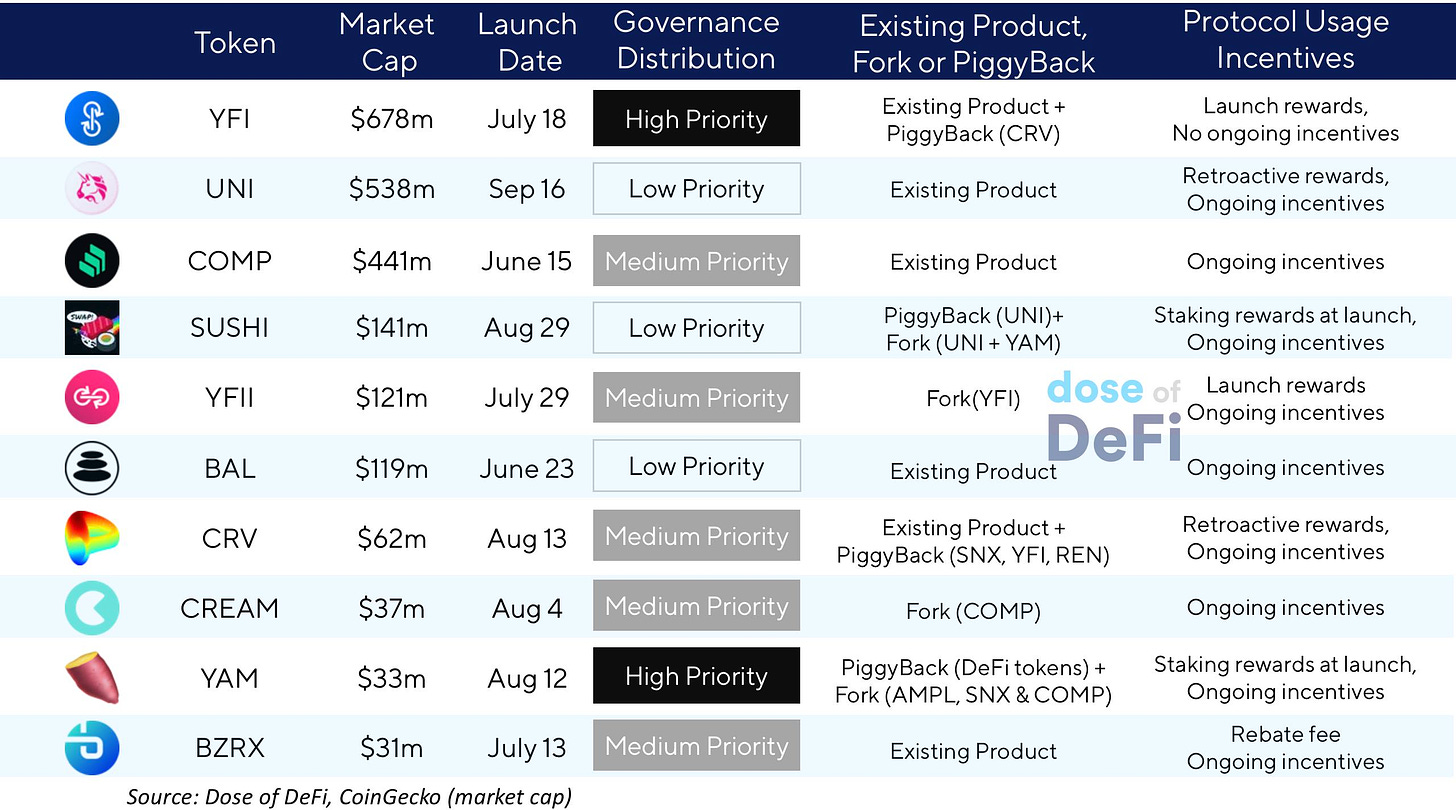

Yes, Synthetix pioneered liquidity mining in the Summer of 2019, but everything changed when DeFi power users started farming COMP this past June. Yield farming was intuitive and an innovative way to attract users and liquidity – Compound has 20x’d its TVL since it started distributing COMP to borrowers and lenders.

YFI’s fair launch built on this concept, but YFI’s token incentives were short-lived and hardly about asset acquisition. Instead, YFI showed how liquidity mining could be used to distribute tokens to key parties to align incentives with the project – a new tool for capital formation.

The rise of retroactive rewards to early users (Curve, Uniswap & 1inch) signals further innovation in token incentives. We may look back and see yield farming as the next evolutionary step in growth hacking following the success of Uber/Airbnb subsidies to bootstrap their networks.

Explore more:

COMP Distribution Will Incentivize Phantom Growth and Open Pandora’s Box [Henry He – June 6]

Distribution is the Game [Dose – July 28]

The Ownership Economy: Crypto & The Next Frontier of Consumer Software [Jesse Walden/Variant – July 14]

Why I have changed my mind on tokens [Hasu/Derebit – Dec 23]

Forks and Food Coins

The fork threat has been a theoretical argument in crypto conversations for years and was used as a defensive tactic for factional disagreements (BCH & ETC), but in 2020, forking became a widely used tactic in DeFi.

The fork and food coin movement was kicked of by YAM’s wild launch at the beginning of August. YAM forked the staking contract of Synthetix, the rebase design of Ampleforth, the governance contract of Compound and the fair launch of YFI. Added together, the YAM launch was “the craziest day in DeFi history” and a playbook on how to use existing Ethereum infrastructure and token communities to bootstrap a new product.

Swerve, Harvest, Pickle and a host of copycats followed, but Sushiswap was the runaway success story of the fork movement. It used a ‘vampire attack’ against Uniswap by issuing SUSHI tokens to those who staked Uniswap LP tokens, which was later migrated to Sushiswap when it launched.

The Sushiswap saga was the most thrilling story of 2020 with heroes, villains and what appears to be a comeback story, based on its last month of growth and the new features being rolled out.

Sushiswap will not be the last fork. Existing smart contracts and front-ends have a certain amount of lock-in from 1. Lindy security effect & using audited code 2. Easy to integrate into existing infrastructure 3. Familiarity by the user (Uniswap’s front-end was forked more than its contracts).

Explore more:

The Composability of DeFi Users [Dose – Sept. 1]

Fork Defense Strategies in DeFi [Ian Lee/IDEO Co. Lab/Bankless – Sept. 16]

YAM: At the Root of DeFi’s Food Obsession [Uncommon Core – Sept. 22]

Stablecoin growth attracts the ire of regulators

Stablecoins had a phenomenal 2020 in terms of market growth – in and outside DeFi, growing 5x in 2020 from $5bn at the beginning of the year to more than $25bn now. Tether remains an enigma wrapped in a riddle, but its success is from CEX usage – its circulating cap is 10x as big as Dai, but Tether has roughly the sameamount of liquidity in DeFi as Dai.

Stablecoin growth may be independent of DeFi, as Circle, Paxos and Maker try to onboard millions of customers to a new payment infrastructure. These users may not be using DeFi protocols themselves, but the products and services they use will be built on DeFi.

The growth of stablecoins did not go unnoticed by regulators, and while there has been no overt regulatory action yet, G7 finance ministers are issuing statements that sound like they will. Add to this China’s central bank digital currency, DCEP, and it seems like crypto in 2021 will be heavily influenced by global politics.

Links

Crypto Dollars & the Evolution of Eurodollar Banking [Max Bronstein – April 7]

The Class Politics of the Dollar System [Yakov Feygin/Dominik Leusder – May 1]

The Crypto-Dollar Surge and the American Opportunity [Nic Carter – Sept. 3]

Fighting to be STABLE: the Evolution of Stablecoins [Haseeb Qureshi – Dec. 23]

Decentralized governance emerges, but question marks remain

0x conducted an ICO in 2017 and was ridiculed for claiming that ZRX’s value would be derived from “governance of the 0x protocol”. Fast forward three years and nearly every project is launching a “governance token”.

The cynical view is that the governance token craze is crypto’s latest cash grab, but that would miss the real on-chain governance decisions that control parameters on DeFi’s largest projects. We are just now starting to see what happens with public, transparent voting.

DeFi governance systems are still in the iterative phase. New designs should try to increase participation rates and make voting less liquid.

Most importantly, projects need to develop a unique governance culture of norms and processes that can scale.

Explore more:

Governance can’t be avoided forever [Dose – March 2]

Ten Theses on Decentralized Network Governance [Mario Laul/placeholder – Sept. 30]

Governance Minimization [Fred Ehrsam/Paradigm – Nov. 28]

DXdao* Manifesto [Ratified on September 19]

Important 2020 trends that just missed the cut:

Capital efficiency optimization, DeFi on Layer 2, Ethereum Gas Wars, Synthetic Assets and on-chain asset management.

Other great 2020 roundups:

Endnotes on 2020: Crypto and Beyond [Vitalik]

DeFi Year in Review [DappRadar/The Defiant]

The State of the Network 2020 Year in Review [Coin Metrics]

Social Tokens Year in Review [Cooper Turley/Seedclub]

10 Ethereum charts that hit ATHs in 2020 [Lucas Campbell/Bankless]

Top Clicked Links on Dose of DeFi in 2020

June 29 – Initial design for the CurveDAO

May 18 - Curve.Fi outperforms Coinbase Dai-USDC market 80% of time [Jake Brukhman/CoinFund]

October 19 – Graphic from 0x’s Will Warren on how Market Makers could exploit AMMs

October 12 - Liquidity Mining rewards are currently wasteful and suboptimal [Andrew Kang/Mechanism Capital]

That’s it! Feedback appreciated. Written in Brooklyn. Thanks for reading. Dose will be off next week. I wish you and your family a safe, healthy and prosperous 2021!

Dose of DeFi is written by Chris Powers. Opinions expressed are my own. I spend most of my time contributing to DXdao*. All content is for informational purposes and is not intended as investment advice.